Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 17, 2015

Corporate hybrids outperform

Dwindling yields are making subordinated debt a star performer in Europe; a trend that corporates have been to embrace.

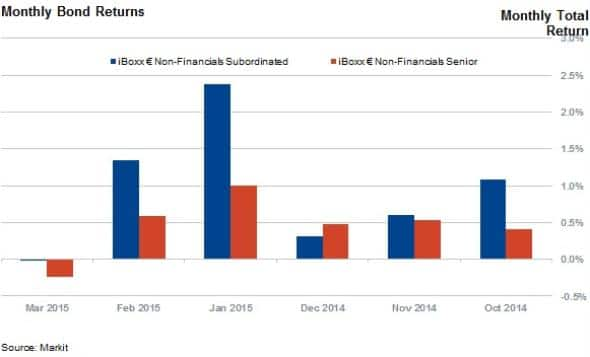

- Hybrid bond, as measured by the iBoxx € Non-Financials Subordinated index, have outperformed senior bonds in five of the last six months

- The iBoxx € Non-Financials Subordinated index provides 1.5% of extra yield over senior bonds

- The return/risk has recently switched in favour of hybrids; making them more attractive than BBB rated corporates

After coming to a near standstill during the financial crisis, hybrid corporate bonds have staged a resurgence as evidenced by the number of major European corporations entering the market. Recent issuances from French oil group, Total and automakers, Volvo and VW have exploited today's low cost of capital environment alongside investor appetite for higher yielding fixed income securities.

Hybrid corporate bonds are usually fixed coupon, perpetual in nature with pre-determined call dates. They are essentially an equal mix of debt and equity and rank ahead of common equity in the event of a default, but are subordinated to senior debt.

From an issuer stand point, they provide extra capital protection due to their half equity structure while still maintaining debt status under tax rules.

Strong Returns

Corporate hybrid bonds have performed strongly this year, continuing a trend which saw the asset class outperform more senior peers in five of the last six months. The iBoxx € Non-Financials Subordinated index has achieved an overall return of 3.71% this year compared to just 1.35% for the iBoxx € Non-Financials Senior.

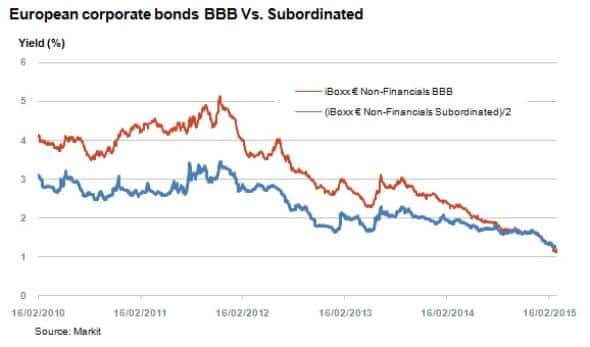

While yields on both hybrids and senior debt have been declining since 2013, largely due to underlying interest rates, the falling spread differential highlights the strong relative demand for the asset class over more senior, lower yielding debt. This spread has compressed by around 0.5% over the last three months and hybrid assets still yield 1.57% more than senior debt.

Vattenfall debut

State owned Swedish utilities firm, Vattenfall issued a hybrid bond last week to strong investor demand. Five times oversubscribed, it included a €1bn bond with 3% coupon callable in 2027.

It is worth exploring how this yield was derived and asking whether it represents fair value when compared to senior counterparts.

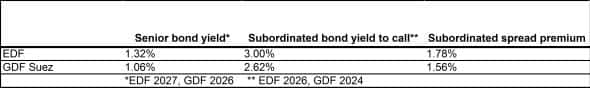

The iBoxx € Non-Financials Subordinated index includes two other comparable European utilities: EDF and GDF Suez.

Markit's bond pricing can be used to calculate the subordinated spread premium used for EDF and GDF Suez, and then apply it to Vattenfall senior bonds. This could provide a good indication of where the new issue could trade at fair value.

The Vattenfall senior bond 5.375% 2024 yields 1.03%, and is closest to the maturity of the new hybrid. Applying the average of the subordinated yield spread between the two comparables would imply a 2.7% yield.

Yield premium

One way of looking at the attractiveness of the asset class is to compare the yield return to the implied credit risk, provided by the rating agencies.

In terms of credit quality, the iBoxx € Non-Financials Subordinated index is made up of around 16% A rated securities and 84% BBB rated securities.

Apply a typical 50% credit/equity split assigned to hybrids by rating agencies, it is possible to compare the iBoxx € Non-Financials Subordinated index to the iBoxx € Non-Financials BBB index. However, one can only factor in the credit part (50%) of the yield.

Based on these assumptions, hybrid credit has been more expensive than BBB credit over the last five years up until recently (February 12th), when this trend reversed.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17032015-credit-corporate-hy.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17032015-credit-corporate-hy.html&text=Corporate+hybrids+outperform","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17032015-credit-corporate-hy.html","enabled":true},{"name":"email","url":"?subject=Corporate hybrids outperform&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17032015-credit-corporate-hy.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Corporate+hybrids+outperform http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17032015-credit-corporate-hy.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}