Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 19, 2015

UK retail sales suffer payback after September surge

UK retail sales fell slightly more than expected in October, but the decline looks to be a one-off and masks a reassuringly solid underlying trend which will likely add to the argument that the economy should be capable of withstanding an initial tightening of policy in the not-too-distant future.

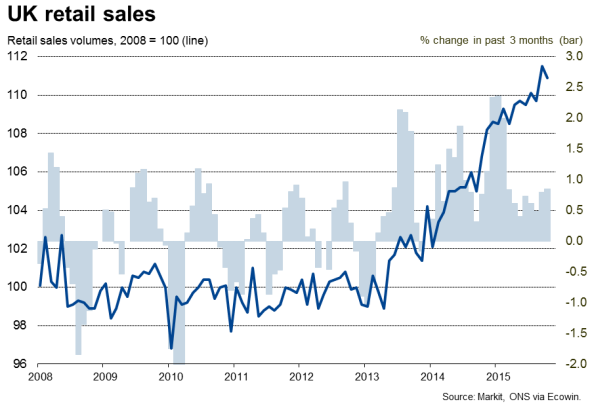

Retail sales volumes fell 0.6% at the start of the fourth quarter, according to data from the Office for National Statistics, compared to expectations of a 0.5% contraction. However, the decline needs to be looked at in light of the 1.7% sales surge seen in September, leaving the three-month growth rate - a good indicator of the underlying sales trend - showing a healthy 0.9% rate of increase. Sales volumes were 3.8% higher than a year ago. Year-on-year sales have now risen continually over the past two-and-a-half years.

Further spending growth is likely in the coming months, for the short-term at least. The longer-term outlook is more uncertain, being dependent on trends in inflation, wages and interest rates.

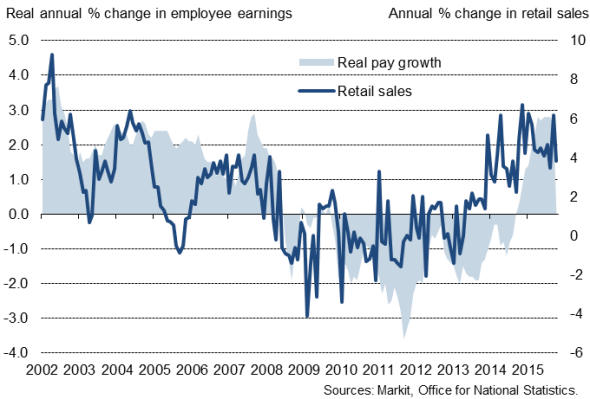

Real wage growth and retail sales

Households' optimism about their future finances improved in November, according to a survey by Markit, with the poll highlighting how spending is being buoyed by a combination of factors, including falling prices, improved pay growth and ultra-low interest rates. This sets the scene for a decent festive season for retailers.

However, the boost to household spending power from falling prices looks set to wane moving into 2016 as inflation starts to pick up again. The hope is that pay pressures will continue to revive, helping to sustain robust real wage growth by offsetting the rise in inflation. However, with interest rate hikes looking a distinct possibility next year, there's clearly a likelihood that consumers will start to pull back on their spending in the New Year.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19112015-Economics-UK-retail-sales-suffer-payback-after-September-surge.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19112015-Economics-UK-retail-sales-suffer-payback-after-September-surge.html&text=UK+retail+sales+suffer+payback+after+September+surge","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19112015-Economics-UK-retail-sales-suffer-payback-after-September-surge.html","enabled":true},{"name":"email","url":"?subject=UK retail sales suffer payback after September surge&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19112015-Economics-UK-retail-sales-suffer-payback-after-September-surge.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+retail+sales+suffer+payback+after+September+surge http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19112015-Economics-UK-retail-sales-suffer-payback-after-September-surge.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}