Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 20, 2015

Week Ahead Economic Overview

This week's highlights come from the US, where revised fourth quarter GDP numbers are released alongside inflation and durable goods orders data and the Markit Flash US Services PMI. Other standouts are GDP updates in Germany and the UK, inflation numbers for the eurozone and flash manufacturing PMI results for China.

One of the key uncertainties for 2015 is the timing of the first hike in US interest rates. Fed policymakers are widely expected to remove the word 'patient' from their guidance at their March meeting, paving the way for a June rate rise. But much clearly depends on the data flow in coming weeks, and next week sees a host of relevant data updates.

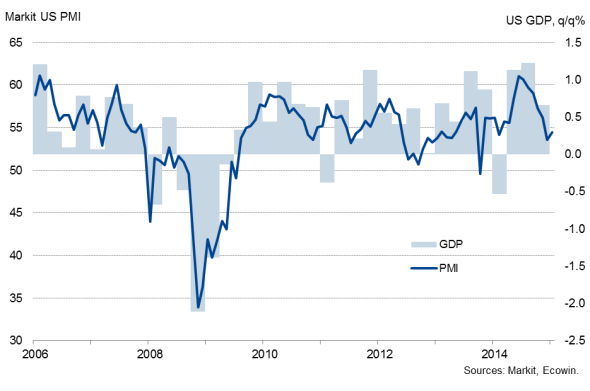

From a backward-looking perspective, policymakers first will be looking to see if the pace of economic growth gets revised as fourth quarter GDP numbers are updated. The first estimate showed the pace of US economic growth slowing to an annualised rate of 2.6%, down from 5.0% in the third quarter. Any significant upward revision clearly raises the likelihood of a summer rate rise.

However, rate setters are also grappling with mixed signals in the first quarter. Although employment growth has surprised on the upside, PMI data and several other key indicators, including retail sales and durable goods orders, suggest that the pace of economic growth remained relatively subdued in January. The release of Markit's Flash US Services PMI for February and updated goods orders will therefore be watched for signs on how the world's largest economy is performing so far in 2015.

Another important release in the US is consumer price inflation. In December, the rate of inflation eased to 0.8%, the weakest in over five years and January data are likely to show a further slowing, possibly down to 0.1% and taking pressure off the FOMC to make any imminent decision on rate rises.

US GDP and the PMI

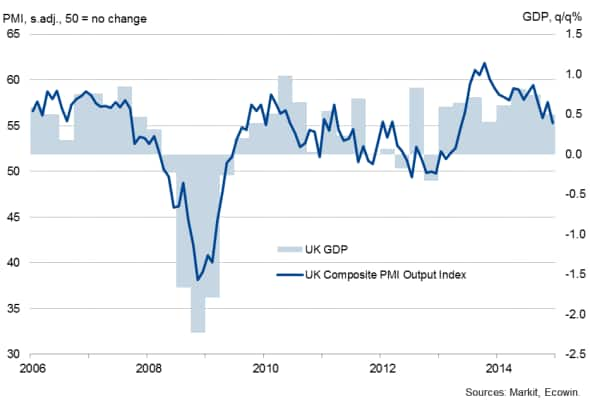

In the UK, the highlight of the week is the second estimate of fourth quarter GDP for 2014. The initial estimate saw the rate of economic growth slowing to 0.5%. The increase was the smallest seen since the final quarter of 2013, but is nevertheless a reasonably robust rise by historical standards. There are good reasons to believe that growth will pick up as we move through 2015. The UK 'all-sector' PMI rose in January and the Bank of England's Inflation Report presented an upbeat view of the UK economy's outlook. However, there is a danger that low inflation could feed through to weaker wage growth, which could require looser policy. The data flow over the next few months will be key as to whether interest rates will rise this year or whether the next step might even be a cut in rates.

UK GDP and the PMI

A flash estimate of inflation for the eurozone showed consumer prices falling 0.6% in January, the steepest drop since 2009. Final numbers will be released by Eurostat on Tuesday. Other important releases in the currency bloc include detailed fourth quarter GDP results in Germany, after the initial estimate showed the eurozone's largest economy growing 0.7%, and a GDP update in Spain, which also enjoyed 0.7% growth according to the initial estimate.

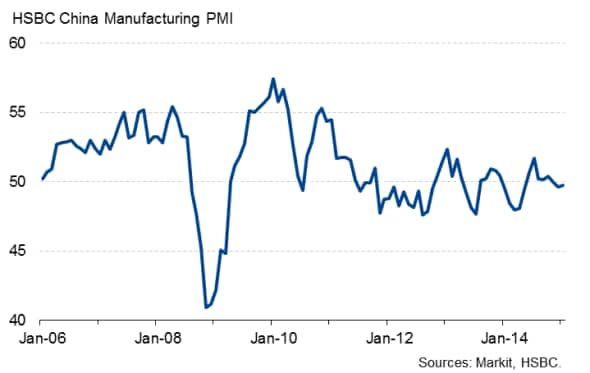

The publication of China's flash manufacturing PMI results is delayed until Wednesday due to the Lunar holidays. Having cut banks' reserve ratio requirements again in early February, policymakers will be hoping to see renewed signs of life in the sector after operating conditions deteriorated in January and economic growth slowed to the weakest in 24 years in 2014.

HSBC China Manufacturing PMI

Monday 23 February

The Bank of Japan issues minutes from its latest monetary policy meeting.

In Russia, monthly GDP numbers are published.

Ifo releases its latest business climate data for Germany.

The Confederation of British industry issues the latest Distributive Trades Survey results.

In the US, existing home sales figures are released.

Tuesday 24 February

Detailed fourth quarter GDP data are issued in Germany, while France sees the release of business confidence numbers.

Inflation figures are meanwhile published for the euro area.

In South Africa, GDP data are updated.

The US sees the release of flash Services PMI data and Case Shiller home prices.

Wednesday 25 February

The HSBC Flash China Manufacturing PMI is released by Markit.

In Brazil, consumer confidence numbers are issued.

Thursday 26 February

The Bank Austria Manufacturing PMI is released.

In Spain and the UK, fourth quarter GDP numbers are updated.

Germany sees the release of unemployment numbers, retail sales figures and Gfk consumer confidence data.

Consumer confidence numbers are issued in France, while the eurozone sees the publication of business climate and M3 money supply data.

Retail sales numbers, wage inflation data and consumer confidence figures are meanwhile released in Italy.

In Canada, inflation numbers are out.

Unemployment data are issued in Brazil.

The US sees the release of inflation numbers and durable goods orders data.

Friday 27 February

In Japan, household spending, inflation, retail sales and unemployment numbers are released alongside industrial output data.

In India, infrastructure output numbers are out.

Germany, Italy and Spain meanwhile see the release of inflation figures, with the latter also updating its current account numbers.

In France, consumer spending data are issued alongside producer price numbers.

Gfk consumer confidence data are out in the UK.

In the US and Greece, fourth quarter GDP numbers are updated with the latter also seeing the release of producer price and retail sales figures.

Brazil meanwhile updates its budget balance.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20022015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20022015-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20022015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20022015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20022015-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}