Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 17, 2014

Top European shorts of 2014

December has seen an increased bout of volatility. Against this backdrop a number of trends that paid off for short sellers across the last 12 months can be revealed.

- 104 of the largest 2000 companies have seen their shares fall by more than 20% after seeing new annual highs in short interest

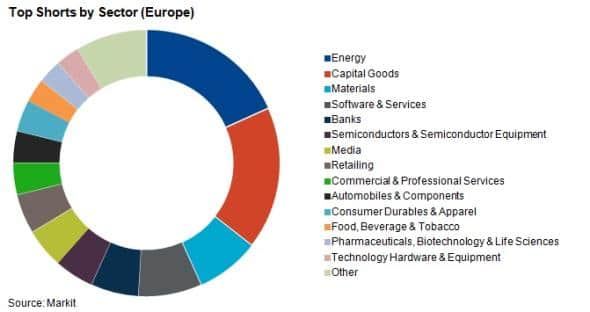

- Energy firms and Capital Goods make up nearly 40% of best performing short sales, led by New World Resources and Polarcus

- Punch Taverns has been the most profitable stocks for short sellers in Europe

From the vantage point of the year-end, 2014's best timed short sales within 2000 of the largest European companies at the start of the year can be revealed. This analysis is based on a weekly screen of the companies seeing a fresh new 52 week highs in short interest, among those that see more than 3.0% of shares out on loan.

Across 2014 just under a quarter of European companies have been targeted by short sellers, as with 457 companies make at least one appearance in the screen. Short sellers appear to have been largely successful at targeting underperforming shares as the companies that make the list have seen their shares fall by 3% on average since appearing on our screen.

On the most successful end of the scale, 104 companies have seen their shares fall by more than 20% since seeing a fresh new annual high in demand to borrow.

Energy shares most successful short sales

Energy firms make up one third of the top 20 most successful short sales this year.

The collapse in energy prices has seen a sharp drop off in energy share prices, and this is represented in the screen with almost 20% of all successful short sales coming out of the energy sector.

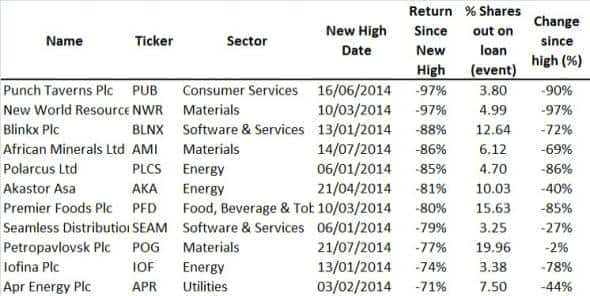

The most successful energy short sales go to Polarcus, closely followed by Akastor.

Both firms provide auxiliary services to the oil and natural gas industries and have come under significant pressure in the wake of a 50% decline the price of crude. Polarcus has seen shares decline by 85% and Akastor is down 81%.

Online video advertising platform, Blinkx came under short selling scrutiny in late 2013 and was a top three short in European markets in 2014. The stock is down 88% with shares outstanding and stock price peaking in January and February of this year at 12.6% and 209p respectively. The stock currently trades near 25p.

New World Resources, a central European coal and coke producer, has been the second best performing short sale for 2014. The company filed for chapter 15 Bankruptcy in July in an effort to reorganise the company and restructure debt. The share price is down 97%.

Narrowly beating New World Resources by 0.2% is embattled Pub operator Punch taverns. The group's share price is down over 97% as hefty dilution had to be incurred in order to fend off total collapse. The group managed to forge ahead with a restructuring plan in October 2014 and the company's large debt burden, built up in the early 2000s, has been partially converted into equity.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17122014-Equities-Top-European-shorts-of-2014.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17122014-Equities-Top-European-shorts-of-2014.html&text=Top+European+shorts+of+2014","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17122014-Equities-Top-European-shorts-of-2014.html","enabled":true},{"name":"email","url":"?subject=Top European shorts of 2014&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17122014-Equities-Top-European-shorts-of-2014.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Top+European+shorts+of+2014 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17122014-Equities-Top-European-shorts-of-2014.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}