Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 22, 2016

Japan flash PMI at eight-month low, signals stalling manufacturing sector

Japanese manufacturers reported a near-stalling of business activity in February, according to the Nikkei Flash Japan Manufacturing PMI, with production barely rising as export orders fell at the fastest rate for three years.

The survey also showed job creation waning markedly in the goods-producing sector, suggesting companies have become more pessimistic about the outlook. Factory prices meanwhile fell at a faster rate as firms sought to support sales by discounting.

The downturn bodes ill for Japan's wider economy in the first quarter, suggesting manufacturing will have acted as a drag and raising the possibility of another slide back into recession.

Here are five key charts from the February flash PMI survey:

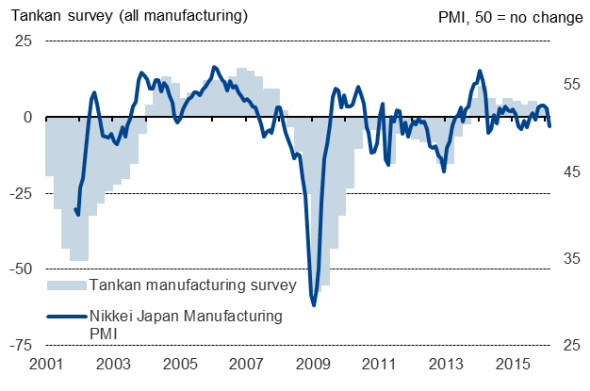

1. Manufacturing activity stalls

The Nikkei Manufacturing PMI fell from 52.3 in January to 50.2 in February, signalling a near-stalling of the goods-producing sector. The reading was the lowest since June of last year and heralded the second successive monthly slowing of the manufacturing economy, according to the 'flash' reading.

The PMI provides an advance indication of the health of the economy, tending to move ahead of other surveys such as the Bank of Japan's Tankan.

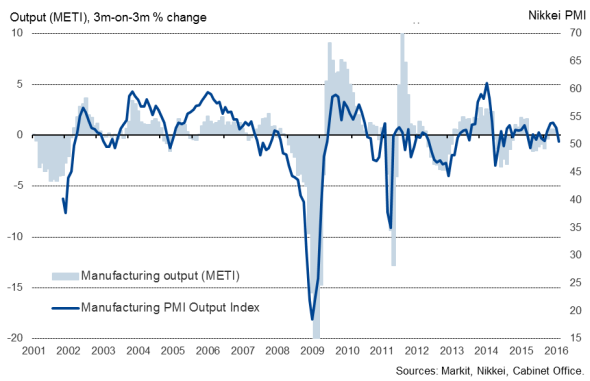

2. Production decline signalled

The headline PMI is a composite indictor derived from survey questions on output, new orders, employment, inventories and suppliers' delivery times. The Output Index (shown above, tracked against comparable official data) hit a ten-month low and the survey's current reading is consistent with the official quarterly growth rate moving into decline.

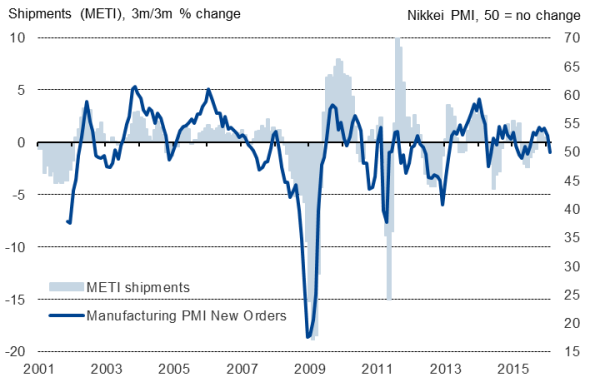

3. Orders books deteriorate

The PMI New Export Orders Index fell to its lowest level since February 2013, dropping below the 50.0 neutral threshold to signal the largest monthly downturn in export volumes for three years. The survey highlights how weak overseas demand and the strength of the yen - up 5% since the start of the year - have hurt exporters.

Although the domestic market provided some support to demand, overall new orders fell marginally in February as a result of the export decline. The drop in total new work was the first seen since last June.

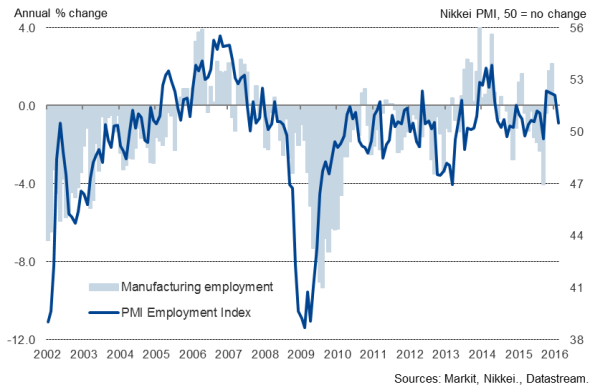

4. Hiring slows

Having shown encouragingly robust growth in the four months to January, the PMI survey's Employment Index fell markedly to a five-month low, down to a level consistent with declining official payroll numbers. The survey indicates that the combination of weak demand and an uncertain outlook has prompted firms to review their need for extra staff, preferring instead to focus on boosting productivity.

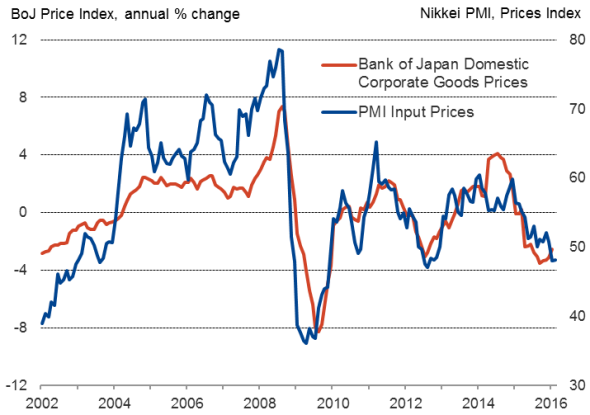

5. Input prices fall again due to oil and FX impact

Input costs fell for a second successive month in February, indicating the strongest period of input price deflation since 2012. The combined effect of lower oil prices and the stronger yen reduced the cost of firms' purchases. Selling prices showed one of the steepest monthly declines seen over the past three years as manufacturers passed the lower costs onto customers in order to help support sales.

Email economics@markit.com for access to the data.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22022016-Economics-Japan-flash-PMI-at-eight-month-low-signals-stalling-manufacturing-sector.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22022016-Economics-Japan-flash-PMI-at-eight-month-low-signals-stalling-manufacturing-sector.html&text=Japan+flash+PMI+at+eight-month+low%2c+signals+stalling+manufacturing+sector","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22022016-Economics-Japan-flash-PMI-at-eight-month-low-signals-stalling-manufacturing-sector.html","enabled":true},{"name":"email","url":"?subject=Japan flash PMI at eight-month low, signals stalling manufacturing sector&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22022016-Economics-Japan-flash-PMI-at-eight-month-low-signals-stalling-manufacturing-sector.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+flash+PMI+at+eight-month+low%2c+signals+stalling+manufacturing+sector http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22022016-Economics-Japan-flash-PMI-at-eight-month-low-signals-stalling-manufacturing-sector.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}