Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Nov 18, 2015

Thai bond returns avoid broader Asean downturn

Sovereign CDS spreads have fallen across the Asean region over the past two months, but only Thailand has seen its government bond returns remain resilient.

- Credit risk across the Asean region has fallen in tandem since September's highs

- In H2, Thai government bond returns have outperformed the next best Asean peer by 1.4%

- Returns in H2 are on par with Chinese peers, boosted by tourism and spending

Emerging market credit has had a volatile second half (H2) in 2015. Falling commodity prices, slowing global trade and a strong US dollar have all impacted credit risk, nowhere more than in the Asean region.

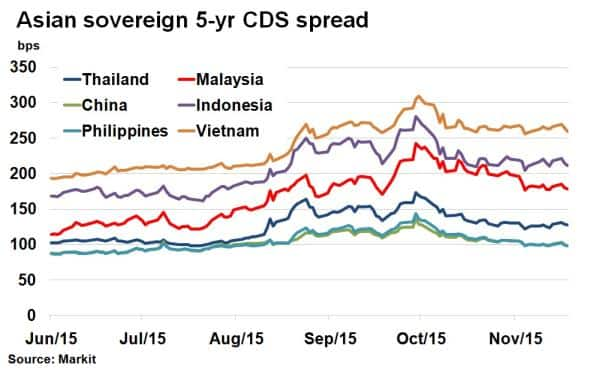

5-yr CDS spreads, which measure implied credit risk, rose steadily in August and September with Malaysia's 5-yr CDS spread more than doubling over the period. Stronger credits such as China and the Philippines were also not immune and saw spreads widen near 150bps, according to Markit's CDS pricing service. Since September's wides, however, credit risk across the Asean region has fallen in tandem, signifying the macro element of the contagion.

Thai safe haven

Whereas sovereign credit risk across the region has been largely interconnected, bond investors have had mixed results in the second half of this year. According to Markit's iBoxx indices, Malaysia's government bonds suffered particularly from falling commodity prices and the impact on the ringgit, having shed over 6% from June to September on a total return basis. More recently Singapore and the Philippines have seen returns dive 1.1% and 2.9%, respectively, month to date, even as 5-yr CDS spreads across the region have fallen.

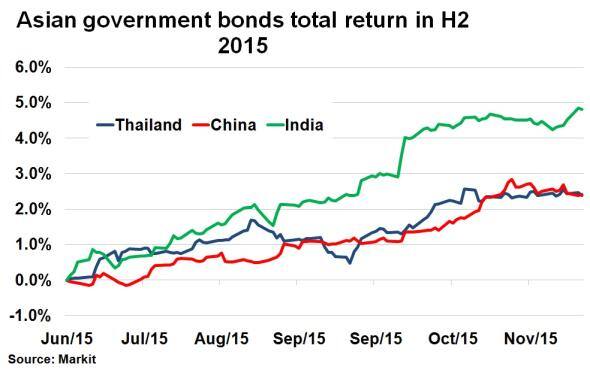

From an investor's perspective, the standout performer in the region has been Thailand, whose government bond returns have sustained the global challenges and remained in positive territory throughout H2. The iBoxx GEMX Thailand index has returned 2.4% so far in H2, 1.4% more than its closest Asean peer. Reduced policy uncertainty, infrastructure spending and tourism have helped investor sentiment in the country while the bigger commodity exporting nations such as Malaysia and Indonesia are expected to suffer more from weaker global trade.

On par with China

Thai government bond returns have also stood up against the larger nations in the Asian region. Undeterred by a slump in commodity prices, both China and India are expected to grow at a faster rate than Thailand, according to the IMF. Meanwhile central bank policy is swaying towards further easing, driving yields down and boosting bond returns. Yet Thailand's government bonds have managed to provide returns on par with Chinese government bonds in H2, although they have lagged India. The performance does, however, demonstrate the resilience of Thai government bonds compared to the riskier end of the Asean spectrum, and may prove to be the safe haven asset if more market turmoil festers.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18112015-credit-thai-bond-returns-avoid.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18112015-credit-thai-bond-returns-avoid.html&text=Thai+bond+returns+avoid+broader+Asean+downturn","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18112015-credit-thai-bond-returns-avoid.html","enabled":true},{"name":"email","url":"?subject=Thai bond returns avoid broader Asean downturn&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18112015-credit-thai-bond-returns-avoid.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Thai+bond+returns+avoid+broader+Asean+downturn http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18112015-credit-thai-bond-returns-avoid.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}