Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 18, 2014

Top Asian shorts of 2014

From the perspective of the year-end, the top performing stocks for short sellers in the Asia Pacific region can be revealed.

- Outside of Japan, 150 of the largest 1440 companies have seen share prices fall by more than 20% after seeing new annual highs in short interest during the year

- Australian energy and materials companies make up six of the top ten best timed short sales in the region

- Japan has not proved fertile ground for short sellers in the last 12 months; only 30 of the country's largest companies at the start of the year have seen their shares dip after seeing new short interest highs

The best timed short sales in the Asia Pacific region can be revealed from the vantage point of the year-end. Japan has been analysed separately, as short sellers have been less active in the face of Abenomics. This analysis is based on a weekly screen of companies seeing new 52 week highs in short interest, among those that see more than 2% of shares out on loan.

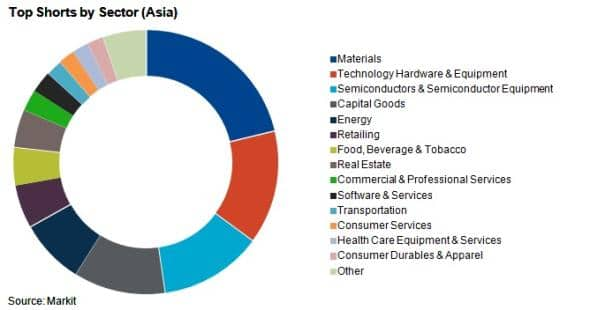

Compared to Europe and North America, where a quarter and a third of companies are heavily shorted, there are far fewer companies being shorted in the region at 11%. These 152 companies' shares have fallen by more than 20% since seeing a fresh new annual high in demand to borrow in 2014.

Australian materials most successful

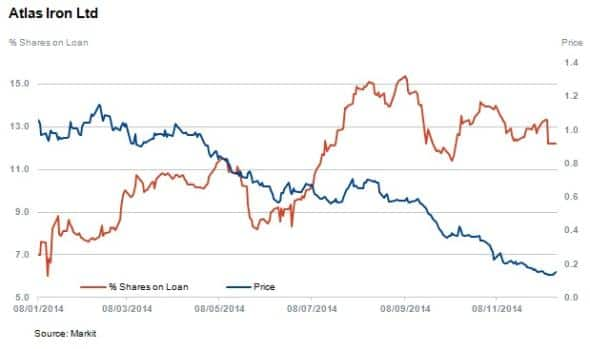

Leading the pack of successful short sales are Australian firms Arrium and Atlas Iron. The companies are involved in iron ore mining and steel manufacture and have faced the lowest ore prices seen in five years. This has put immense pressure on smaller, higher cost producers with some operations shutting down.

Arrium's shares outstanding on loan first peaked in March at 2.3% and subsequently short sellers increased their positions throughout the year. The company announced a share sale to pay off debt in September, sending shares tumbling. The stock is now down 88%.

Vulnerable Atlas Iron's stock is down 86% since short interest first peaked in January. Short sellers have continued to climb into the stock as the shares lost 88% of their value.

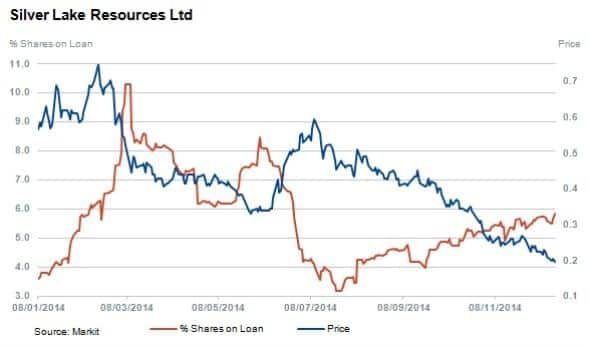

Short sellers had a double take at Silver lake resources in 2014. The stock is down 67% since the first 52 week high signal in February, but short sellers benefited again as the stock rallied in July with short sellers pre-empting the future large decline in share price.

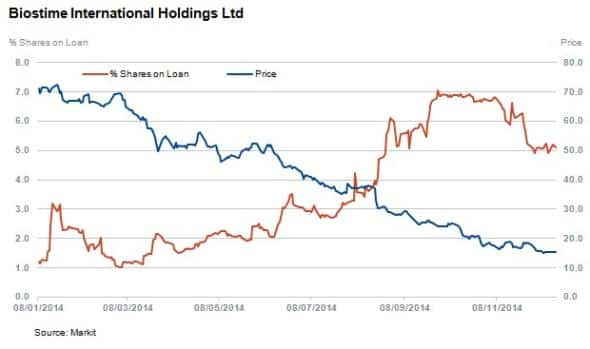

Paediatric Nutrition provider Biostime rose to all-time highs after the announcement in November 2013 of China relaxing the 'one chid' policy. An expected baby boom in the most populous country pushed shares higher. However the boom did not arrive as costs are seemingly too burdensome for Chinese parents. This development made Biostine the top "pure play" Chinese short of the last year

The initial short interest high for the stock was signalled in January and the shares have continued to decline throughout the year. Short sellers have only started covering towards the end of October. The stock is down 79% and shares outstanding on loan have increased to 4.9% over the year.

Energy short sales

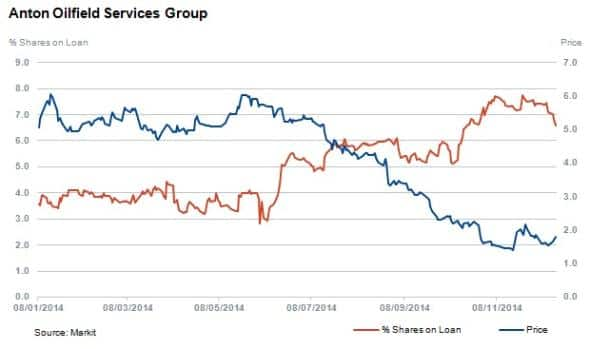

Top performing energy shorts in the region, are oil industry exposed Anton Oilfield services and Newocean Energy. The top short of the two is Anton, with a 68% decline in share price since June, with short sellers recently seen covering.

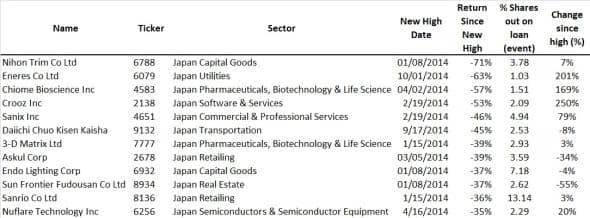

Japan less fertile

Japan has not been as fruitful for short sellers as only 30 firms among the largest 1200 listed equities at the start of the year have seen their share prices retreat by more than 20% in the wake seeing new 52 week highs in demand to borrow. This poor showing for short interest comes despite the country's recent dive back into recession in the third quarter.

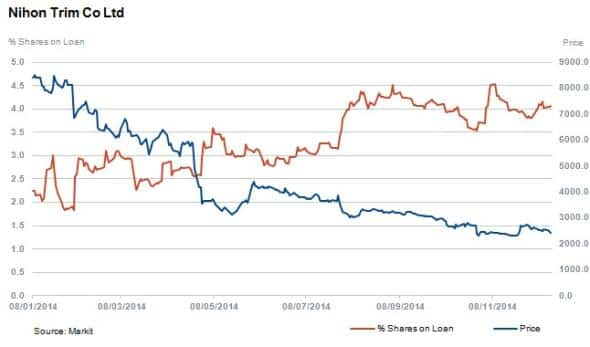

No single quarter stands out as particularly profitable for short sellers in the country. Capital goods firms top the count of most successful Japanese short sales, with six firms among the 30 successful stocks for short sellers, including the best timed short in Japan of the last year; Nihon Trim.

The water purification company has seen its shares fall by over 70% after experiencing a fresh high in demand to borrow in the opening week of the year. Short sellers have continued to target the firm in the wake of the collapse in its share price as short interest is twice where it stood when the company first made the list.

Retail firms have also provided a few successful short sales, led by office furniture firm Askul which fell by just under 40% after its new annual high in short interest in March. Interestingly, all three successful retail shorts were seen in opening months of the year, prior to the sales tax increase which provided headwinds for the sector in the latter parts of the year.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122014-equities-top-asian-shorts-of-2014.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122014-equities-top-asian-shorts-of-2014.html&text=Top+Asian+shorts+of+2014","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122014-equities-top-asian-shorts-of-2014.html","enabled":true},{"name":"email","url":"?subject=Top Asian shorts of 2014&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122014-equities-top-asian-shorts-of-2014.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Top+Asian+shorts+of+2014 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122014-equities-top-asian-shorts-of-2014.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}