Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 18, 2015

Oil price impacts the sector's bond yields

A fall in demand for oil and gas high yield bonds has helped contribute to the spike in US corporate bond yields.

- The Markit iBoxx $ Liquid High Yield index yield widened by 49bps during March

- Oil and gas bond yields widened by 90bps over the same period as oil prices have continued to retreat

- ETF investors tapered exposure to high yield bonds; but the selloff halted ahead of the FOMC results

The highly anticipated FOMC guidance will set the tone for the timing of future rate rises in the US. Investors have been eager to get ahead of the Fed's potential emergence from almost eight years of near zero interest rates. This is evident by the recent yield spike seen in 10-Year treasuries and the dollar's strength. However, the stronger dollar has complicated the Fed's interest rate decision.

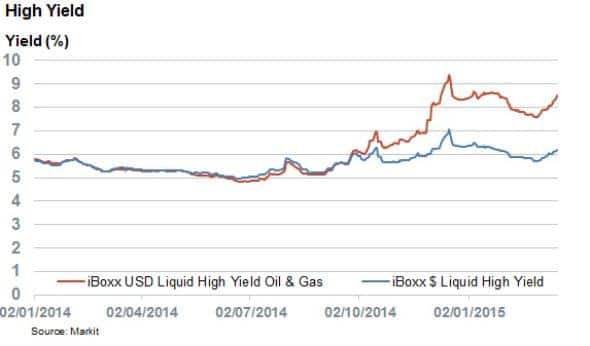

In the corporate bond market, high yield credit issuers have echoed the recent spike in treasury yields over the last couple of weeks, but yields are still far below the highs seen in the closing weeks of last year.

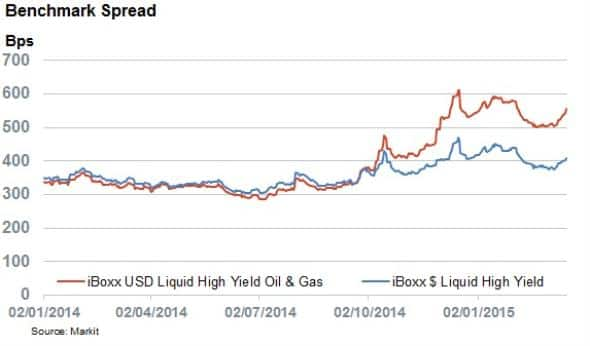

The Markit iBoxx $ Liquid High Yield Index now yields 6.18%, almost 0.5% higher than February's close. This jump in yield was more pronounced than that of benchmark yields, denoting that investors now require 29bps more to hold high yield credit than two weeks ago.

Despite the recent widening, the extra 409bps yield needed by investors to hold high yield credit is still way off the recent high seen in the closing weeks of last year when investors were asking for 470bps of extra yield to hold high yield credit.

Oil and Gas Yield

The recent unease in high yield credit was largely driven by increased bearish sentiment towards oil and gas borrowers, whose bonds have widened by a greater margin than the rest of the market.

The Markit iBoxx USD Liquid High Yield Oil & Gas Index saw its yield widen by 90bps since the start the month to 8.5%. Resurgent yields are reflecting both the recent interest rate speculation as well as the continuing weakness in oil prices.

Much like the wider high yield market, the recent yield surge still trails the highs seen in the closing weeks of last year, when the iBoxx USD Liquid High Yield Oil & Gas Index yielded 9.4%.

Oil and gas names make up just under 15% of the overall high yield universe so the continuing headwinds faced by the energy sector have contributed to more than their fair share of the recent high yield surge.

ETF investors start to head off

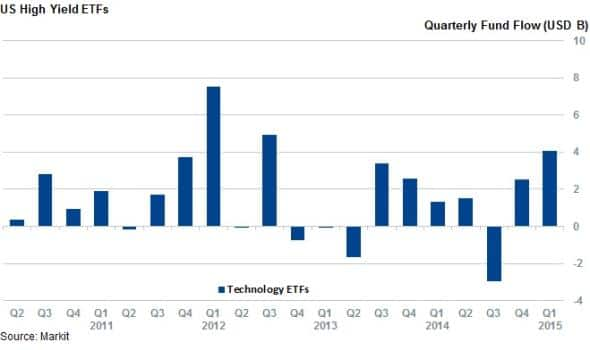

US high yield bond ETFs experienced a slight selloff in the wake of the recent yield spike, with investors withdrawing $2.4bn of assets in the opening two weeks of March from the 41 products which track the asset class. This trend has halted somewhat as these ETFs have seen just under $400m of inflows in the four days leading up to the FOMC announcement.

Having said that, high yield bond ETFs are still on track for their best quarterly inflows in over two years, having already attracted over $4bn this year.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18032015-Credit-Oil-price-impacts-the-sector-s-bond-yields.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18032015-Credit-Oil-price-impacts-the-sector-s-bond-yields.html&text=Oil+price+impacts+the+sector%27s+bond+yields","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18032015-Credit-Oil-price-impacts-the-sector-s-bond-yields.html","enabled":true},{"name":"email","url":"?subject=Oil price impacts the sector's bond yields&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18032015-Credit-Oil-price-impacts-the-sector-s-bond-yields.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Oil+price+impacts+the+sector%27s+bond+yields http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18032015-Credit-Oil-price-impacts-the-sector-s-bond-yields.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}