Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 16, 2014

China flash PMI signals renewed downturn in December

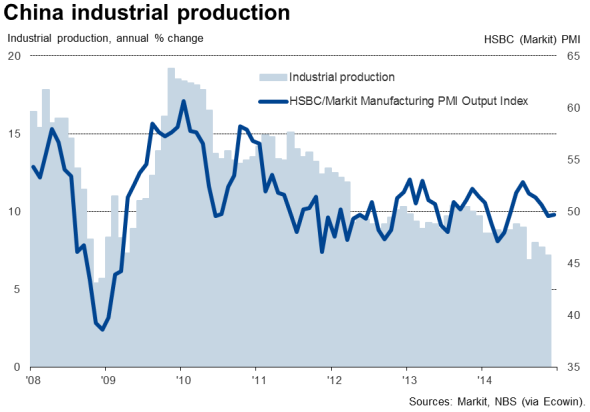

China's factories ended 2014 on a weak note. The HSBC Flash Manufacturing PMI", compiled by Markit, signalled a deterioration of business conditions for the first time since May. The index fell from 50.0 in November to 49.5 in December. At 50.0, the average PMI reading for the fourth quarter was down from 50.7 in the third quarter.

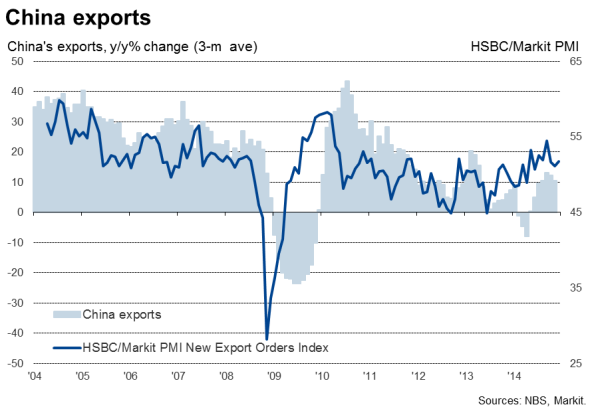

New orders fell for the first time since April, albeit only marginally, and output fell slightly for a second month running. Some positive news came in the form of a modest uptick in growth of new export orders, suggesting the main source of weakness in December came from domestic markets, but even export growth remained weak by historical standards, attributable to sluggish demand in key export markets such as Europe and Japan.

Growth target missed?

The data bode ill for growth in China's manufacturing-oriented economy, which has already seen GDP expand at the weakest annual rate since early-2009 in the third quarter, easing to 7.3%. The downturn in the PMI in the fourth quarter adds to the likelihood that economic growth will have slipped below the government's 7.5% target in 2014, which is being confirmed by less up-to-date official data.

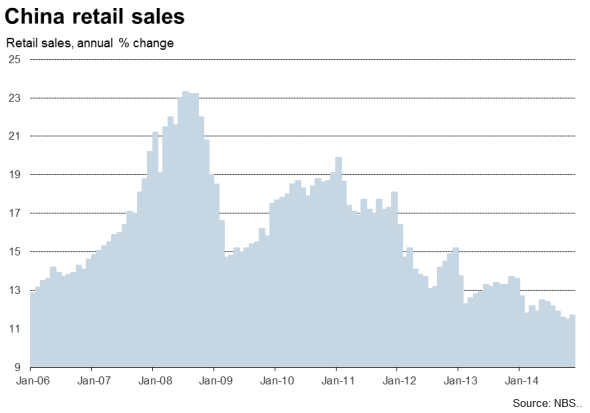

Official statistics showed industrial production rising at an annual rate of just 7.2% in November, down from 7.7% in October. Retail sales growth picked up from 11.5% to 11.7%, but that's still one of the weakest growth rates seen over the past decade.

Similarly, official data showed China's export performance slipping in recent months though, like the PMI, providing an important prop to the manufacturing sector in the face of weakening domestic demand.

Exports were just 4.7% higher than a year ago in November, the weakest rise seen since April. However, the three-month trend rate showed annual export growth has merely eased from a recent peak of 13.1% in the third quarter to a still-robust 10.5% in the three months to November.

Downsizing

Employment continued to fall, sustaining the downward trend that has been seen in every month bar-one since April 2013, highlighting how China's manufacturers are still cutting capacity in line with the weakened demand environment.

Raw material inventories were also reduced at the fastest rate since April as firms cut capacity, with the fourth quarter as a whole seeing the steepest decline for one-and-a-half years.

Prices fall at increased rate

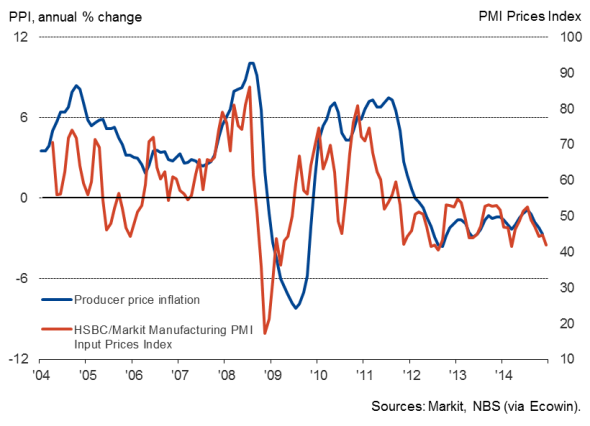

The flash survey results also showed a further steep fall in factory prices, adding to signs that disinflationary trends are gaining momentum. Input prices and factory selling prices both fell sharply in December, dropping at the fastest rates since March, and both showing some of the largest monthly declines seen in recent years.

Weak demand, meaning manufacturers and their suppliers have increasingly sought to compete on price to win sales, has been behind the trend of falling prices in recent months, exacerbated in December by lower oil prices. The further drop in oil prices in recent days, if sustained, suggests that industrial costs and prices will continue to fall in coming months, exerting further downward pressure on headline inflation in China. Consumer price inflation had already fallen to a five-year low of 1.4% in November, with factory prices down 2.7% on a year ago.

Producer prices

Aiming for lower growth

The weak data will add to calls for the authorities to take further action in supporting economic growth. Economic growth looks likely to come in a shade below the government's target of 7.5% in 2014, and the central bank is expecting it to wane further to 7.1% in 2015, citing the slowdown in real estate investment as a primary cause of the softening economic picture in China.

However, current PMI levels suggest that this outlook is too optimistic and that stronger demand is needed to support economic growth of 7-7.5%. The authorities have already taken steps to boost bank lending in recent weeks, including a surprise cut in interest rates in November, to help boost domestic demand and prevent a further deterioration in the economic outlook. However, the surveys suggest more action may be required too boost economic growth in the face of a cooling domestic economy, including a deflating property market, and weak global demand for China's exports.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122014-economics-china-flash-pmi-signals-renewed-downturn-in-december.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122014-economics-china-flash-pmi-signals-renewed-downturn-in-december.html&text=China+flash+PMI+signals+renewed+downturn+in+December","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122014-economics-china-flash-pmi-signals-renewed-downturn-in-december.html","enabled":true},{"name":"email","url":"?subject=China flash PMI signals renewed downturn in December&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122014-economics-china-flash-pmi-signals-renewed-downturn-in-december.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+flash+PMI+signals+renewed+downturn+in+December http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122014-economics-china-flash-pmi-signals-renewed-downturn-in-december.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}