Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 22, 2016

Week Ahead Economic Overview

In another important week for data watchers, the US Federal Open Market Committee announces its latest monetary policy decision a couple of days before fourth quarter GDP numbers are released. Latest economic growth figures are also updated in France, Spain and the UK, while inflation data are out in the eurozone and Japan.

With oil prices plummeting, turmoil in the stock market and an uncertain outlook for the global economy, it would be a big surprise if the US Fed raised interest rates at its January meeting. However, the press conference following the decision will be closely watched by the markets for information on whether the Fed still thinks it will be able to deliver its planned four rate hikes during the year in the light of recent market events.

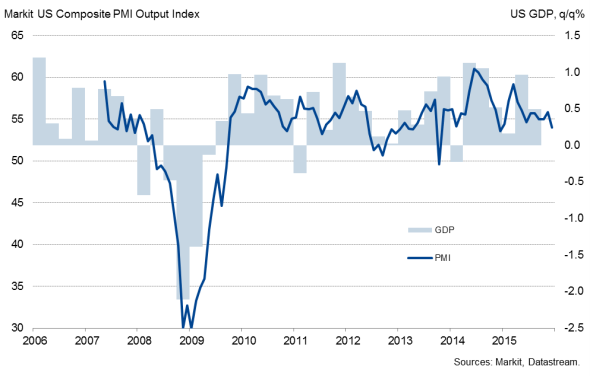

Two days after the Fed's decision, the US Bureau of Economic Analysis releases the first estimate of fourth quarter GDP numbers, which will provide the Fed with additional information on the health of the economy. Markit's PMI data signalled a slowing in the pace of economic growth, below 2%, with a slumping energy sector (excluded from the PMI) posing further downside risks. Economists polled by Thomson/Reuters expect growth of 1.3%.

US GDP and the PMI

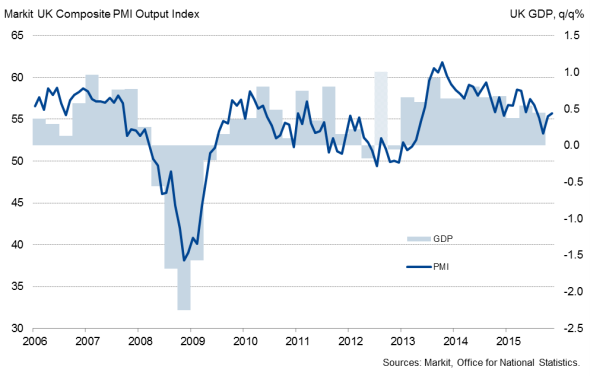

The Office for National Statistics meanwhile releases official fourth quarter GDP in the UK. Business survey data are consistent with economic growth of 0.5%, which would present a mild uptick on the 0.4% growth rate recorded over the third quarter. However, PMI data highlight a strong dependence on the services economy, with the manufacturing index consistent with a near-stagnation of factory production. The slowing in manufacturing signalled by the business survey data was confirmed by official numbers from the ONS.

UK GDP and the PMI

As expected, the European Central Bank left monetary policy unchanged in January, but bank boss Mario Draghi commented that "we will review and possibly reconsider our monetary policy in March". With price stability being the mandate of the ECB, the release of flash inflation numbers for January (out on Friday) will be closely watched by policymakers. Consumer prices rose 0.2% in December, up on the previous month, but still well below the bank's target of 2%. Moreover, sluggish economic growth and declining inflation expectation measures add to the likelihood of the ECB stepping up its QE programme.

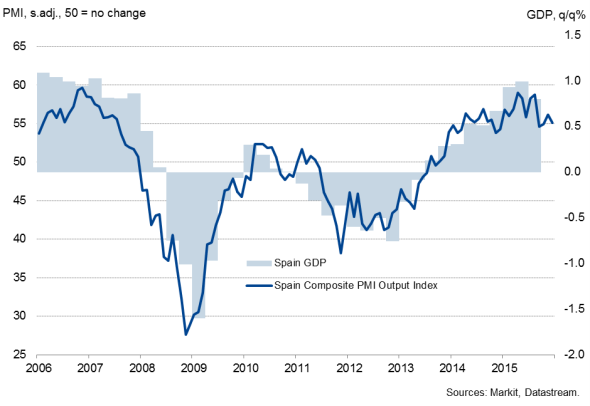

Other important releases in the currency union include consumer sentiment data and GDP figures for France and Spain. Further robust economic growth is expected in Spain, with PMI data signalling a rate of expansion close to the 0.8% seen in Q3. However, unemployment remains a major problem, despite the jobless rate dropping to its lowest since the second quarter. Business survey data for France meanwhile signal only moderate growth in the French private sector.

Spain GDP and the PMI

There will be a big focus on Japan during the week, with industrial output, inflation and unemployment data released and the Bank of Japan announcing its latest monetary policy decision. Recent data have shown that Japan's economic situation is improving slowly, as an initial economic recession in the third quarter was eventually revised away, according to official data. Moreover, PMI data from Nikkei, produced by Markit showed that the manufacturing sector continued to enjoy its best quarterly performance since the start of 2014 in January despite the recent market turmoil.

Monday 25 January

Trade data are issued in Japan.

The latest Ifo Business Climate Index is published in Germany.

In Italy, industrial orders, retail sales and trade numbers are released.

Tuesday 26 January

Nigeria's Central Bank announces its latest monetary policy decision.

Import price figures are out in Germany.

In Brazil, current account numbers are updated.

The US sees the release of home price data and the latest set of Markit's flash PMI data for the service sector.

Wednesday 27 January

In Australia, inflation numbers and the latest NAB Business Conditions Index are released.

Inflation, retail and unemployment data are meanwhile issued in Russia.

Consumer confidence numbers are updated in Brazil, Italy, France and Germany.

BBA mortgage approval and nationwide house price data are out in the UK.

The US Federal Open Market Committee announces its latest monetary policy decision.

Thursday 28 January

Monetary policy decisions are announced by central banks in New Zealand and South Africa.

Trade prices are published in Australia.

Japan sees the release of retail sales figures.

In South Africa, producer price numbers are out.

The Bank Austria Manufacturing PMI is released.

Eurozone business and economic sentiment data are published.

Consumer price information are updated in Germany, while Italy sees the release of wage inflation figures.

Retail and unemployment numbers are issued in Spain.

The first estimate of fourth quarter GDP data is released by the Office for National Statistics in the UK.

Brazil sees the publication of unemployment figures.

Durable goods orders and initial jobless claims numbers are issued in the US.

Friday 29 January

Producer price figures are issued in Australia, Brazil, Canada and Italy.

In Japan, household spending, consumer price, unemployment, housing starts and industrial production data are published. Moreover, the Bank of Japan announces its latest monetary policy decision.

M3 money supply and trade balance numbers are meanwhile out in South Africa.

Flash inflation figures and M3 money supply information are released in the euro area.

Preliminary fourth quarter GDP numbers are out in France and Spain, with the former also seeing the release of consumer spending data.

Meanwhile, Greece sees the publication of producer price and retail sales figures.

GfK consumer confidence numbers are out in the UK.

In the US, annualised fourth quarter GDP numbers and the latest Reuters/Michigan Consumer Sentiment Index are out.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22012016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22012016-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22012016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22012016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22012016-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}