Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 17, 2015

Sears CDS bearish after RadioShack bankruptcy

In the wake of the RadioShack bankruptcy, US retailer Sears has seen the CDS market turn increasingly bearish.

- The CDS curve in Sears has inverted in recent months; a sign of increased distress in the name

- Bonds have yet to react to these developments with both short and long dated bonds trading relatively flat

- This disconnect between the cash and credit world has led to a large basis

Sears, a once powerhouse American chain of department stores, continues to lose out to other brick and mortar competitors such as Walmart, Target and Best Buy, as well as new age e-commerce players like Amazon. The last few years have seen sales slump as the company struggles to implement a clear strategy, forcing sales of parts of the business to raise capital. The recent bankruptcy filing of fellow retailer RadioShack has not helped Sears' position, as CDS traders have treated the company's credit with increasing bearish sentiment in the last couple of weeks.

Credit simmering

Looking deeper into credit markets, sentiment has slowly been turning negative as liquidity has picked up this year.

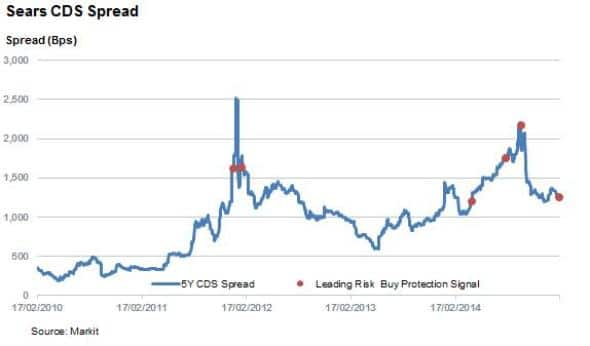

5 year CDS spreads jumped to 1366bps on January 21st, before coming down with the current level at 1251bps. It is worth noting that the single name is also being quoted on an 'upfront' basis, and has been for some time; a convention used by traders only when a name becomes sufficiently distressed.

This sort of volatility has by no means been a one off. Over the past five years spreads have twice hit over 2000bps, in January 2012 and more recently in September 2014. On both occasions the scare was short lived and spreads pummelled down 500bps within a month as optimism about the group's performance improved.

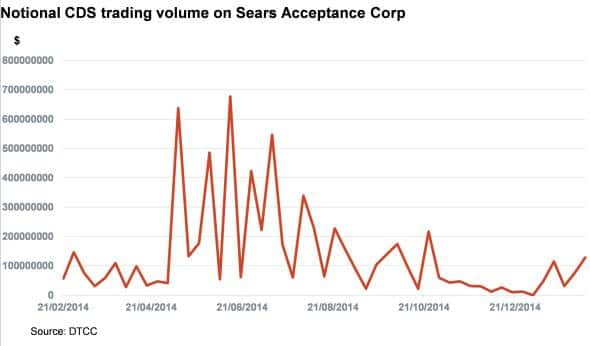

Liquidity has slowly been picking up this year with 128.5m notional traded the week ending February 6th; the highest since October last year, and dealer and contributor depth also remains high across the tenors. But we have recently seen the short end of the curve come under pressure as bid/ask spreads for the 1 year tenor have reached 280bps compared to 80bps for the 5 year.

This flattening/inversion of the curve, with the 1 year at 1420bps and 5 year at 1224bps, which goes against investor logic, has triggered an alert from Research Signals & Leading Risk, a unique proprietary credit indicator, to buy protection on Sears Acceptance Corp. This is second such alert after one in April of last year, which saw the CDS spread surge past the 200bps mark.

Current CDS spreads imply a 66% default probability over the next five years, and 25% over the next year.

Bonds muted

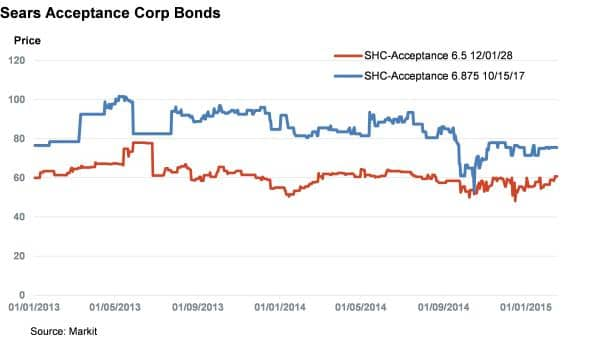

There hasn't been much of a reaction in cash markets as yet, and this can be exemplified by looking at the SHC-Acceptance 6.875% 2017 bond, the shortest of all bonds outstanding and most susceptible to short term volatility. Its price range has been relatively stable so far in 2015, trading at between 71-75.5 cents to the dollar. Its most liquid longer term bond, the 6.75% 2028's, has also been trading in a very narrow price range of 60-61 cents to the dollar so far this year.

The disconnect between cash and credit, which is typical in distressed names, can be seen by the CDS-Bond basis (the difference between CDS and bond spreads) which stands at -260bps for the shorter term bond and 386 bps for the longer term bond. This signals that the bond markets rate short term prospects much worse than the CDS market, and have been for some time. To put negative basis into context; to exploit the arbitrage, you would have to buy the bond (receive bond spread) and buy protection (pay CDS spread) simultaneously.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17022015-credit-sears-cds-bearish-after-radioshack-bankruptcy.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17022015-credit-sears-cds-bearish-after-radioshack-bankruptcy.html&text=Sears+CDS+bearish+after+RadioShack+bankruptcy","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17022015-credit-sears-cds-bearish-after-radioshack-bankruptcy.html","enabled":true},{"name":"email","url":"?subject=Sears CDS bearish after RadioShack bankruptcy&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17022015-credit-sears-cds-bearish-after-radioshack-bankruptcy.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Sears+CDS+bearish+after+RadioShack+bankruptcy http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17022015-credit-sears-cds-bearish-after-radioshack-bankruptcy.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}