Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 22, 2016

US flash manufacturing PMI drops to joint-lowest since 2009

US factories are reporting the worst business conditions for over three years, and one of the worst months since the global financial crisis.

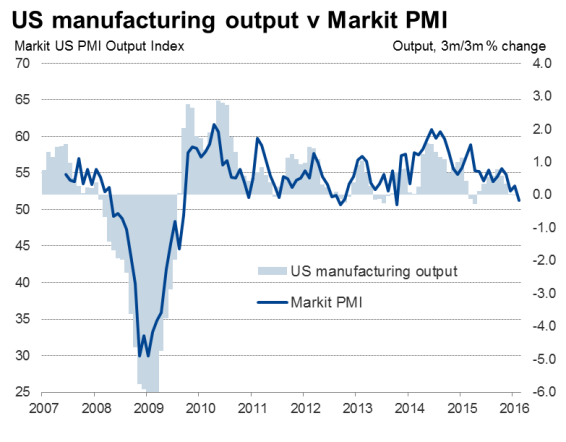

The headline Markit PMI fell from 52.4 in January to 51.0 in February, according to the 'flash' reading, an early cut of the data based on around 85% of expected monthly replies. The February reading matched the post-recession low seen in October 2012.

Warning lights

Every indicator from the flash PMI survey, from output, order books and exports to employment, inventories and prices, is flashing a warning light about the health of the manufacturing economy. The survey showed output and order books growing at one of their slowest rates since late-2012, with exports falling amid weakened global demand and the strong dollar.

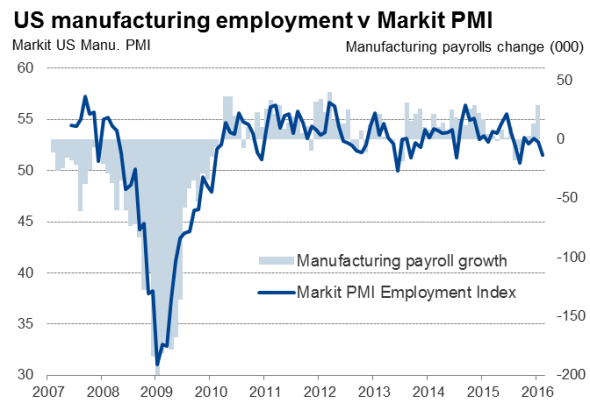

Hiring has weakened as a result. With backlogs of work slumping to the greatest extent since the height of the recession in 2009 and inventories rising for the third successive month, the survey suggests that firms will come under increasing pressure to cut payroll numbers and production in coming months unless demand revives.

Prices charged are meanwhile falling at the fastest rate since mid-2012 as firms compete to win or retain customers.

The one caveat is that the survey was conducted in a month in which parts of the US suffered extreme weather. However, few survey respondents reported that the weather had a material impact on business over the month, instead often simply observing a general slowdown in trade and the economy.

A simple regression-based model indicates that the survey is indicating a 0.3% quarterly (1.2% annualised) rate of decline of manufacturing output. The survey's employment index is meanwhile consistent with a 4,000 fall in factory payroll numbers in February.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22022016-economics-us-flash-manufacturing-pmi-drops-to-joint-lowest-since-2009.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22022016-economics-us-flash-manufacturing-pmi-drops-to-joint-lowest-since-2009.html&text=US+flash+manufacturing+PMI+drops+to+joint-lowest+since+2009","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22022016-economics-us-flash-manufacturing-pmi-drops-to-joint-lowest-since-2009.html","enabled":true},{"name":"email","url":"?subject=US flash manufacturing PMI drops to joint-lowest since 2009&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22022016-economics-us-flash-manufacturing-pmi-drops-to-joint-lowest-since-2009.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+flash+manufacturing+PMI+drops+to+joint-lowest+since+2009 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22022016-economics-us-flash-manufacturing-pmi-drops-to-joint-lowest-since-2009.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}