Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 19, 2017

Most shorted ahead of earnings

We reveal how short sellers are positioning themselves in companies announcing earnings this week

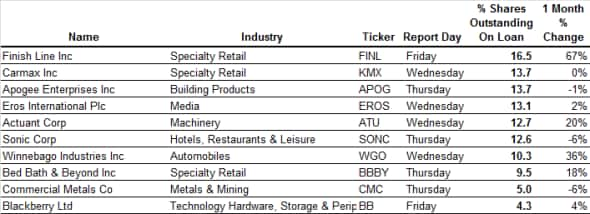

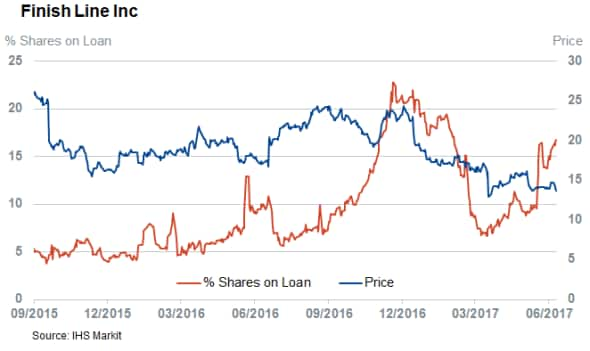

- Finish Line sees shorts increase their positions by two thirds in the last month

- Carmax heavily targeted by short sellers heading into earnings

- Short sellers have covered their positions in SAS as analysts upped their forecast

North America

The relatively light earnings activity this week hasn't precluded short sellers from indulging in a bit of retail therapy. This year's favorite sector for short sellers continues to dominate the headlines: the news that Amazon is expanding into brick and mortar with the takeover of Whole Foods will no doubt embolden short sellers. For example, this week's high conviction retail short, Finish Line - which saw its short positions increase by over 60% in recent weeks - will release earnings on Friday. Meanwhile, the same morning the Whole Foods deal was announced, Finish Line saw its share price fall by over 3%.

Short sellers also targeted fellow retailer Bed Bath & Beyond over the last month, and the retailer saw its shares fall significantly on the news of the Whole Foods takeover.

In the automotive industry, the falling value of second-hand cars caught the attention of short sellers in recent months. Bears are targeting used car dealer CarMax with increased ferocity and have more than 13% of all shares on loan ahead of Wednesday's earnings announcement. This very high demand earns the firm the second spot on this week's list of the most shorted North American companies.

Caravan manufacturer Winnebago has also been hit by short sellers, as the demand to borrow its shares surged by 36% over the past month.

Europe

This week, the only firm to see major shorting activity in Europe is airline SAS, which has around 7% of its shares out on loan. Year-to-date, investors have been bullish on SAS, and the price of its shares rallied by more than a third.

Analysts are also behind this rally and steadily increased their expectations for the firm's upcoming earnings: they are now forecasting a 10% increase in revenue over Q2 2016. Short sellers, however, are getting increasingly unwilling to gamble against this rally as the demand to borrow SAS shares has fallen significantly in the last few months.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19062017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19062017-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19062017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19062017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19062017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}