Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jan 21, 2016

Chinese corporate bonds on edge amid market turmoil

Further market volatility this year has been testing China's vast corporate bond market, with some areas proving more resilient than others.

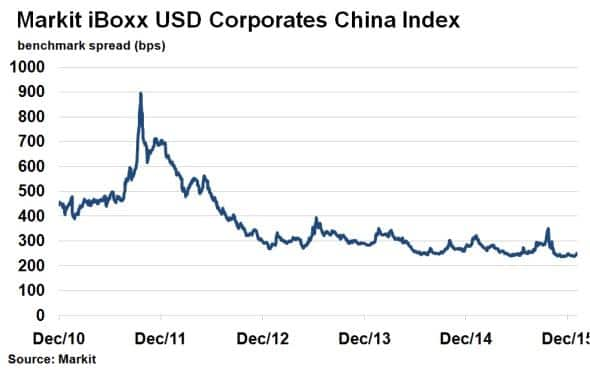

- Markit iBoxx USD Corporates China Index spread is 10bps tighter than its one year average.

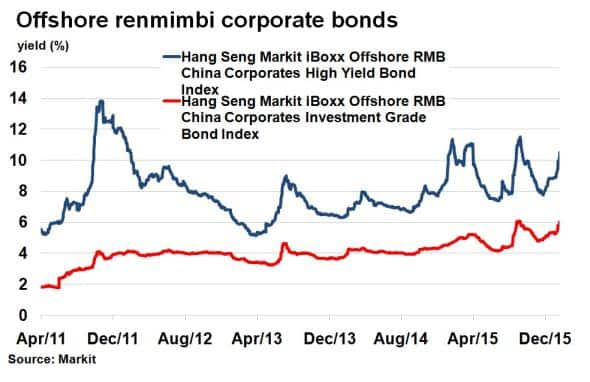

- Yields on Chinese offshore renminbi investment grade bonds are back to 6%, touching last September's highs.

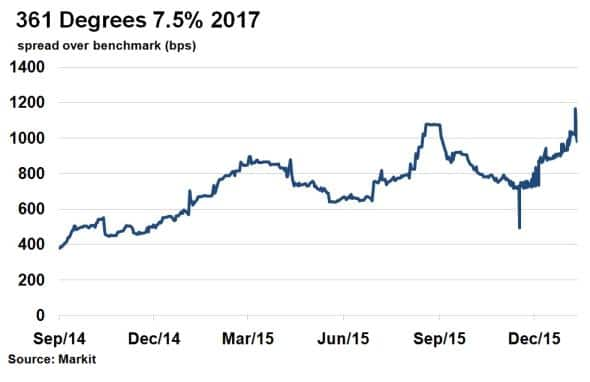

- Sports good's supplier 361 Degrees' short term bonds are now trading at distressed levels.

After a relatively quiet few years, the Chinese corporate bond market saw multiple high profile defaults last year in names such as Kaisa Group and China Shanshui cement. 2016 has already started with much caution with stock market turmoil and weakening economic conditions effecting market sentiment.

US dollar debt

One of the biggest shifts last year was the development of the domestic Chinese bond market, which led issuers to shift towards lower cost onshore issuance.

Existing US dollars issuers, many of which are state backed and/or operate in the improving real estate and property sector, benefitted from the renewed access to domestic markets, and this helped strengthen their credit position. This is reflected in the In the Markit iBoxx USD Corporates China Index, which saw its spread over treasuries hit a five year low of 237bps last November. The start of 2016 saw modest widening, to 252bps as of January 20th. This remains 10bps tighter than the one year average, highlighting the relative resilience the Chinese corporate US dollar debt market has had so far this year while other dollar markets have been ensued in volatility.

Offshore renminbi

Offshore issuers in Yuan however have fared differently with the yield on the Hang Seng Markit iBoxx Offshore RMB China Corporates Investment Grade Bond Index topping 6% for the first time since last September. Since the index's inception, the average daily yield has been little over 4%.

High yield renminbi, as represented by the Hang Seng Markit iBoxx Offshore RMB China Corporates High Yield Bond Index has also seen yields move higher recently. On two occasions last year, in March and September, yields surpassed 11% as first troubles among property developers, and later economic slowdown fears induced risk. The index yield is currently 10.51% and fast approaching new four year highs.

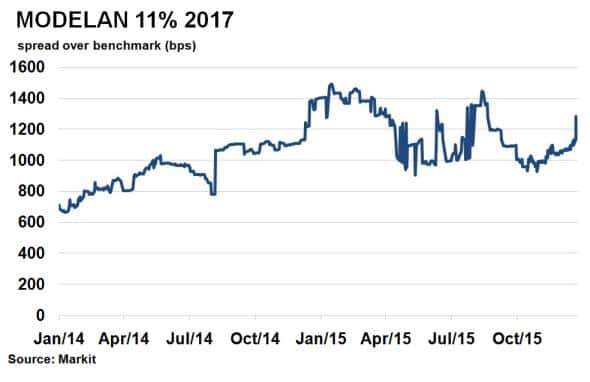

The heightened risk among high yield offshore renminbi Chinese issuers has seen some issuers trade at spreads at distressed levels (>1000bps).

Modern Land China Co Ltd, a real estate and hotel operator has seen its 11% 2017 bond spread over Chinese government bonds top 1,200bps.

While Chinese sports good supplier 361 Degrees International Ltd has seen its 7.5% coupon bond maturing in 2017 spread over benchmark top September's highs of 1075bps.

Onshore renminbi

The attractiveness of China's onshore market in terms of relative funding costs (which makes it more attractive to high yield issuers) combined with the strong domestic investor demand, is likely to keep the market buoyant. Having said this, risks do remain for issuers from an operational and cash flow standpoint, given the recent weakness in China's economy.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21012016-credit-chinese-corporate-bonds-on-edge-amid-market-turmoil.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21012016-credit-chinese-corporate-bonds-on-edge-amid-market-turmoil.html&text=Chinese+corporate+bonds+on+edge+amid+market+turmoil","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21012016-credit-chinese-corporate-bonds-on-edge-amid-market-turmoil.html","enabled":true},{"name":"email","url":"?subject=Chinese corporate bonds on edge amid market turmoil&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21012016-credit-chinese-corporate-bonds-on-edge-amid-market-turmoil.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Chinese+corporate+bonds+on+edge+amid+market+turmoil http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21012016-credit-chinese-corporate-bonds-on-edge-amid-market-turmoil.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}