Shorts target luxury sector premiums

Luxury high end names have seen increasingly bearish sentiment in recent weeks; a trend that has accelerated in the wake of weak demand from the Asian market.

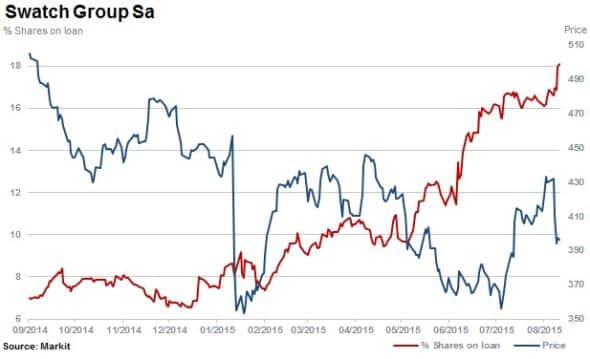

- A fifth of Swatch Group shares are short sold, an all-time high

- Tightly held Italian firms Prada and Tod's attracting shorts, driving cost to borrow higher

- $8bn in short bets across the 25 most short sold luxury and apparel retailers

The impact of recent currency fluctuations and continued downturn in commodities is starting to filter through the luxury goods sector. A weaker euro and stagnating demand out of Asia has turned the sector's once coveted exposure to the region into a risk factor.

Swiss firms in the scope

Swiss exporting firms were hit hard in January 2015 when the National Bank removed the Swiss franc's exchange rate cap against the weakening euro. The surprise move caused large single day selloffs in Swiss luxury exporters including watchmaker Swatch and luxury goods maker Richemont, whose shares fell by 17% and 15% resepectively.

While both these stocks recovered most of their lost ground in subsequent weeks, weaker demand data emanating from Asian markets has seen shares sink. Both firms are now down by over 11% for the year.

Swatch Group has seen a 90% jump in short interest in the last six months with shares out on loan increasing to 18.6%, an all-time high.

Swatch is used as a market barometer for Chinese luxury demand as Hong Kong and China represent the watch maker's biggest market, ahead of the US.

Swatch's reported sales for the first half of 2015 showed growth in mainland China continued, whereas Hong Kong experienced a slowdown.

Similarly, Richemont has ~40% of sales exposure to Apac. Richemont reported difficult trading conditions in May 2015 in the region, affected specifically by lower Hong Kong and Macau based revenues.

Italian luxury

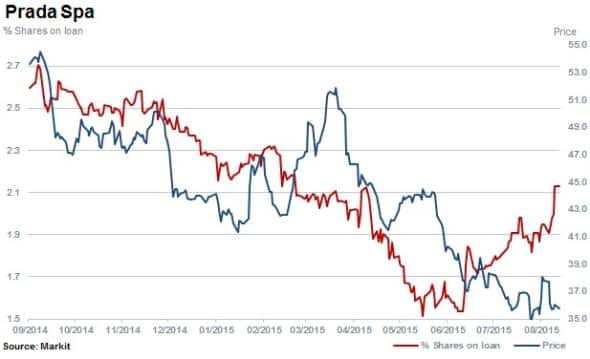

Euro weakness has seen luxury handbag maker Chanel cut prices in Asia to secure local sales due to widening price differentials of products globally. However on aggregate this seems to be a function of lower Chinese and Asian weakening consumer demand for luxury goods in general - as seen in handbag maker Prada.

Prada has also reported continued difficult trading conditions in Hong Kong and Macua in the first quarter of 2015.

Prada has seen shares decline by 35% in the last 12 months with short sellers recently increasing positions over a third in the last three months with shares out on loan increasing to 2%. This represents 88% of shares available to short. The limited supply of stock has pushed the cost to borrow above 6%.

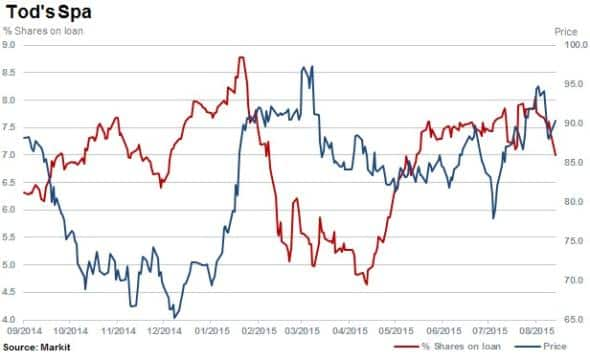

Fellow luxury goods retailer Tod's has seen an increase in shorting activity recently with shares outstanding on loan rising to 7%. The demand to borrow the tightly held stock has increased by 100% in the last month, with the cost to borrow rising above 3%.

In terms of value on loan, Prada is currently the tenth most short sold luxury goods retailer across the Consumer Durables & Apparel sectors with $256m out on loan. Swatch currently leads the sector in terms of value short sold with $2.3bn currently on loan.

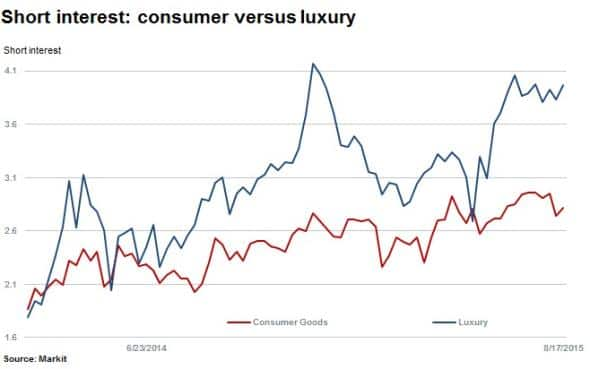

Shorts rotate into luxury

These firms highlight a broader trend of short sellers entering into the luxury segment of the market over the last few months. Average short interest in luxury stocks has increased by almost a third, rising to 3.9% compared to the consumer goods sectors' average rising to 2.8% of shares out on loan.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.