Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 17, 2015

Letting European markets run

Investors have shown little appetite to stand in the way of the recent strong run in European equities.

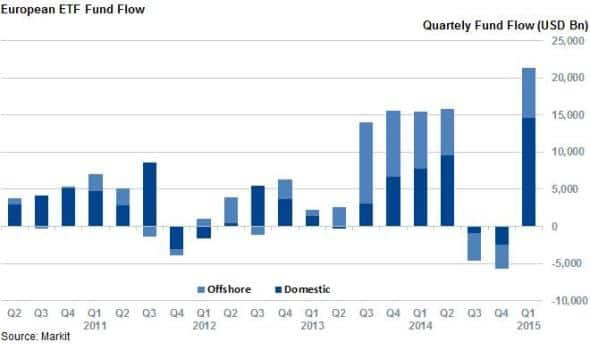

- European ETFs on track for largest ever quarterly inflows with $21.4bn of net new assets

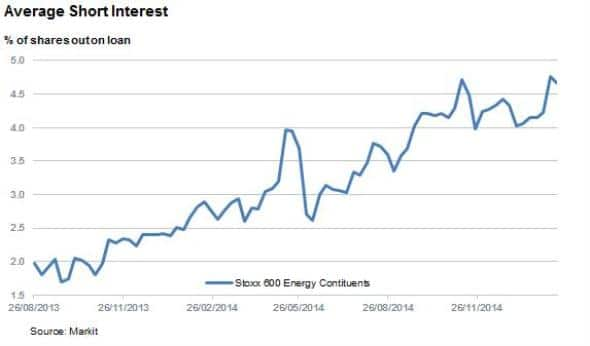

- Short interest across the Stoxx 600 has remained flat despite double digit returns in the index

- Pockets of short interest have been seen in energy shares, excluding which the index has seen covering

Risk assets are back in favour in Europe as the ECB's quantitative easing program has seen European assets jump ahead since the start of the year. At the top of the asset classes are equities, with the Stoxx 600 now up by 10% since the start of 2015 to close at its highest level in nearly eight years.

This surge has been well received from investors, who have actively added to their European positions and have shown little appetite to short European equities in the wake of the recent rally.

Investors piling in

European exposed ETFs have been at the forefront of the recent trend, and the asset class is on track for its best inflow quarter in over five years.

Only six weeks into the first quarter and the $21.4bn inflows into European exposed ETFs have already overtaken the previous record inflow quarter seen in Q3 2008 when investors added $18bn of European exposure.

This strong vote of confidence has come from both overseas and domestic investors as products listed in both areas have attracted new asset for the year. The 110 overseas listed European exposed products have seen roughly a third of the recent inflows with $7bn, while domestic traded funds have made up the balance with $14.6bn of net new assets.

Eurozone products leading the way

Funds directly exposed to eurozone countries, as opposed to the wider European market, have seen the lion's share of these inflows. These 571 products make up roughly 60% of the total European ETF AUM, but have managed to attract three quarters of the inflows for the region

The two products that have inspired investors the most in the recent trend have been the WisdomTree Europe Hedged Equity Fund which saw $4bn of inflows as US investors actively sought currency protection afforded by this currency hedged fund. The largest eurozone ETF, the iShares DAX UCITS, has also enjoyed the recent bullish mood with investors adding $970m to the fund after actively shunning it over the last year.

Short sellers not getting in the way

The recent bullish mood is also captured in the fact that short sellers have shown little appetite to grab the other side of the rising market trend, as short interest across the region has remained flat in the wake of the recent surge. Average demand to borrow constituents of the Stoxx 600 now stands at 2% of shares outstanding, roughly the same level seen over the last year.

This relatively flat number is masked somewhat by the fact that energy shares have continued to come under pressure from short sellers. These shares have seen average demand to borrow spike by 10% since the start of the year as oil continues to fluctuate.

Removing energy shares, whose fortunes are arguably tied to factors outside of the ECB's control, would have shown an overall covering in "core" European focused sectors.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17022015-Equities-Letting-European-markets-run.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17022015-Equities-Letting-European-markets-run.html&text=Letting+European+markets+run","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17022015-Equities-Letting-European-markets-run.html","enabled":true},{"name":"email","url":"?subject=Letting European markets run&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17022015-Equities-Letting-European-markets-run.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Letting+European+markets+run http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17022015-Equities-Letting-European-markets-run.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}