Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 20, 2015

Greenback with volatility

A brief pause in the steady rise of the US dollar in 2015 has implications for firms generating significant earnings in foreign currencies. A subsequent reversal and recent show of dollar strength highlights the increased volatility that investors face.

- USD strength dampens earnings as European quantitative easing continues

- US stocks which have digested the dollar's rise: poised to benefit from future weakness

- European sector exposure to dollar strength the strongest in utilities

The dollar run

The recent greenback rally highlights increased volatility in foreign exchange markets as quantitative easing programmes continue in Europe and central banks hold interest rates at record lows.

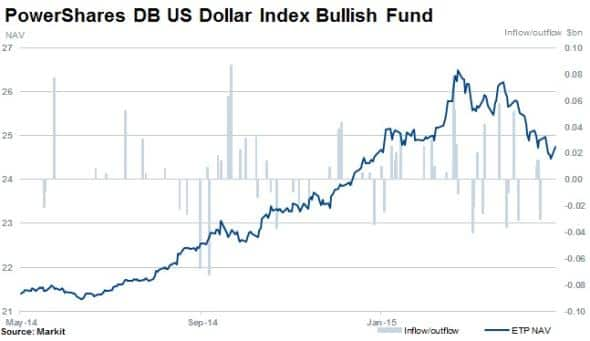

The US dollar has increased by 14% over the last 12 months, according to on the Power Shares DB US Dollar Index ETF (UUP) which tracks a basket of currencies, , despite decreasing 7% year to date (ytd).

In recent earnings releases, the impact of lower translated foreign earnings has been substantial in the US. Evaluating a company's relative exposure to the USD can assist investors in identifying risk and opportunities.

Companies' dollar ranks

MarkitResearch Signals' factor, US Dollar Value Sensitivity, ranks companies by their respective sensitivity to movements in the dollar. Sensitivity is based on the ICE US Dollar Index futures contract.

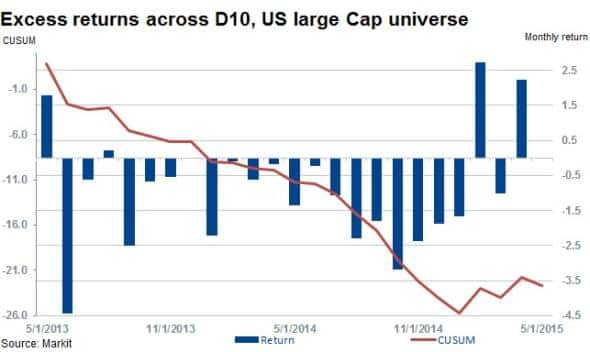

A long short strategy employing factor rankings would have generated substantial returns. Going long and shorting the top and bottom ranked firms respectively would have delivered a cumulative return of 53% in the last 12 months, with a hit rate of 84% across a universe of large capitalisation stocks in the US.

Reinforcing the impact of weaker foreign earnings, the strategy above would have delivered a cumulative return of 9% across a universe of small cap stocks in the US. This is congruent with the fact that larger companies typically earn more foreign earnings and are more sensitive to USD changes.

Sector exposures

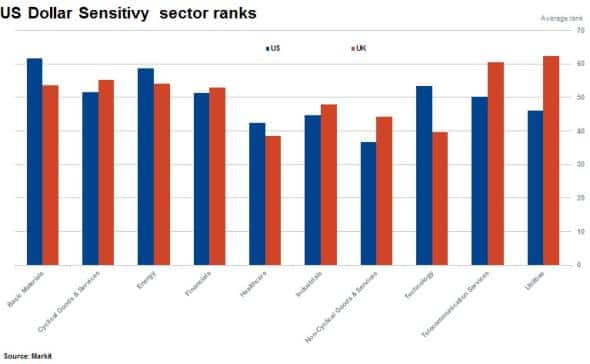

Aggregating USD rankings up to the sector level, the most sensitive sectors in the US to changes in the USD are basic materials, energy and technology. While energy and basic resources and commodities are generally priced in dollars and therefore affect the pricing of goods in these sectors, the tech sector has been specifically hurt by foreign based earnings.

Facebook (FB) is ranked in the 10th decile, according to USD sensitivity. This is not surprising as the company earns more than half of its total revenues from outside the US.

FB reported strong sales and earnings growth for the first quarter of 2015 but noted a substantial impact to revenues due to currency movements. In aggregate the strength of the USD decreased revenue by approximately $182m for the quarter.

Interestingly, using a developed European universe and aggregating for sector ranks reveals that the sectors most sensitive to USD are utilities, telecommunications and cyclical goods. USD priced energy costs for European utilities could explain the sector's current high ranking.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20052015-Equities-Greenback-with-volatility.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20052015-Equities-Greenback-with-volatility.html&text=Greenback+with+volatility","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20052015-Equities-Greenback-with-volatility.html","enabled":true},{"name":"email","url":"?subject=Greenback with volatility&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20052015-Equities-Greenback-with-volatility.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Greenback+with+volatility http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20052015-Equities-Greenback-with-volatility.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}