Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 16, 2014

Top North American shorts of 2014

As the year winds down with a bout of volatility, we look back at the trends that paid off for short sellers over the last 12 months.

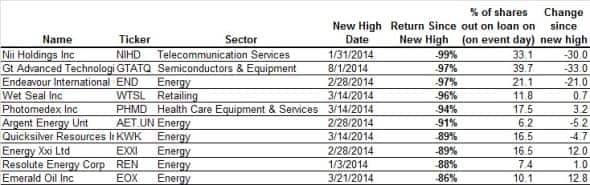

- 262 of the largest 3000 companies have seen their shares fall by more than 20% after seeing new annual highs in short interest

- Energy firms make up nearly a third of the year's top shorts, led by Endeavour International

- Nii and Gt Advanced are this year's top shorts in the region

In a look back at over the last 12 months, we review the year's best timed shorts within the 3000 largest North American companies at the start of the year. This analysis is based on a weekly screen of the companies seeing a fresh new 52 week high in short interest among those that see more than 3.5% of share out on loan.

Across the last year, just under a third of companies across the region have been the target of short sellers as 898 companies make at least one appearance in our screen. Shorts look to have been largely successful at targeting underperforming shares as the companies that make the list have seen their shares fall by 5% on average since appearing on our screen.

On the most successful end of the scale, 262 companies have seen their shares fall by more than 20% since seeing a fresh new annual high in demand to borrow.

Energy shares most successful shorts

The energy sector has provided the most fertile ground for short sellers, as the recent collapse in energy prices saw 74 different companies make up the top short list in the region. This represent just under a third of the overall top shorts of the region.

Energy firms are also very present at the top end of the best performing short list with, six firms among the 10 best performing shorts.

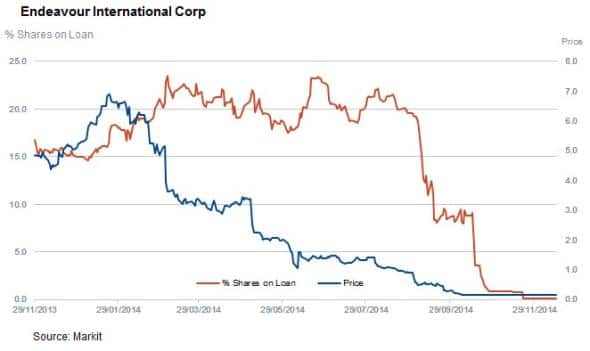

The sector's contribution among the best performing shorts is led by Endeavour International, which has seen its shares fall by 97% on its way to filing bankruptcy, after it saw its first new annual high in the last week of February when shorts jumped above 21% of shares outstanding.

Five of the six most successful energy shorts have come from companies whose market cap stood at less than $1bn when they first became targeted by short sellers. Shorts have also been successful at targeting larger cap energy names as four firms make the year's most successful short list with a market cap greater than $10bn when they first made the list.

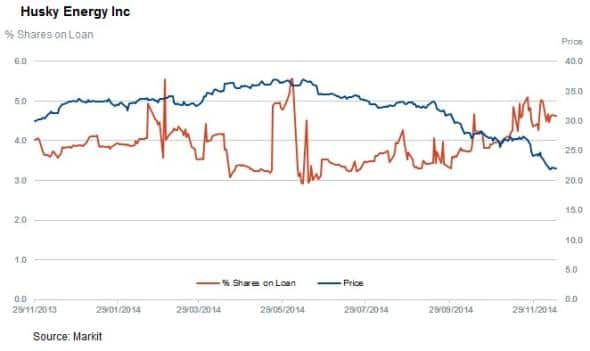

The four successful large cap shorts this year are Husky Energy and Continental Resources which have seen their shares retreat by 39% and 52% respectively since seeing fresh new annual highs in short interest.

The other two successful shorts are drilling rig operators Seadrill and Transocean whose shares have tumbled by more than 60% since coming under renewed scrutiny from short sellers.

Other top shorts

While the energy sector features most prominently among this year's top shorts, the most successful short goes to shares in the tech and telecommunication sector, which has seen the greatest fall in average share price since seeing a fresh new high in short interest.

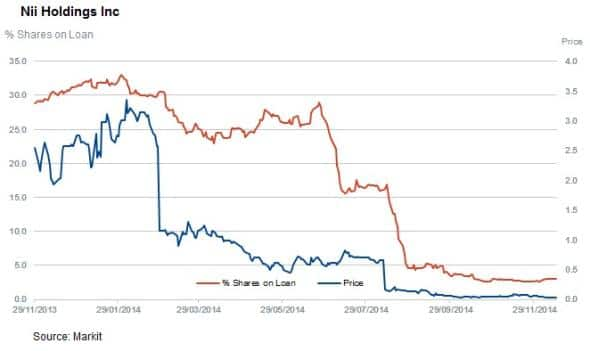

Telecommunication firm Nii Holdings is this year's most successful short after its shares fell by over 99% since its shares first registered a fresh new 52 week high in demand to borrow in January.

Rounding out the top three most successful shorts in North America is sapphire glass manufacturer GT Advanced technology whose shares have fallen by 97% in the wake of filing for bankruptcy protection in October, stemming from a breakdown in its relationship with phone manufacturer Apple. Shorts were on top of the trend as they added to their already substantial positions ahead of the filing.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122014-equities-top-north-american-shorts-of-2014.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122014-equities-top-north-american-shorts-of-2014.html&text=Top+North+American+shorts+of+2014","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122014-equities-top-north-american-shorts-of-2014.html","enabled":true},{"name":"email","url":"?subject=Top North American shorts of 2014&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122014-equities-top-north-american-shorts-of-2014.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Top+North+American+shorts+of+2014 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122014-equities-top-north-american-shorts-of-2014.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}