Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 20, 2017

Shorts net unlikely payday from Whole Foods deal

The fallout from the Whole Foods/Amazon takeover has more than compensated for any immediate pain felt by short sellers

- Short sellers net $100m from North American food retailers on Friday

- Costco nearly offset half the losses faced by shorts on the Whole Foods deal

- Short sellers halved their positions since Jana Partners first agitated for change

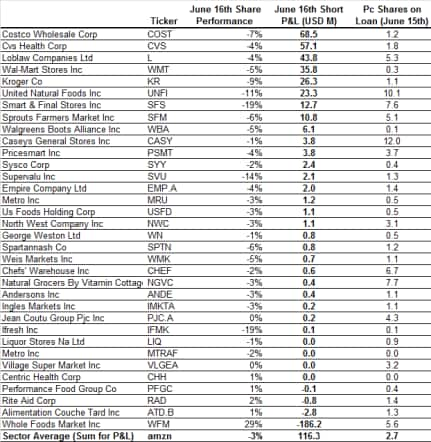

Over the past few years, Whole Foods has been a prime target for short sellers. With last Friday's announcement that the company will be taken over by Amazon, observers anticipated an unmitigated disaster for short sellers. Although the deal inflicted a paper loss of $180m for short sellers, its impact on a traditionally shorted section of the market more than offset the immediate losses. In fact the short P&L for North American food and staples - based on Thursday night's short positions - generated a $100m profit at Friday's close.

This offset was driven by the rout experienced in the wider North American food & staples sector as the market digested the disruptive potential of the sector's new well-capitalized interloper. In fact these losses largely represented over 4% of the sector's entire market cap which indicates more turbulent times for the sector.

Warehouse retailer Costco was the chief source of solace for short sellers on Friday, returning over $68m as its shares fell by over 7%. With only 1.2% of shares outstanding on loan, Costco was not a high conviction short target, yet its large size and the large fall in its share price, made sure that the company offset about half of the pain felt by short sellers from the Whole Foods deal.

Short sellers were much better positioned to profit from the 18% share price decline of fellow warehouse store operator Smart & Final - they had positions worth 7.6% of the company's outstanding shares. Smart & Final's shorts only netted $12m on the day however due to the firm's relatively small size.

Whole Foods competitor United Natural Foods was the most profitable on the list of high conviction short plays. The company has over 10% of its shares out on loan, netting bearish investors $23m from the retreat in its share price.

Interestingly, convenience store operator Casey's General Stores, which is the most shorted North American grocer, saw its shares trade relatively flat on Friday. This could be due to the fact that the market feels the convenience sector is relatively immune to online competition, or that its disappointing earnings have fairly valued the firm.

Could have been much worse for shorts

Short sellers may have Jana Partners to thank for their bumper payday. The activist investor firm started to agitate for Whole Foods to take a strategic initiative when it went public with a position in the grocer back in April. Short sellers have taken the threat of this change seriously, and they halved their positions in the ensuing weeks. The 6% of Whole Foods shares that were out on loan on Friday morning represent the lowest demand in over 12 months. Short sellers would have faced $200m of additional losses had they kept their positions at the same levels when Jana Partners first agitated for change.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20062017-Equities-Shorts-net-unlikely-payday-from-Whole-Foods-deal.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20062017-Equities-Shorts-net-unlikely-payday-from-Whole-Foods-deal.html&text=Shorts+net+unlikely+payday+from+Whole+Foods+deal","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20062017-Equities-Shorts-net-unlikely-payday-from-Whole-Foods-deal.html","enabled":true},{"name":"email","url":"?subject=Shorts net unlikely payday from Whole Foods deal&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20062017-Equities-Shorts-net-unlikely-payday-from-Whole-Foods-deal.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shorts+net+unlikely+payday+from+Whole+Foods+deal http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20062017-Equities-Shorts-net-unlikely-payday-from-Whole-Foods-deal.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}