Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 16, 2014

Marketing spend optimism in the UK brings welcome upbeat economic news

UK companies increased their marketing budgets on average in the third quarter, extending the strongest spell of growth for marketing expenditure seen for at least 15 years. The upturn reflected increased optimism about sales and bodes well for further robust economic growth in coming months.

Marketing booms

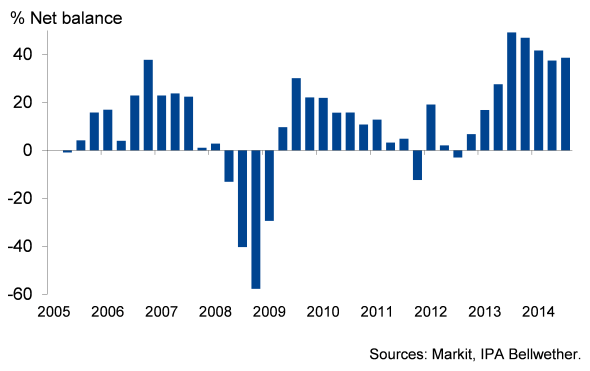

The IPA Bellwether survey, compiled by Markit, found companies continued to boost their marketing budgets in the third quarter. The latest upturn in the survey, which is based on a sample of 300 UK companies constructed to encompass firms of varying sizes and sectors, extends a strong run of growth than began in earnest in the spring of last year.

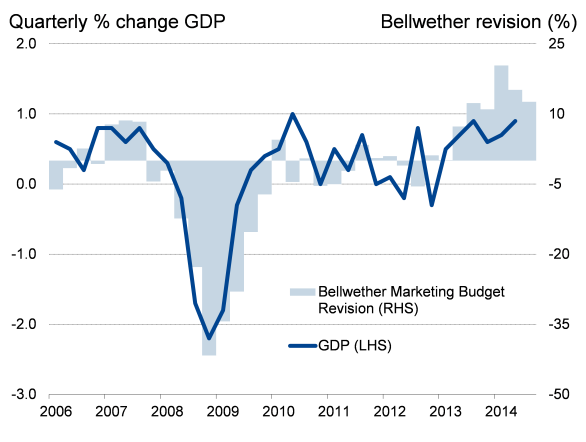

The survey presents an encouraging picture of the UK economy continuing to enjoy robust growth in the second half of 2014. The extent to which marketing spend is revised higher or lower correlates well with the pace of growth in the wider economy, therefore providing a timely indicator of gross domestic product. With the proportion of companies revising their marketing budgets higher outnumbering those reporting a decline by 13% in the third quarter, GDP is likely to grow strongly again after rising 0.9% in the second quarter. However, with the Bellwether survey readings somewhat less buoyant than earlier in the year, there is a suggestion that the pace of economic growth will have moderated slightly in the three months to September.

This moderation in the Bellwether's main indicator should not be seen as a worrying sign for the economy for various reasons.

Marketing spend and economic growth

Positive Outlook

First, the extent to which budgets are being revised higher has merely fallen from a record high in the first quarter of the year. The third quarter reading remains higher than any time in the survey's 15-year history prior to the start of this year. The most important signal from the survey is that budgets are still being revised higher.

Second, the sustained upward revision trend builds on 2014-15 annual budgets that were already set higher than 2013-14 budgets. All too often in previous years the survey has shown budgets that were initially set higher for the year being revised lower as the year proceeded. This usually reflected weaker than hoped for sales. This year has been markedly different, with spend being revised higher as the year has proceeded due to sales often beating expectations. These upward revisions mean 2014-15 spend looks set to show the strongest rise in the history of the survey.

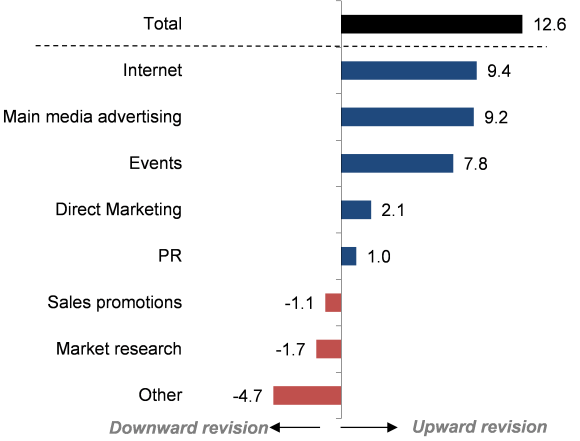

Third, the nature of the marketing activities that companies are focusing on also presents an encouraging picture. Marketing spend directed towards sales promotions, for example, often means companies are seeking to offer discounts in the hope of competing on prices amid weak demand. Such activities are clearly often detrimental to profits. This has not been the case in recent quarters. The third quarter Bellwether in fact showed main media advertising to have enjoyed the strongest upturn in budgeted spend. Main media includes TV and other broadcast advertising, as well as print. These are often expensive activities that require a certain minimum of confidence in the economic outlook before such large investments in brand building are considered appropriate.

The fact that more companies are investing in main media brand-building exercises is therefore an encouraging feature of the Bellwether and also points to rising business investment in general.

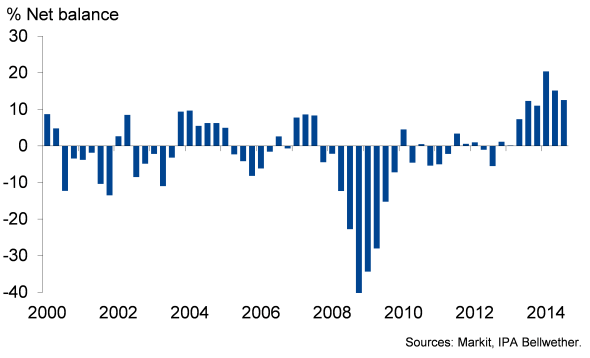

Fourth, the survey found that companies' views on their financial prospects improved compared to the second quarter. The proportion of companies reporting their financial prospects to have improved outnumbered those reporting a deterioration edged up from 38% in the second quarter to a buoyant 39%, moving closer to the all-time high of 49% seen in the third quarter of 2013.

While there are therefore signs that the economy may be starting to slow, companies are clearly expecting the pace to remain sufficiently strong to grow their sales through rising marketing spend. This points to only a modest slowdown as we head into 2015.

Companies' financial prospects

Breakdown of Q3 marketing budget revisions

Long-run history of marketing budget revisions

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102014-Economics-Marketing-spend-optimism-in-the-UK.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102014-Economics-Marketing-spend-optimism-in-the-UK.html&text=Marketing+spend+optimism+in+the+UK+brings+welcome+upbeat+economic+news","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102014-Economics-Marketing-spend-optimism-in-the-UK.html","enabled":true},{"name":"email","url":"?subject=Marketing spend optimism in the UK brings welcome upbeat economic news&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102014-Economics-Marketing-spend-optimism-in-the-UK.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Marketing+spend+optimism+in+the+UK+brings+welcome+upbeat+economic+news http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102014-Economics-Marketing-spend-optimism-in-the-UK.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}