Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 22, 2016

Japan flash PMI signals manufacturing resilience at start of year

Japanese manufacturers reported ongoing growth of production, order books, exports and employment at the start of 2016, suggesting the sector remained in expansion mode despite recent financial market volatility.

The Nikkei Manufacturing PMI registered 52.4 in January, down from 52.6 in both November and December but remained comfortably above the 50.0 'no-change' level, according to the 'flash' reading.

The latest reading is only marginally below the fourth quarter average PMI level of 52.5, which was in turn the highest score seen since the first quarter of 2014. The January data suggest that manufacturing output is growing at a quarterly rate of approximately 1% at the start of the year, showing resilience in the face of China's slowdown and the recent financial market turmoil. Export orders even showed slightly stronger growth than in December.

The rate of factory job creation also remained encouragingly solid, close to recent 20-month highs, as factories raised production capacity.

However, it was not all good news. New order inflows waned amid weaker growth of domestic demand, and backlogs of work fell to the greatest extent in four months, hinting the capacity expansion may have been expanded too much recently, meaning stronger inflows of new business will be required to justify the expansion.

Prices charged meanwhile fell at one of the fastest rates seen over the past three years, though the survey responses suggest the decline was largely the result of the 15% oil price fall since December rather than weak demand. Average input costs fell at the fastest rate since October 2012.

Here are five key charts from the January flash PMI survey:

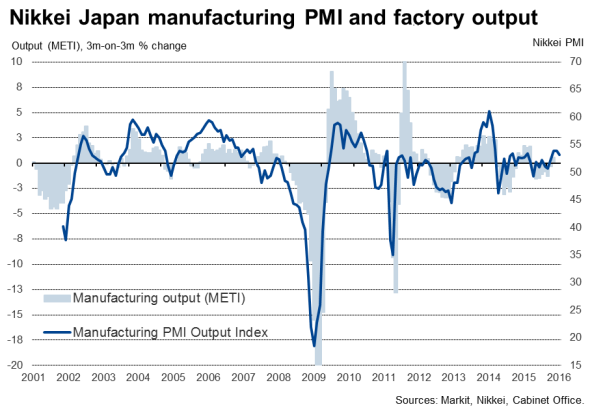

1. Factory output recovery continues into 2016

The survey's Output Index fell to a three-month low but remained firmly in expansion territory to merely indicate a slower pace of growth rather than a decline in production. The survey pointed to a 1% quarterly rate of increase of the official production data in the fourth quarter and the flash number suggests this pace was more or less maintained at the start of 2016 (the two series have a correlation of 81% with the PMI acting with a lead of one month).

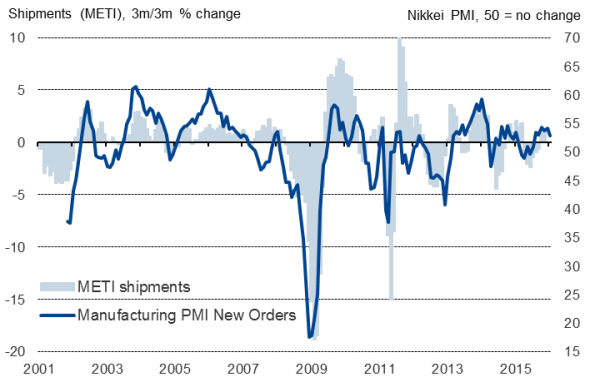

2. New orders growth dips

Sources: Markit, Nikkei, METI.

The survey's New Orders Index, which includes both domestic and export orders, showed a modest easing in the rate of increase compared to late last year, though corresponds with a rate of increase in the official METI shipments series of just less than 1% (the two series have a correlation of 73% with the PMI acting with a lead of one month). The index was dragged down by slower growth of demand from domestic customers.

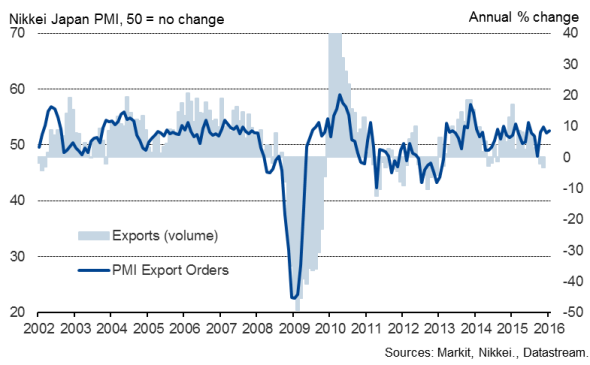

3. Export growth ticks higher

The PMI New Export Orders Index edged higher in January, despite the recent strengthening of the yen, to suggest that the official trade data will show a turnaround after the brief bout of weakness seen last year with the survey pointing to a return to the strong 8% annual rate of increase of export sales seen earlier last year. The survey and official export data have a correlation of 72% with the PMI acting with a lead of two months.

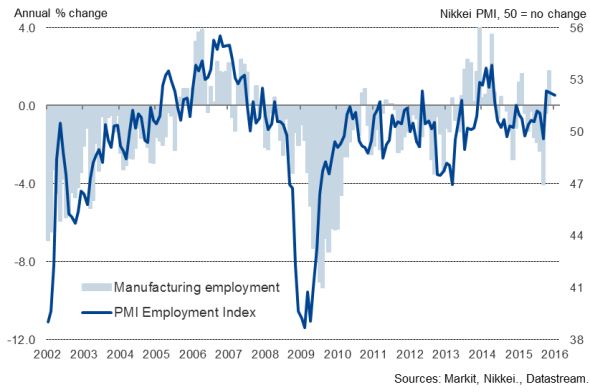

4. Robust factory job creation persists

The January survey showed factories taking on staff for a fourth successive month in January, consistent with a 1% annual rise in the official factory employment gauge (the two series have a correlation of 72% with the PMI acting with a lead of six months). Producers have been taking on extra staff to boost capacity in line with the improving export trend in particular.

5. Input prices fall sharply as oil drops

Sharply falling oil prices were a key factor behind a steep reduction in factory input costs in January. Average buying prices for inputs showed the largest month drop since October 2012 as lower commodity prices offset the impact from the historically weak exchange rate on import costs. Average selling prices meanwhile showed the joint-largest fall in close to three years as firms passed the lower commodity prices on to end customers.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22012016-economics-japan-flash-pmi-signals-manufacturing-resilience-at-start-of-year.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22012016-economics-japan-flash-pmi-signals-manufacturing-resilience-at-start-of-year.html&text=Japan+flash+PMI+signals+manufacturing+resilience+at+start+of+year","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22012016-economics-japan-flash-pmi-signals-manufacturing-resilience-at-start-of-year.html","enabled":true},{"name":"email","url":"?subject=Japan flash PMI signals manufacturing resilience at start of year&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22012016-economics-japan-flash-pmi-signals-manufacturing-resilience-at-start-of-year.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+flash+PMI+signals+manufacturing+resilience+at+start+of+year http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22012016-economics-japan-flash-pmi-signals-manufacturing-resilience-at-start-of-year.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}