Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 20, 2015

US homebuilders soar; shorts target real estate

A spike in single-family home building in the US has seen ETFs tracking the sector outperform while the real estate sector lags; attracting short sellers to niche REITs and online marketplace Zillow.

- Homebuilder ETFs trounce real estate by 25% as US housing market heats up

- Western Asset Mortgage Capital is currently the most short sold REIT in the US

- Short interest in Zillow jumps to 37%, now the most short sold in the sector

From builders to retailers like Home Depot, US homebuilding related stocks have continued to perform in 2015. Real estate investments have however underperformed, with investors taking stock of an impending US interest rate rise impacting financing costs and subsequent valuations.

Recent housing data shows that single-family home construction boosted overall US housing starts in July 2015, which rose by 0.2% to an adjusted rate of 1.2m buildings. Single-family units supported the overall figure growing by 13%, the highest level since 2007.

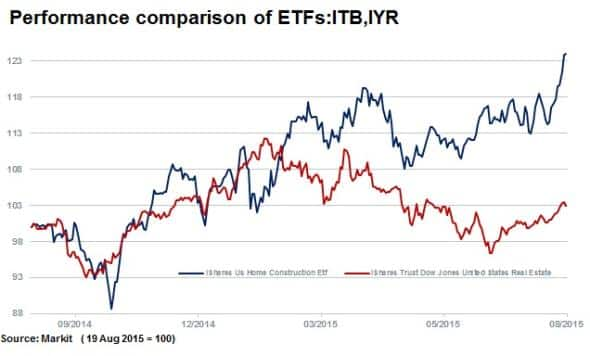

The uptick in building activity has been echoed in the recent price performance of the iShares US Home Construction ETF (ITB), up 25% over the last 12 months. The biggest constituent of ETF is the largest new homebuilder in the US, DR Horton which reported strong net sales order growth in the third quarter of 12%; confirming the trend.

Real estate lagging

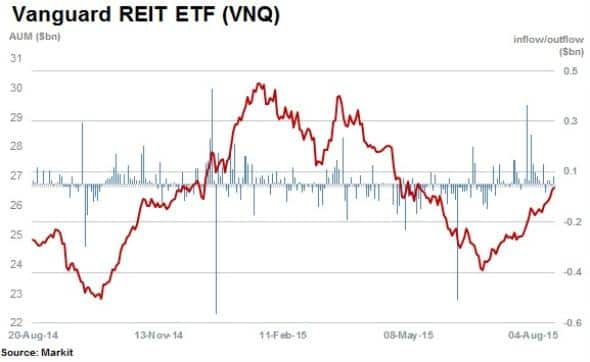

The real estate sector has lagged the homebuilders, down 1% year to date according to the iShares US Real Estate ETF. The performance has been mirrored in the in the Vanguard REIT ETF, tracking similar assets, with $26.5bn in AUM.

The ETF tracks listed real estate investment trusts (REITS) and the fund has seen strong inflows in the past two months of almost $900m.

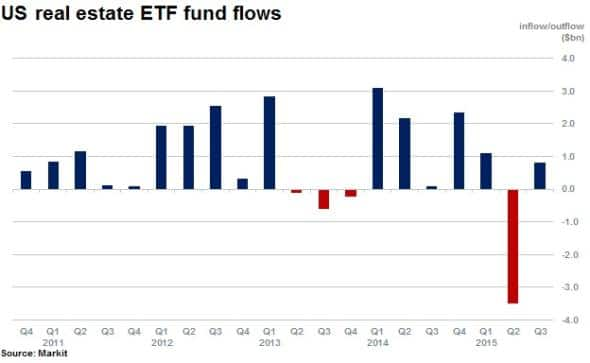

Overall, real estate ETF investors pulled $3.5bn from real estate focused ETFs in second quarter of 2015, the biggest outflow seen in five years following the underperformance.

Short sellers REIT attraction

The most shorted real estate companies in the US currently are REITs as well as real estate service companies Altus and Zillow.

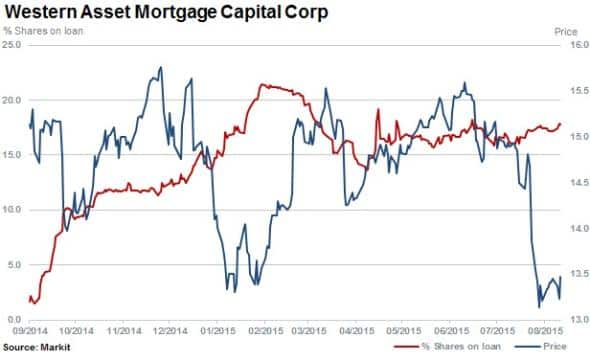

Short interest in Western Asset Mortgage Capital has risen from zero to 17.7% over the last 12 months while the stock has declined 11%. The REIT invests and manages portfolios of residential mortgage-backed securities.

Forestar Group has seen shares outstanding on loan more than double from 6% to 13.7% over the last 12 months. The stock has fallen 35% over this period. The REIT owns real estate and commercial income producing assets which include mineral acreage in oil rich basins in Bakken and Three Forks.

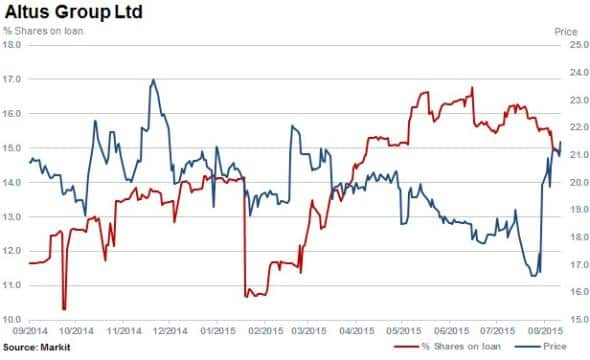

Advisory, research and valuation provider to the property sector Altus Group saw short sellers cover recently as the stock spiked on the release of positive second quarter results. Shares outstanding on loan have however increased by a third over the last 12 months to 14.9%, with the stock now up 6%.

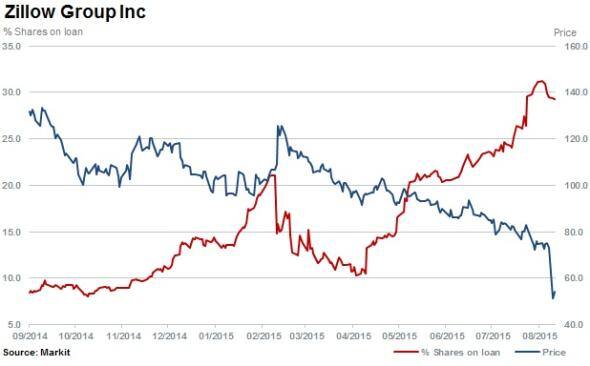

Zillow attracts short sellers

Despite posting revenue growth for the second quarter of 2015 of 20% year on year, Zillow still posted another loss. Attracted to Zillow for some time, short sellers have since dramatically increased positions and a sharp rise in short interest has been seen in recent days, jumping to 37%.

This occurred as the company implemented a stock dividend programmed announced at the last earnings call.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20082015-Equities-US-homebuilders-soar-shorts-target-real-estate.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20082015-Equities-US-homebuilders-soar-shorts-target-real-estate.html&text=US+homebuilders+soar%3b+shorts+target+real+estate","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20082015-Equities-US-homebuilders-soar-shorts-target-real-estate.html","enabled":true},{"name":"email","url":"?subject=US homebuilders soar; shorts target real estate&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20082015-Equities-US-homebuilders-soar-shorts-target-real-estate.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+homebuilders+soar%3b+shorts+target+real+estate http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20082015-Equities-US-homebuilders-soar-shorts-target-real-estate.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}