Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 18, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

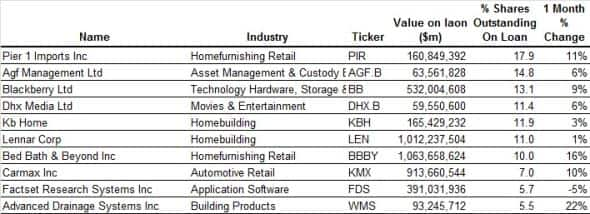

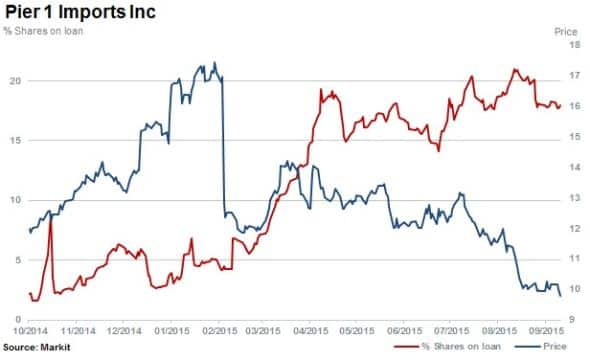

- Home d"cor retailer Pier 1 Imports is the most shorted ahead of earnings in North America

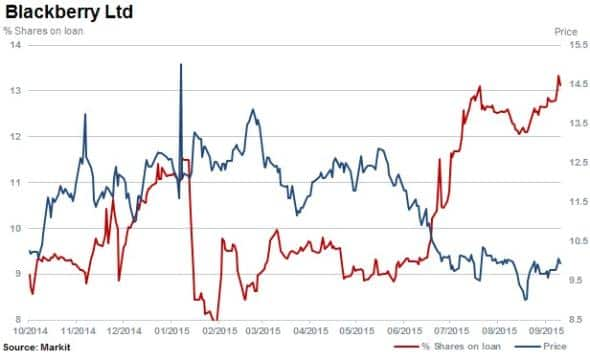

- Short sellers return to BlackBerry as short interest levels shoot up to a two year high

- Markit Dividend Forecasting expects Esprit, the most shorted in Apac, to suspend its final dividend

North America

For a consecutive quarter, the most shorted ahead of earnings in North America is home d"cor retailer Pier 1 Imports. Short sellers have continued to target Pier 1 Imports, increasing positions by 15% in the last three months with shares outstanding on loan rising to 17.9%. The stock has declined 19% over the same period as the firm's profit stagnates amid moderate sales increases and margin pressure.

The home furnisher Bed Bath & Beyond joins Pier 1 Imports in seventh position among the most shorted with 10% of shares outstanding on loan ahead of earnings.

BlackBerry, the now niche handset maker which is expected to release its first Android powered smartphone shortly, has once again attracted the attention of short sellers.

The company's first quarter earnings reported in June 2015 initially pleased investors with signs of a turnaround. However, concerns that higher software revenues were not recurring saw shares slide and short interest levels rise.

Shares outstanding on loan have risen to a two year high of 12.1%, climbing 40% in the last three months while the stock has slipped 9%.

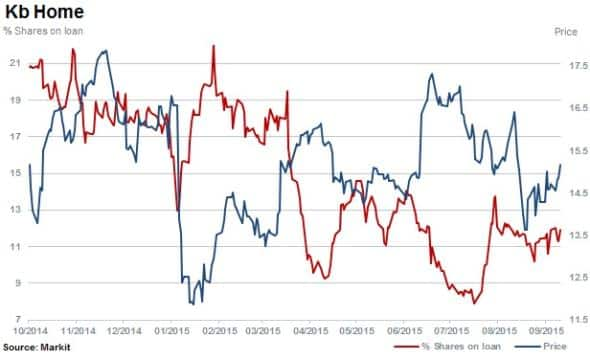

Shorts have marginally covered positions in Kb Home with the company moving down the most shorted rankings from second to fifth with 11.9% of shares outstanding on loan

Kb Home is closely followed by homebuilder Lennar, which has 11% of shares outstanding on loan ahead of earnings.

Western Europe

Europe is relatively quiet in terms of high short interest activity in companies reporting earnings in the coming week.

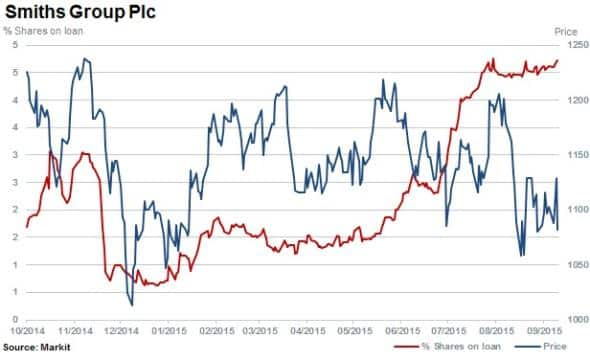

Most shorted is Smiths Group with 4.7% of shares outstanding on loan. Short interest has increased twofold over the last 12 months in the industrial technology company.

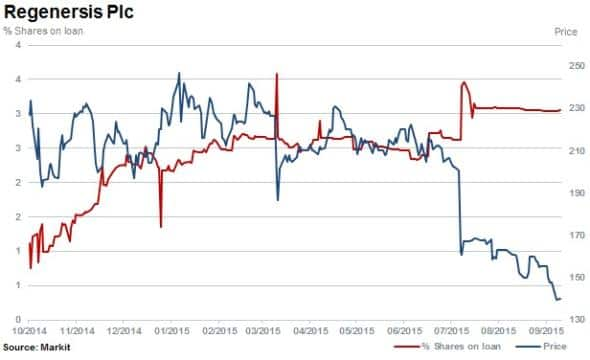

Regenersis, a global electronics repair outsource partner to consumer brands, is among the most shorted companies in Europe ahead of earnings this week. With 3% of shares currently outstanding on loan, the stock has fallen 57% in the last 12 months. Shares came under pressure after a key client announced consolidation plans, impacting the company's depot operations.

Apac

Hong Kong listed clothing retailer Esprit is the most shorted ahead of earnings this week in Apac with 6.6% of shares outstanding on loan. Esprit stock is down a third over the last 12 months.

After a turnaround in profitability in FY14, Esprit announced it expects to record a substantial loss in FY15. Underperformance in China and weak sales of managed retail stores contributed to non-recurring provisions and impairments. With an expected loss for the current year, Markit Dividend Forecasting anticipates the final dividend to be suspended.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18092015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18092015-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18092015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18092015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18092015-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}