Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Oct 20, 2015

Credit risk gathers pace among Gulf states

With oil prices showing little in terms of recovery, credit risk among oil exporters in some Gulf nations is faring better than others.

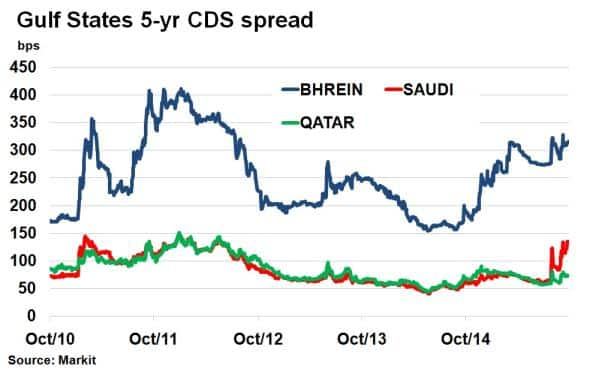

- Saudi Arabia and Bahrain's 5-yr CDS spread is now at its widest since mid 2012

- Qatar's 5-yr CDS spread has remained stable, driven by reserves and prudent fiscal measures

- USD denominated corporate bonds in Oman, Saudi Arabia and Bahrain now yield above US investment grade bonds

Highly oil dependent Gulf states are continuing to feel the strain of low prices as sovereign credit risk remains elevated.

While energy prices have bounced from August's yearly lows, they remain over 50% lower than mid 2014. With oil cartel OPEC showing no signs of reducing output, weaker global demand, US shale reliance and expected inflows from Iran, bearish sentiment around energy prices has remained rooted.

Among the Gulf states for which there is a viable CDS market, Saudi Arabia and Bahrain stand out. Saudi Arabia's 5-yr CDS spread has continued to widen this month, increasing its spread by 12bps to 134bps, the widest level since June 2012. Likewise Bahrain's 5-yr CDS spread remains elevated at three year highs.

Both countries are heavily reliant on petrodollar revenue to finance government spending. As a result, the need to restructure fiscally is causing concerns among investors. Saudi Arabia's cash reserves remain high, however, allowing it to continue its strategy of maintaining oil market share at the expense of short term pain (higher credit risk). On the other hand Bahrain has little room to manoeuvre from a fiscal standpoint, and its 5-yr CDS spread is representative of that. At 315bps, it is the widest among the Gulf states and is now even wider than that of Russia.

Unlike its Gulf peers, Qatar's sovereign credit spread has remained stable and has actually tightened 5bps so far this month. Remarkably, as recently as June, Qatar's 5-yr CDS spread was wider than that of Saudi Arabia's. Fortunes have since diverged and spread differential now stands at 62bps.

Qatar's ability to keep investors calm is due to several factors not least the huge reserves of both oil and wealth, dwarfing regional peers on a per capita basis. Qatar has also used its low debt to GDP ratio to effectively tap capital markets and invested heavily on infrastructure and projects as well as diversifying its revenue base. It also has much lighter fiscal imbalance than its peers, where its breakeven oil price is just $60.

Corporate bonds

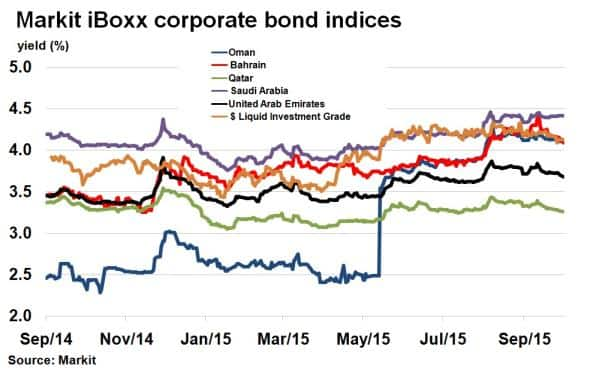

The increased sovereign credit risk is also starting to be felt in the corporate space. According to the Markit iBoxx indices, US dollar denominated corporate bond yields among the Gulf nations have been on a steady rise since March of this year. Usually tightly linked to the credit risk of the sovereign, corporate bond yields among Qatar, UAE and Bahrain have diverged significantly over the past year. Where once the difference between corporate bond yields among the three nations was 7bps, it now stands at 85bps.

From an investor's standpoint, USD denominated corporate bonds in Oman and Bahrain now yield above US investment grade, as represented by the iBoxx $ Liquid Investment Grade index. They were approximately 35bps tighter just three months ago.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20102015-credit-credit-risk-gathers-pace-among-gulf-states.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20102015-credit-credit-risk-gathers-pace-among-gulf-states.html&text=Credit+risk+gathers+pace+among+Gulf+states","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20102015-credit-credit-risk-gathers-pace-among-gulf-states.html","enabled":true},{"name":"email","url":"?subject=Credit risk gathers pace among Gulf states&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20102015-credit-credit-risk-gathers-pace-among-gulf-states.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Credit+risk+gathers+pace+among+Gulf+states http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20102015-credit-credit-risk-gathers-pace-among-gulf-states.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}