Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 17, 2015

US interest rates polarise expectations

Doves within the FOMC who aim to maintain stimulus for the US economy with ultra-low interest rates low will have been bolstered by the recent falling inflation readings, but investors think otherwise.

- Investors anticipate interest rate increases given the surge in yields for US treasuries

- Stocks which benefit from low inflation continue to generate excess average monthly returns

- ETF investors' appetite for inflation protection has gained momentum

Inflating prices

The gap between the hawks and the doves has narrowed with expectations that The Federal Open Market Committee (FOMC) will raise US interest rates in either June or September 2015. This expectation of an impending rate rise is also reflected in the bond market, where US 10-year treasury bonds registered a sharp increase in yield over the last couple of weeks to above 2%.

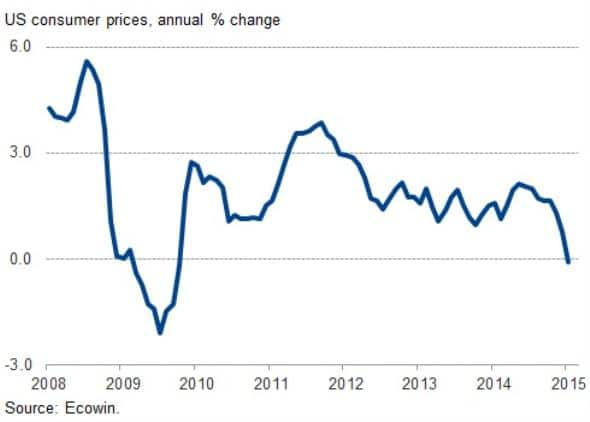

Despite this growing talk of rate normalisation, the US recovery over the last couple of years has seen little inflation, which has always been the cornerstone of monetary policy. The recent negative US inflation readings could provide more ammunition to inflation "doves" in the FOMC who seek to keep interest rates low.

Inflation hedging

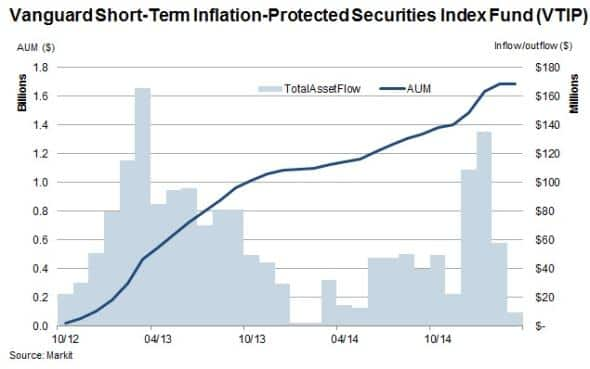

Inflows into the largest inflation protected ETF by AUM, the Vanguard Short-Term Inflation-Protected Securities Index Fund (VTIP) have continued to accelerate since the start of 2015 as investors have sought protection against price increases.

The VTIP ETF tracks a benchmark of inflation protected US treasuries with maturities of less than 5 years. Since the ETF's launch in 2012 it has seen steady inflows to take its AUM to just shy of $1.7bn.

The recent fall in the US consumer price index has seen the fund underperform the largest short dated US treasury fund, its comparable peer. This indicates that the recent rush to protect against a surge in inflation may have been overblown.

Since the financial crisis, the persistently low inflation rate environment has provided a tailwind for firms which historically benefit from low inflation. Markit Research Signals'

equity Inflation Sensitivity* factor, ranks companies according to their sensitivity to inflation.

Across the Markit US Large Cap universe consisting of over a 1,000 large cap companies in the US, those companies that ranked in the tenth decile (the least sensitive to changes in inflation), have generated average monthly excess returns of 0.37% since March 2006. Most of this recent outperformance in inflation tolerant shares was seen since 2009 when inflation tapered off to the recent lows.

In the last 12 months the average monthly excess return has fallen to half that figure - at 0.18%.

However, March has seen these shares significantly outperform their peer which indicates that the recent taming inflation numbers have seen investors return to the low inflation trade.

On the other side of the universe, the most inflation sensitive stocks in the first decile have delivered negative average monthly returns of 0.16% since 2006.

Energy and utilities stocks stand to benefit from a rise in inflation according to the current inflation sensitivity factor rankings. Both these sectors have underperformed in the last few months as inflation tapered. Some interesting energy names which feature in the top decile include First Solar and Gulfport Energy.

* The Markit Research Signals Inflation Sensitivity factor is defined as the beta coefficient to Change in Inflation, which is estimated by a 60 month multiple regression of returns on several macroeconomic factors. Markit Ranks this factor in descending order

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17032015-Equities-US-interest-rates-polarise-expectations.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17032015-Equities-US-interest-rates-polarise-expectations.html&text=US+interest+rates+polarise+expectations","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17032015-Equities-US-interest-rates-polarise-expectations.html","enabled":true},{"name":"email","url":"?subject=US interest rates polarise expectations&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17032015-Equities-US-interest-rates-polarise-expectations.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+interest+rates+polarise+expectations http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17032015-Equities-US-interest-rates-polarise-expectations.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}