Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 17, 2015

Weak retail sales add to signs of slowing UK economy

Sluggish growth of retail sales adds to the recent flow of economic data which point to a slowing in the UK economy.

Wages rise amid tighter labour market

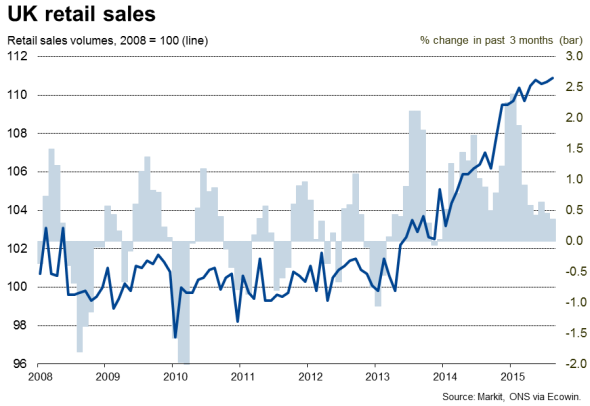

Retail sales were up 0.2% in August, according to the Office for National Statistics, a disappointingly modest pace of expansion which followed a mere 0.1% increase in July.

So far in the third quarter, sales are up just 0.15% on average compared to the second quarter, well down on the 0.6% rise seen in the three months to June and the 0.9% rise in the opening quarter of the year.

The sluggish sales performance over the past two months suggests that retailers are facing the worst quarter of growth since the final quarter of 2013.

The waning retail sales trend follows other data which point to a cooling in the pace of economic growth. Industrial production fell 0.4% for a second successive month in July, and business surveys such as the PMI have indicated the weakest pace of economic growth for two years in August. Put all the information together and it's pointing to the economy growing by 0.4% in the third quarter, down from 0.7% in the second quarter.

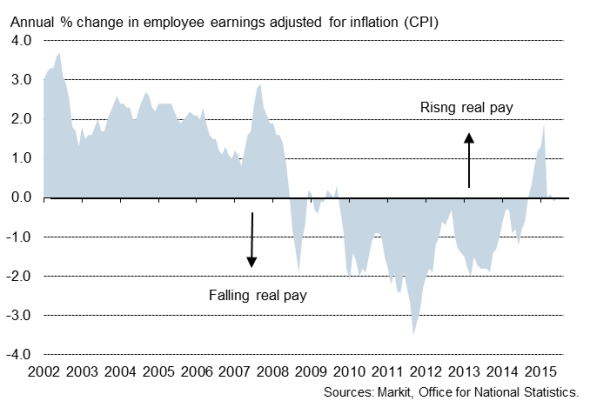

Household mood improves

However, this may well be just a soft patch. Household confidence picked up in September, according although remained below earlier in the year. The survey data show consumer spending power being boosted by the ongoing lack of inflation and slumping oil prices. The combination of low inflation and rising wages, growth of which hit a six-year high in July, should spur an upturn in retail sales in coming months.

Pay growth adjusted for inflation

Uncertainty rules out rate hike

However, it is also evident from the PMI survey data that business uncertainty has risen in recent months, dampening investment and hiring, amid worries about the global economy, the outlook for US interest rates and financial market volatility.

It's therefore too early to say whether this is a soft patch or if the economy is facing a steeper slowdown. Given this uncertainty, it seems likely that policymakers will want to hold off on any interest rate hikes until the picture becomes clearer.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17092015-Economics-Weak-retail-sales-add-to-signs-of-slowing-UK-economy.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17092015-Economics-Weak-retail-sales-add-to-signs-of-slowing-UK-economy.html&text=Weak+retail+sales+add+to+signs+of+slowing+UK+economy","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17092015-Economics-Weak-retail-sales-add-to-signs-of-slowing-UK-economy.html","enabled":true},{"name":"email","url":"?subject=Weak retail sales add to signs of slowing UK economy&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17092015-Economics-Weak-retail-sales-add-to-signs-of-slowing-UK-economy.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weak+retail+sales+add+to+signs+of+slowing+UK+economy http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17092015-Economics-Weak-retail-sales-add-to-signs-of-slowing-UK-economy.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}