Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Aug 21, 2015

Saudi's CDS spikes as market frets currency float

Kazakhstan recently devalued its currency and investors anticipate Saudi Arabia will follow suit, while in the US high yield bonds continue to freefall.

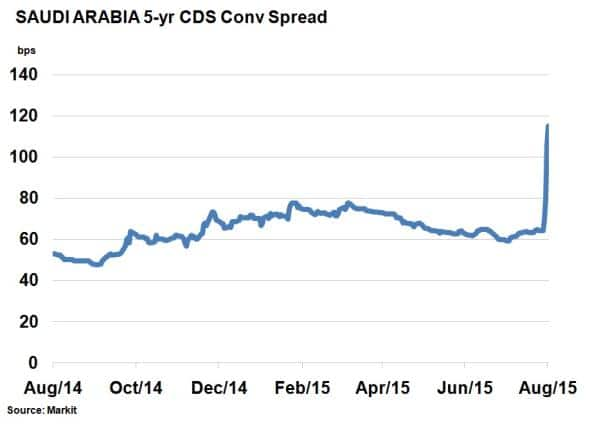

- Saudi Arabia's 5-yr CDS spread has widened 76% over the past week

- Greece's government bond yield curve has flattened, but new elections pose risk

- US HY bonds are now negative for 2015 on a total return basis, now surpassed by IG

Saudi enters the mix

A strong US dollar and the prospect of sustained low commodity prices are starting to bite countries that have pegged their currencies to the greenback. We saw a glimpse of the action last week when The People's Bank of China systematically devalued its currency, albeit marginally.

Yesterday saw Kazakhstan become the latest victim. A country with oil reserves nearly as large as the US, it was forced to de-peg its currency against the US dollar. Its currency instantly fell 23%. Spending off easy petrodollars over the years, major oil exporters have been forced to make their currencies more competitive as oil prices halved over the past year. While Kazakh equities rallied, its 5-yr sovereign CDS spread widened 5% yesteday, according to Markit's CDS pricing.

Attention has now turned to another big oil exporter with a fixed currency in the region; Saudi Arabia. Low oil prices have already forced it to delve into the debt capital markets to stabilise its finances, and Kazakhstan's currency move has sparked frenzy as investors believe Saudi Arabia may follow suit. Its 5-yr CDS spread has widened 50bps to 115bps over the past week. Credit risk in the region is on the up.

US high yield turns negative for 2015

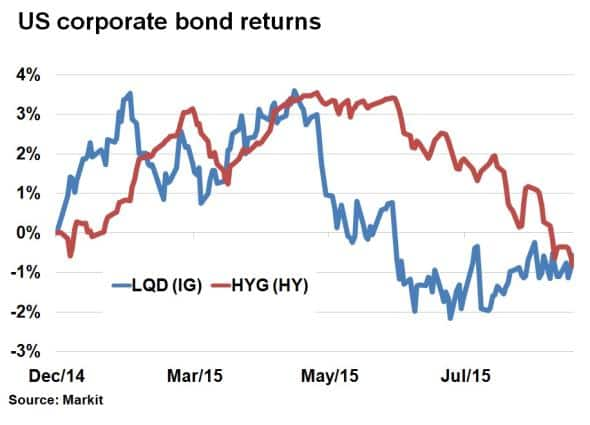

On August 11th, US high yield (HY) bond returns tuned negative for the first time since January in what has been a topsy-turvy year so far for the sector. The Markit iBoxx $ Liquid High Yield Index (ETF:HYG) has now returned -0.84% on a total return basis for the year, having returned over 3% by May.

This week also marks a turnaround in HY performance against its investment grade (IG) peers for the first time since March. The Markit iBoxx $ Liquid Investment Grade Index (ETF:LQD), although also returning negative so far this year, now returns -0.56% (28bps more than HY) at the latest close.

US HY has had an abysmal run since June, impacted first by crises in Greece and Puerto Rico, and now weaker commodities and slowing global growth. ETF investors have followed suit, pulling $2.81bn out of HYG over the last three months.

Credit and politics

After securing a €86m bailout over the next three years, Greece's credit position looks a lot more stable.

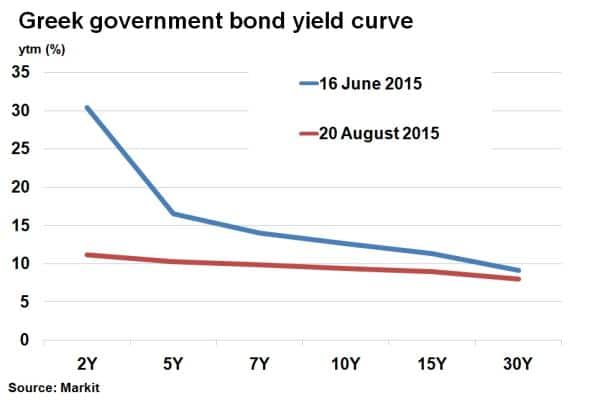

Using Markit's bond pricing service, a plot of Greece's government bond yield curve shows a term structure that is now a lot more flat than previously. As short term tensions have eased, the 2-yr rate has tightened from over 30% to around 10%. An inverted yield curve is usually sign of severe stress in a credit, when interest rate risk is usually overlooked. A flat curve and eventually a normal upward sloping curve is what one would expect as credit risk abates.

This improving prospect may have been shot in the foot however, as Greece's prime minister Alex Tsipras has called for new elections after a rebellion in his party Syriza. Short term bond yields widened 50bps to 11.52% on the news.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082015-credit-saudi-s-cds-spikes-as-market-frets-currency-float.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082015-credit-saudi-s-cds-spikes-as-market-frets-currency-float.html&text=Saudi%27s+CDS+spikes+as+market+frets+currency+float","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082015-credit-saudi-s-cds-spikes-as-market-frets-currency-float.html","enabled":true},{"name":"email","url":"?subject=Saudi's CDS spikes as market frets currency float&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082015-credit-saudi-s-cds-spikes-as-market-frets-currency-float.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Saudi%27s+CDS+spikes+as+market+frets+currency+float http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082015-credit-saudi-s-cds-spikes-as-market-frets-currency-float.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}