Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 16, 2014

Japan manufacturing upturn lacks conviction amid stalling exports and falling prices

A further increase in manufacturing activity adds to signs that Japan has pulled out of the brief recession caused by the sales tax rise earlier in the year. However, demand remains worryingly weak, especially for exports, meaning companies are having to cut prices despite seeing sharply increased costs arising from the yen's recent decline, boding ill for corporate profits and the sustainability of the upturn.

Stronger fourth quarter

Manufacturing activity increased for a seventh successive month in December, according to Markit's flash manufacturing PMI. The pace of expansion picked up marginally to round off the best calendar quarter since the first quarter of the year, adding to hopes that the country has pulled out of the recent recession signalled by GDP data. The headline PMI rose from 52.0 in November to 52.1, driven higher by faster growth of output and employment.

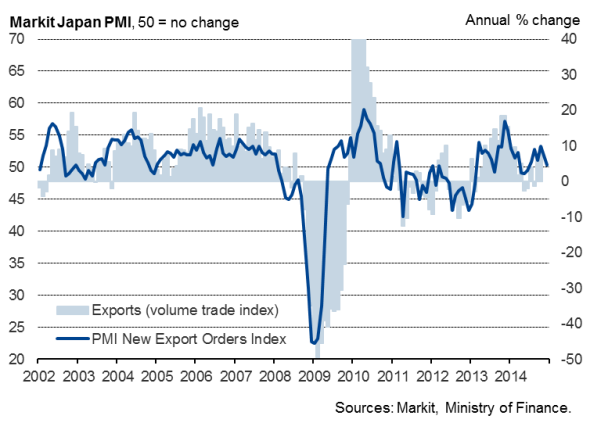

New orders also continued to rise, but December saw the smallest monthly increase since July, linked largely to a near-stagnation of new export orders. Such weakening order book growth raises the risk of output growth slowing again early next year unless demand revives.

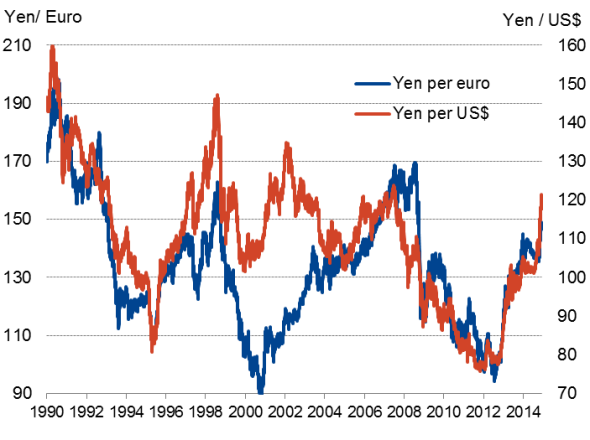

The stalling of export growth is a particular concern, as much of Japan's economic growth has been attributable to the weaker yen boosting overseas sales. The yen has fallen to a seven-and-a-half year low against the US dollar, linked to a combination of renewed stimulus by the Japanese authorities, notably a doubling of the central bank's balance sheet through quantitative easing, at the same time that the US authorities appear to be moving closer to tightening policy. A failure of exports to grow with such a favourable exchange rate raises worries about the weakness of global demand for Japanese goods.

Goods exports

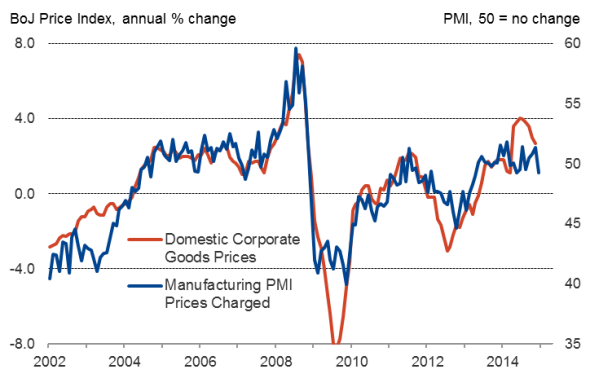

Input costs spike higher, selling prices fall, profits margins squeezed

While the drop in the exchange rate appears to be failing to bring the advantage of improved exports, manufacturers are suffering the disadvantage of the flip-side of the currency's decline in the form of higher import prices. Average input costs rose at the fastest rate since January, registering one of the largest monthly increases seen over the past three years, primarily linked by companies to having to pay more for imported goods due to the exchange rate.

Weak demand meanwhile meant companies were often unable to pass on higher costs to customers, and increasing numbers of firms instead cut prices in home markets as well as abroad. Average factory gate prices fell for the first time since August as a result, squeezing profit margins.

Exchange rate

Corporate goods prices

Abenomics under fire

Squeezed profit margins suggest business investment could be subdued as we move into 2015 after showing signs of life in late-2014, which in turn bodes ill for longer term economic growth and productivity improvements. The business mood may start to improve, however, if the official data follow the PMI survey data in the fourth quarter, signalling an end to Japan's fourth recession since the financial crisis (a recession which PMI data suggest in fact overstates the true weakness of the economic situation in Japan in the second half of 2014 - see our paper from 8 December.

A postponement of a further hike in the sales tax, previously scheduled for next October, should also help the recovery from being derailed again, suggesting the outlook for 2015 is one of modest economic growth.

However, despite the signs of growth, the surveys do little to dispel the fear that the stimulus efforts to date under the first two arrows of Abenomics, namely monetary and fiscal policy stimulus, have so far been insufficient to engender a sustainable robust expansion and an upturn in underlying price pressures in the absence of a more aggressively fired third arrow of structural reforms.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122014-economics-japan-manufacturing-upturn-lacks-conviction-amid-stalling-exports-and-falling-prices.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122014-economics-japan-manufacturing-upturn-lacks-conviction-amid-stalling-exports-and-falling-prices.html&text=Japan+manufacturing+upturn+lacks+conviction+amid+stalling+exports+and+falling+prices","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122014-economics-japan-manufacturing-upturn-lacks-conviction-amid-stalling-exports-and-falling-prices.html","enabled":true},{"name":"email","url":"?subject=Japan manufacturing upturn lacks conviction amid stalling exports and falling prices&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122014-economics-japan-manufacturing-upturn-lacks-conviction-amid-stalling-exports-and-falling-prices.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+manufacturing+upturn+lacks+conviction+amid+stalling+exports+and+falling+prices http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122014-economics-japan-manufacturing-upturn-lacks-conviction-amid-stalling-exports-and-falling-prices.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}