Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 21, 2015

Contagion in Chinese property developing

Chinese markets and financial stocks took a dramatic tumble this week as the government cracked down on overzealous margin trading and suspected corrupt property developers. But this has not led investors to turn away from the majority of the country's financials.

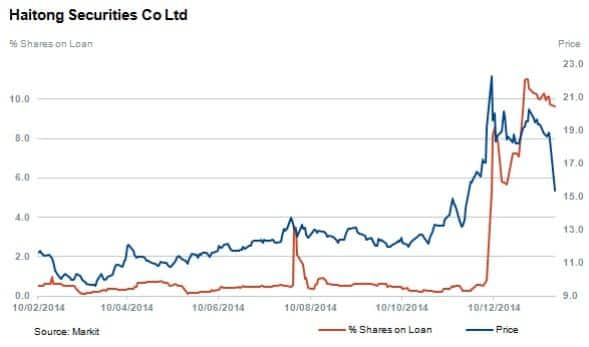

- Broker Haitong saw short interest double before being reprimanded by China's market regulators

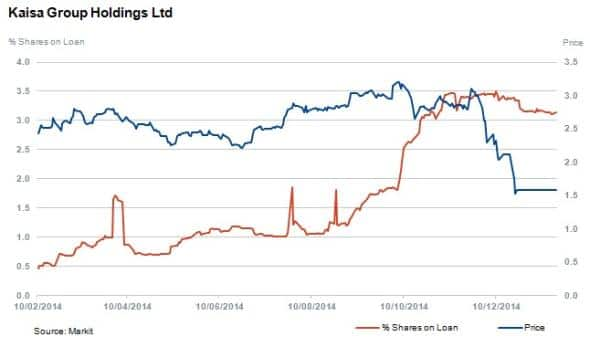

- Property developer Kaisa is one of the four developers seeing meaningful short interest

- Investors have continued to add to their exposure to China's financials

Putting the brakes on exceptional growth

Economic growth in China slowed to 7.4% in 2014, the lowest level in 24 years, falling slightly short of the country's target of 7.5%. The Asian economy is however 25-times bigger than it was in 1990; a tremendous achievement. A large portion of this recent rise has been underpinned by property development and investment, both of which are now exhibiting significant signs of weakness.

The property sector experienced a recent clampdown from the Chinese government on corrupt relationships. Additionally, financial markets were agitated last week when the China Securities Regulatory Commission (CSRC) banned new margin trading accounts at the country's top three brokerages, a move that some read an attempt to curb the practice. The ban sent the Shanghai Composite (SHC) down 7.7% on Monday.

Clamping down on margin trading

Chinese mainland shares, measured by the SHC have run-up a staggering 31% since the beginning of November 2014, including Monday 19th January's steep 7% decline. The concern is that the impressive rise has been driven by margin trading and improper use of credit to prevent closure of levered positions.

Short sellers were well positioned ahead of the recent falls in stock prices as they held onto all-time high levels of short positions in Haitong, one of the brokers singled out by the CSRC. The percentage of Haitong shares outstanding on loan peaked at 11.4% after doubling ahead of the CSRC announcement, which sent Haitong shares down sharply.

Another broker, Citic Securities, fell by 16.5% on the news of the ban. Citic had been a favourite of short sellers over much of last year, but saw sustained short covering in the run-up to Monday's drop.

The sector did recover somewhat on Tuesday 20th January, as the CSRC released a statement that the market should not "over-interpret" the regulatory action.

Pull back in Chinese property stocks

Chinese property developers have come under tremendous scrutiny in recent weeks as trading in shares of integrated urban housing developer Kaisa Group was suspended on December 29th 2014. The suspension came after the stock declined 47% during the month following shocking investors with news that the government had blocked four projects in Shenzen due to on-going corruption investigations.

Senior executives have since left the company without explanation and the firm proceeded to miss a $23m coupon payment, sending bonds falling. Despite securing a 30 day extension on interest payments due in early January, Moody's downgraded the company and stated that it expects "substantial losses".

Short sellers seemed to have timed the precipitous drop in Kaisa's share price particularly well ahead of the trading suspension. Prior to the rapid share price decline following the December 10th announcement of blocked projects, shares outstanding on loan had increased by 130% to 3.2% of shares outstanding.

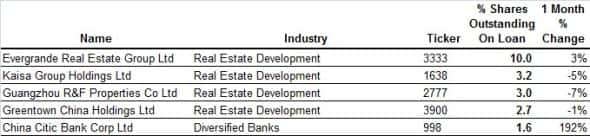

Short sellers target Chinese real estate

There is concern that these issues are not isolated to Kaisa and that the effects could spill over in the broader Chinese real estate and financial markets. The event did indeed trigger a selloff in similar stocks, as Glorious Property and Fantasia tumbled by 35% and 16% respectively. It's worth noting that both firms did not see significant short interest ahead of these recent developments.

Looking at the broader sector, there seems to be little appetite from short sellers as the three real estate firms that currently see more than 3% of shares out on loan only make up around 13% of the market cap in the sector.

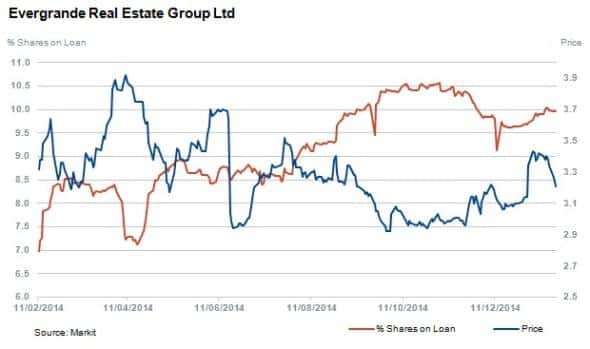

In fact, the other two highly short sold property stocks, Evergrande and Guangzhou, R&F which have 10% and 3% of shares outstanding on loan respectively have seen covering in recent months.

Inflows into Chinese financial ETFs

The recent developments have not dented investor's appetire for Chinese financials as ETFs exposed to the sector are on track for their best quarterly inflows in over five years after investors added nearly $180m of to their positions in the opening weeks of the year.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21012015-Equities-Contagion-in-Chinese-property-developing.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21012015-Equities-Contagion-in-Chinese-property-developing.html&text=Contagion+in+Chinese+property+developing","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21012015-Equities-Contagion-in-Chinese-property-developing.html","enabled":true},{"name":"email","url":"?subject=Contagion in Chinese property developing&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21012015-Equities-Contagion-in-Chinese-property-developing.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Contagion+in+Chinese+property+developing http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21012015-Equities-Contagion-in-Chinese-property-developing.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}