Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 20, 2017

Official data confirm pick-up in Taiwan export orders

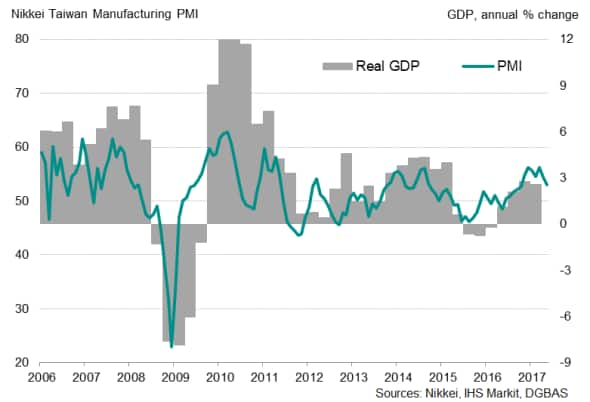

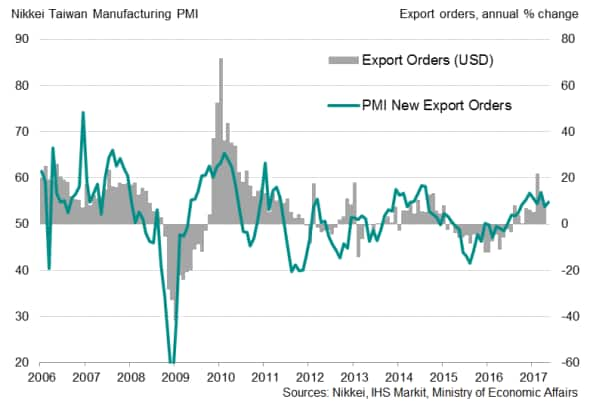

Official data showed that Taiwan's export order growth gained momentum in May, confounding analysts' expectations of a slowdown. However, the pick-up in export sales had been signalled in advance by the Nikkei PMI survey.

Taiwan economic growth and the PMI

The latest export orders data reflected strong external demand, but that may not translate into a commensurate upturn in production. Taiwanese manufacturers face a number of problems in boosting production capacity, according to anecdotal evidence from the latest PMI surveys.

PMI new export orders and official data compared

Electronics drive manufacturing

The Ministry of Economic Affairs indicated that export orders increased 9.1% year-on-year in May, up from 7.4% in April. Sales to the US, greater China and Japan rose further, increasing at double-digit rates. By contrast, demand from the ASEAN economies fell for a third straight month.

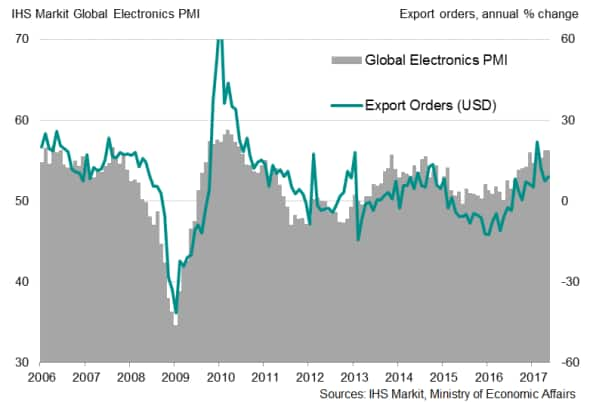

A key driver of recent manufacturing growth has been the rising demand for electronics, a mainstay of the Taiwanese exporting industry. Comparing the IHS Markit Global Electronics PMI and Taiwan's export orders yields a strong correlation (see chart).

Global Electronics PMI and Taiwan's export orders

Output capacity lags order book growth

The global trade upturn has led to increased activity in Taiwan's manufacturing sector. Total new orders, including new export sales, continued to grow at a solid pace in May, although slower compared to the first-quarter average.

But production capacity has not kept pace with the strong order book growth. May survey data showed that manufacturing output increased at the weakest rate since September last year.

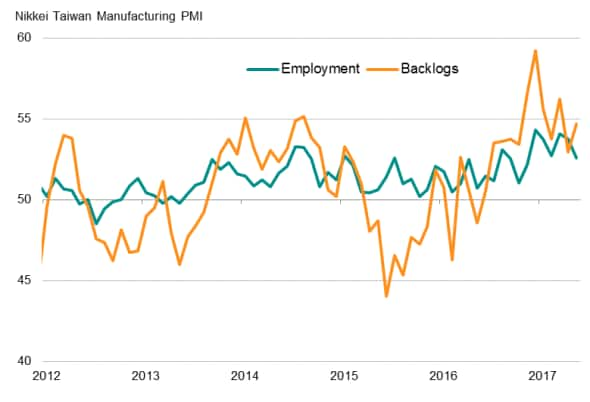

Surveyed companies highlighted that recent changes to labour regulations, mandating more rest days for workers, resulted in less time for work, particularly overtime work. While employment increased further, the extent to which workforce numbers were raised was the slowest in six months. A pick-up in backlogs suggested that the rise in hiring was insufficient to cope with the additional workload that resulted from the recent upturn in orders.

Slower employment growth

Sources: Nikkei, IHS Markit

Insufficient staffing capacity was not the only factor contributing to the slowdown in output growth; shortages of certain raw materials and semi-manufactured parts were also responsible. Companies listed a number of items that were in short supply, including many types of metal, semiconductors, RFID chips, integrated circuits, machining parts and paper.

Facing labour issues and inconsistent input supplies, Taiwanese factories signalled less confidence in the outlook for production growth, according to the May PMI survey. By contrast, the Future Output Index's readings for the previous two months were the highest in over two years. That suggested that stronger output growth hinges on making improvements to supply chains and adjustments to staff numbers amid strong inflows of new work.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20062017-economics-official-data-confirm-pick-up-in-taiwan-export-orders.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20062017-economics-official-data-confirm-pick-up-in-taiwan-export-orders.html&text=Official+data+confirm+pick-up+in+Taiwan+export+orders","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20062017-economics-official-data-confirm-pick-up-in-taiwan-export-orders.html","enabled":true},{"name":"email","url":"?subject=Official data confirm pick-up in Taiwan export orders&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20062017-economics-official-data-confirm-pick-up-in-taiwan-export-orders.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Official+data+confirm+pick-up+in+Taiwan+export+orders http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20062017-economics-official-data-confirm-pick-up-in-taiwan-export-orders.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}