Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 17, 2015

UK sees sustained deflation for first time

The UK's Consumer Price Index (CPI) remained in negative territory in October, helping shore up the Bank of England's belief that there's no rush to start raising interest rates.

Prices were 0.1% lower than a year ago, according to the Office for National Statistics, having slipped into deflation back in September. This is the first time that we have seen falling consumer prices for two consecutive months since data were first available in 1996. Inflation has been completely absent from the UK economy since February as low oil and commodity prices, plus a stronger currency, have helped bring down prices. Food, fuel and transport costs all fell heavily compared to a year ago in October.

Core inflation rose to 1.1%, but clearly remains subdued by historical standards and will present little concern to policymakers.

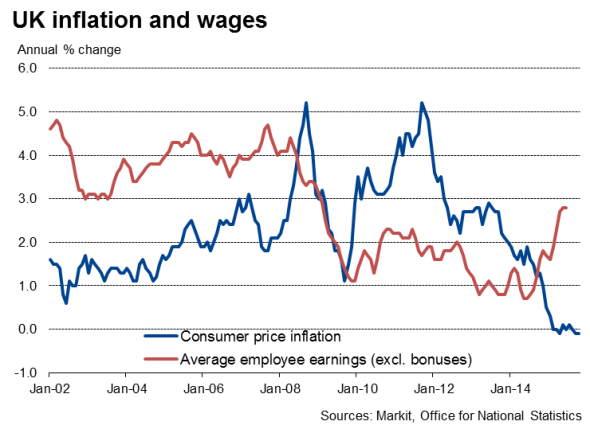

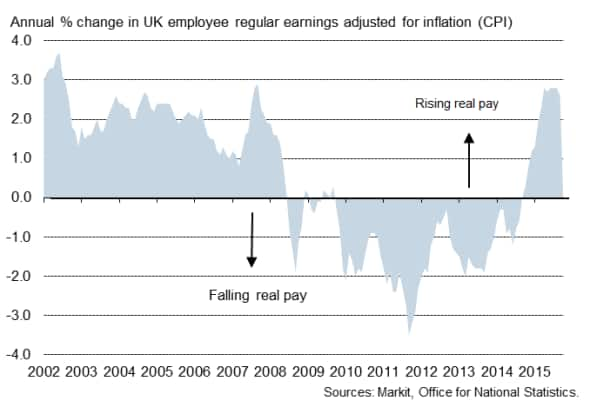

Real wage growth

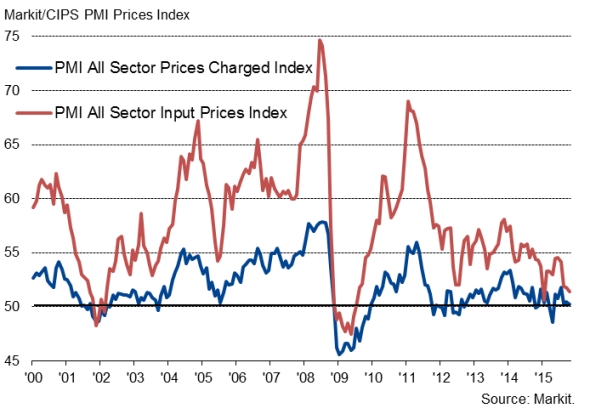

The lack of inflationary pressures is also evident in business survey data on companies' costs, which suggest that inflation will stay subdued in coming months. PMI surveys have shown that manufacturing costs have been falling at the fastest rate for six years in recent months and service sector costs rising at a reduced rate, held down by low energy prices and intense competition among suppliers.

Business survey price gauges

The deflationary picture supports the Bank of England's dovish outlook, which envisages interest rates staying on hold until 2017. However, this outlook is dependent on oil prices and wage pressures remaining low, with strong chances that these deflationary effects will fade as we move into the new year.

The benefit of ongoing low inflation is not only that interest rates will stay lower for longer but that real wage growth remains robust, which will in turn continue to boost consumer spending power and help sustain the economic upturn, albeit with this boost moderating in 2016.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112015-economics-uk-sees-sustained-deflation-for-first-time.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112015-economics-uk-sees-sustained-deflation-for-first-time.html&text=UK+sees+sustained+deflation+for+first+time","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112015-economics-uk-sees-sustained-deflation-for-first-time.html","enabled":true},{"name":"email","url":"?subject=UK sees sustained deflation for first time&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112015-economics-uk-sees-sustained-deflation-for-first-time.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+sees+sustained+deflation+for+first+time http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112015-economics-uk-sees-sustained-deflation-for-first-time.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}