Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 21, 2015

Investors return to US inflation bonds

With inflation expectations rising this year, Treasury Inflation Protected Securities, or TIPS, have seen renewed investor appetite.

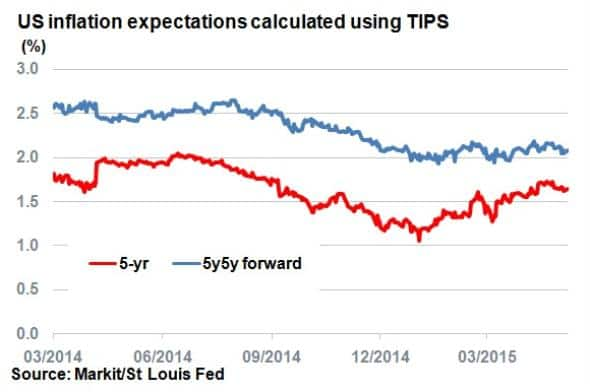

- 5-yr inflation expectations have picked up but remain below 2% Fed target

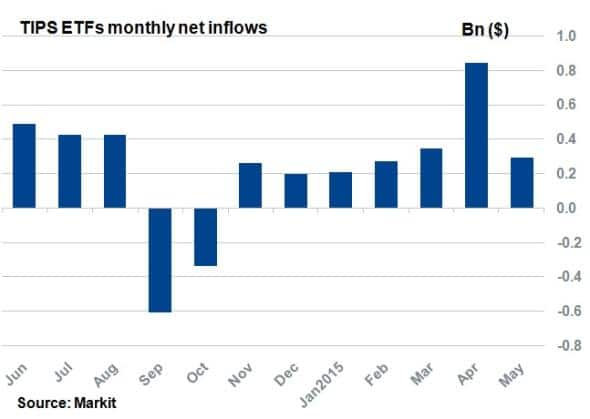

- ETFs that track TIPS have experienced over $1bn of inflows over the last two months

- Markit iBoxx TIPS Inflation-Linked Index real yield has risen 32bps over the past month

Introduced in 1997 by the US Treasury, TIPS have proved popular among market participants looking to hedge against rises in inflation. While the last few years have not provided a fertile ground for inflation investing, particularly the wake of the collapse in oil prices, recent months have seen investment expectations rise; encouraging investors to return to the asset class.

Official inflation figures for the first three months this year have read -0.1%, 0% and

-0.1% and future inflation expectations are also picking up. The 5-yr breakeven inflation rate priced in the TIPS market, a gauge of what market participants think inflation will average over the next five years, has picked up to 1.63% from a low of 1.05% in mid- January.

If investors believe inflation to average higher than 1.63% over the next five years, TIPS become an attractive proposition .A combination of factors has led to the reversal in the deflationary trend. Oil prices have recovered slightly from lows of $43 in March to around $60 today. This should translate into increasing energy costs; stoking inflation. Timid economic growth in the first quarter this year has also set back expectations for short term interest rate rises, further stimulating the economy by keeping borrowing costs low for longer.

Longer term inflation expectations however have remained relatively stable this year. The 5yr5yr forward breakeven rate, the favoured metric for European central bankers, has remained just above 2% this year, in line with the Fed's target. This figure gives a measurement of what investors think five year inflation will average in five years' time.

TIPS investor appeal

TIPS are certainly more attractive than traditional assets used to protect against inflation. They are more liquid than other inflation hedged products such as real estate and provide a regular source of income, unlike precious metals. They also provide a government guarantee on return of full principle (no capital loss).

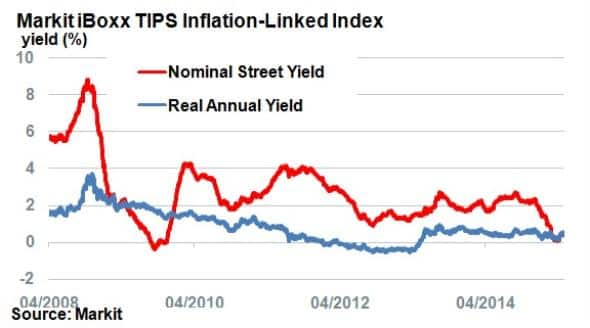

TIPS also provide a beneficial method for investors who want to protect against downside risk. As Markit's iBoxx TIPS Inflation-Linked Index shows, real yields are much less volatile to movements than nominal yields. Deflationary pressures over the past year have caused nominal yields to tumble towards zero, while real yields remained lower but stable.

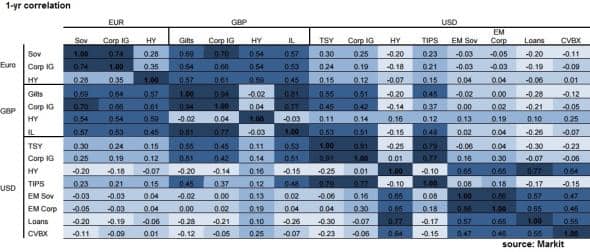

From an investor standpoint TIPS also offer diversification benefits as they provide low correlations to other asset classes such as convertible bonds, emerging market, high yield bonds and loans.

Investor demand

The recent uptick in inflation expectations has been well received by ETF investors, who have returned to ETFs tracking indices composed of TIPS, which have had more than $1bn of inflows over the last two months.

As 5-yr breakeven inflation rates remain below the fed's 2% target; investors look to be getting ahead of any possible jumps in inflation expectations which would benefit TIPS securities. The recent move in treasuries which has translated in a 32bps rise in the Markit iBoxx TIPS Inflation-Linked Index over the past month, has also boded well for income investors.

With the US treasury to set reopen the 10-yr TIPS at auction tomorrow, all eyes will be on demand amid the recent uptick in real yields and inflation expectations.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-Credit-Investors-return-to-US-inflation-bonds.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-Credit-Investors-return-to-US-inflation-bonds.html&text=Investors+return+to+US+inflation+bonds","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-Credit-Investors-return-to-US-inflation-bonds.html","enabled":true},{"name":"email","url":"?subject=Investors return to US inflation bonds&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-Credit-Investors-return-to-US-inflation-bonds.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+return+to+US+inflation+bonds http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-Credit-Investors-return-to-US-inflation-bonds.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}