Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 22, 2016

Eurozone flash PMI weakness raises economic growth and deflation worries

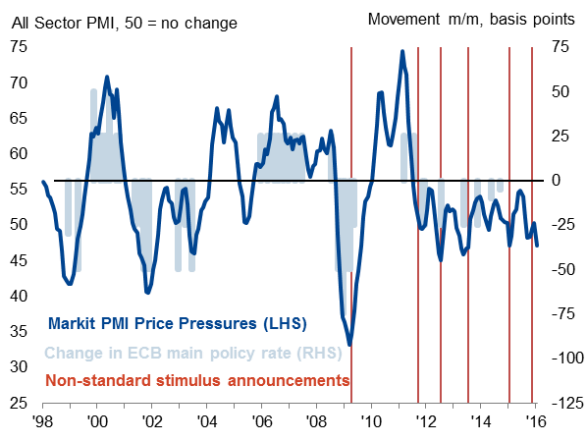

Disappointing PMI survey data for February greatly increase the odds of more aggressive stimulus from the ECB in March. Not only did the 'flash' survey indicate the weakest pace of economic growth for just over a year, but deflationary forces intensified.

The data will fuel expectations that the ECB will unleash further quantitative easing and deeper negative interest rates at its March meeting.

Eurozone PMI price pressures* and ECB policy

* Index derived from PMI price and supplier delivery times data.

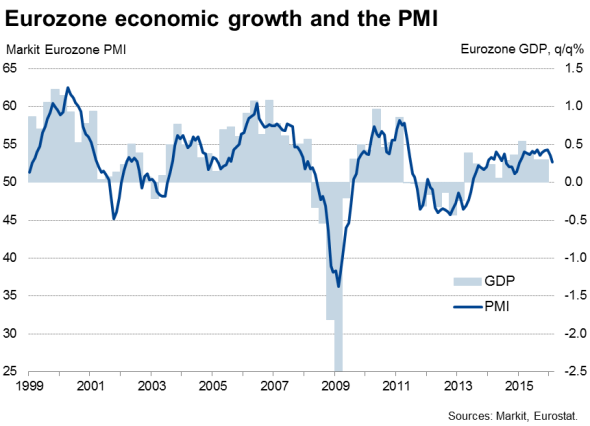

The flash Markit Eurozone PMI fell from 53.6 in January to 52.7, the lowest since January of last year. Economic growth is therefore likely to slow below 0.3% in the first quarter unless we see a sudden uplift in March, which on the basis of the forward-looking components of the PMI seems unlikely. In fact, growth looks more likely to slow further than accelerate.

The survey saw a waning in growth of new orders for a third successive month, resulting in the smallest rise in new business for a year.

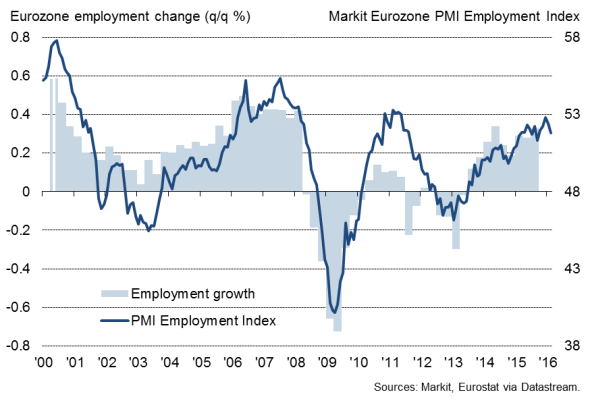

Backlogs of work were broadly unchanged as a result of the weaker increase in new work. With outstanding business stagnant, firms limited their hiring of new staff, leading to the weakest net increase in employment for five months.

Employment

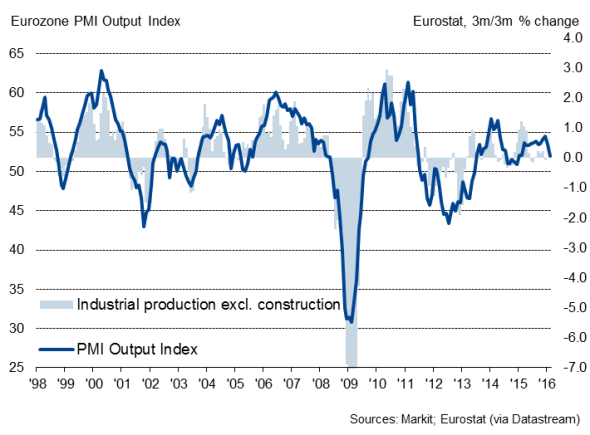

Manufacturing output showed the smallest increase since December 2014, moving closer to stagnation amid a further faltering in growth of new orders and exports. Services saw growth weaken to the slowest since January of last year. Moreover, a sharp deterioration in optimism about future activity growth in the service sector points to further weakness in coming months.

Manufacturing output

Digging into the data shows France to be flat-lining and German growth being held back as weak global demand hits its manufacturers. Elsewhere across the region, growth slowed to the weakest since the start of last year.

The need to compete on price has become increasingly widespread amid weak demand, leading to an escalation of deflationary pressures that will worry policymakers.

Average prices charged by companies for their goods and services fell at the steepest rate for a year. Average input costs fell marginally for a second successive month, the first back-to-back monthly decline since the spring of 2013.

Manufacturing prices fell especially sharply, with purchase costs dropping to the greatest extent since July 2009 on the back of low global commodity prices and intense competition among suppliers. Suppliers' delivery times, a key gauge of capacity utilisation, pointed to the weakest supply chain pressures since July 2013.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22022016-economics-eurozone-flash-pmi-weakness-raises-economic-growth-and-deflation-worries.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22022016-economics-eurozone-flash-pmi-weakness-raises-economic-growth-and-deflation-worries.html&text=Eurozone+flash+PMI+weakness+raises+economic+growth+and+deflation+worries","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22022016-economics-eurozone-flash-pmi-weakness-raises-economic-growth-and-deflation-worries.html","enabled":true},{"name":"email","url":"?subject=Eurozone flash PMI weakness raises economic growth and deflation worries&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22022016-economics-eurozone-flash-pmi-weakness-raises-economic-growth-and-deflation-worries.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+flash+PMI+weakness+raises+economic+growth+and+deflation+worries http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22022016-economics-eurozone-flash-pmi-weakness-raises-economic-growth-and-deflation-worries.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}