Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 21, 2016

German discounters drive US grocery shorts

After shaking up the UK grocery landscape, German retailers are setting their sights on the US market; encouraging short interest in US grocery firms to surge to recent highs.

- Average short interest in US grocers has doubled in the last year to 4% of share outstanding

- Whole Foods is the favourite short target with 12% of its shares shorted, most in five years

- Diversified retailers Costco and Target also see elevated shorting activity

German discount retailer Lidl has set its sights on the US as its next target market, following in the footstep of fellow German firm, Aldi. The potential for a large scale shake up of the US grocery market as cost cautious shoppers desert established retailers has seen short sellers load up their positions in US grocers.

These high conviction short positions proved to be winning trades when the two firms established themselves in the UK grocery scene. Anticipations of a repeat scenario has seen the average shorting activity among the seven pure play US listed grocers double in the last 12 months. These firms now have 4% of shares outstanding on loan on average - just shy of the two year high seen three weeks ago.

Short sellers piling in

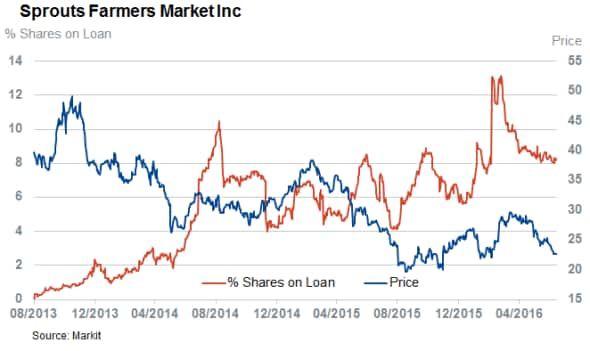

The two standout high conviction short plays in the current market are organic retailers Whole Foods and Sprouts.

Whole Foods (WFM) recently opened a discount store concept, aimed at retaining its incumbent position in at the top of organic retail league table especially among cost conscious younger shoppers. But investors are yet to be sold on the concept, given that the demand to borrow Whole Foods shares has doubled in the last three months. Short sellers have been willing to ride out a recent rebound in WFM shares and their patience looks to have been prescient given the stock's 13% tumble in the last two weeks, taking it near the four year lows seen earlier in 2016.

The same forces driving demand to borrow Whole Foods shares are also at play with smaller rival Sprouts, which has 8% of its shares out on loan. Short sellers have covered one-third of their positions in Sprout shares from the all-time highs seen earlier in March, but current short interest is still one-third higher than the levels seen in January.

The Kroger Co, the largest of the sector's constituents, has also seen short interest tick up in recent months and current demand to borrow its shares stands at 3% of shares outstanding, three times higher than 12 months ago.

Diversified firms also targeted

While focused short interest has been relatively focused on a narrow set of pure play grocers, large established retailers Costco and Target have also seen their short interest tick up over the last year. Both firms have seen demand to borrow their shares jump several fold in the last 12 months with 5% and 2% of these firms' shares now out on loan respectively. This number is likely to grow in the coming months, should the German retailers manage to disrupt the grocery landscape on a similar magnitude than that seen in previous markets they entered.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21062016-Equities-German-discounters-drive-US-grocery-shorts.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21062016-Equities-German-discounters-drive-US-grocery-shorts.html&text=German+discounters+drive+US+grocery+shorts","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21062016-Equities-German-discounters-drive-US-grocery-shorts.html","enabled":true},{"name":"email","url":"?subject=German discounters drive US grocery shorts&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21062016-Equities-German-discounters-drive-US-grocery-shorts.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=German+discounters+drive+US+grocery+shorts http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21062016-Equities-German-discounters-drive-US-grocery-shorts.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}