Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 20, 2016

UK household worries mount amid job, price and interest rate concerns

Households' worries about their future finances have risen to the highest since last December.

Sentiment among families about their overall financial situation in 12 months' time deteriorated on average in April, according to Markit's HFI based on a survey of 1,500 households. Although income from employment rose and debt levels declined in April, families remained worried about job security and became more concerned about rising prices, as well as the threat of the Bank of England lifting interest rates.

Job security has been running at its highest for almost two years in recent months. April saw marked deteriorations in the manufacturing, financial services and media, culture & entertainment sectors.

Household finance survey

Households meanwhile perceived prices to have risen in April at the fastest rate since December 2014, with expectations about future inflation also picking up to the joint-highest seen over this period.

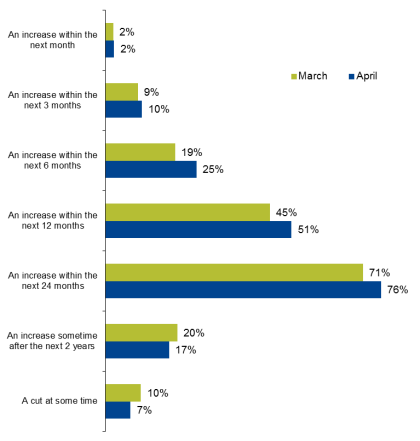

Higher inflation perceptions appeared to have altered households' views regarding the next change in the Bank of England base rate during April. One-in-four households expect interest rates to start rising within the next six months - the highest proportion since January. For the first time in three months, more than half of panellists anticipate higher interest rates over the coming year. The proportion of households expecting the next move in rates to be a cut fell from 10% to 7% in April.

Households' views on next move in Bank of England base rate*

* "The interest rate set by the Bank of England is currently 0.5%. Please let us know when and how you think the Bank will next change interest rates by choosing one of the options below: Please choose one answer."

Historical data are available upon request.

Source: Markit

It should be stressed that the survey gauges of household sentiment about future finances and job security remain well above the respective averages seen between 2009 and 2014, in the aftermath of the global financial crisis. But the fact that worries are mounting suggests that consumer spending could weaken, contributing to a further slowing of economic growth in the second quarter.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20042016-Economics-UK-household-worries-mount-amid-job-price-and-interest-rate-concerns.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20042016-Economics-UK-household-worries-mount-amid-job-price-and-interest-rate-concerns.html&text=UK+household+worries+mount+amid+job%2c+price+and+interest+rate+concerns","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20042016-Economics-UK-household-worries-mount-amid-job-price-and-interest-rate-concerns.html","enabled":true},{"name":"email","url":"?subject=UK household worries mount amid job, price and interest rate concerns&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20042016-Economics-UK-household-worries-mount-amid-job-price-and-interest-rate-concerns.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+household+worries+mount+amid+job%2c+price+and+interest+rate+concerns http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20042016-Economics-UK-household-worries-mount-amid-job-price-and-interest-rate-concerns.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}