Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 16, 2017

Fine weather for shorts

Short sellers have returned to their winning ways which has prompted them to increase their average positions to the highest level in over eight months.

- Short sellers to extend their winning streak to four months in June

- Average short interest in Russell 3000 shares up by 13% from recent lows

- Shorts overweight the energy and healthcare sectors while underweight financials

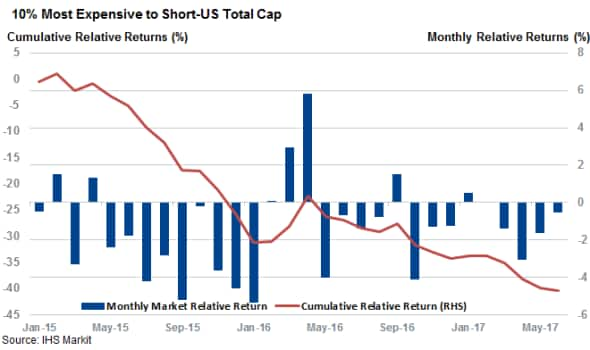

The market's recent surge to all-time highs hasn't precluded short sellers from successfully picking underperforming stocks. The 10% most expensive to borrow US stocks - which are essentially the highest conviction short positions according to their willingness to pay - have already underperformed the market for three months; June is shaping up to be another successful month for short sellers given that these stocks have underperformed the market by 0.5% in the first two weeks of the month. This consistent underperformance, relative to the IHS Markit Total Cap universe, means that the favorite short positions have underperformed the market by a cumulative 5.5% in the opening five months of the year.

There is no denying that the post-election bull market did make it tough for short sellers; however, this proved to be a relatively short lived trend, as shorts have been as successful in 2017 as in the preceding two years. While the average monthly underperformance of the high conviction short positions year-to-date (1.1%) is somewhat lower than the 1.4% registered over 2015 and 2016, the fact that shorts have come out ahead in four of the opening six months means that they have been as consistent in finding underperforming stocks than at any time during the recent market.

Shorts adding to their positions

Short sellers have been emboldened by this recent run of form as we've seen an increase in shorting activity across US stocks. This newfound bravado from short sellers is evidenced by the fact that the average borrow activity across the Russell 3000 index has jumped to an eight month high of 4.1% of shares outstanding.

Short sellers had initially been scared off by the post-election market, as average shorting activity fell to 3.6% of shares outstanding in early February, but the fact that short interest has jumped by more than 10% from the recent lows indicates that bears are feeling more comfortable in the current market and adding to their positions.

Transportation names have helped carry the average higher as the sector registered a 40% increase in average demand to borrow. Rental car companies Avis and Hertz have driven that trend after a series of disappointing earnings drove short sellers to increase their positions in both firms past the 20% of shares outstanding mark.

Trucking company USA Truck has also come under attack as short sellers have increased their positions more than tenfold to the current 7% of shares outstanding.

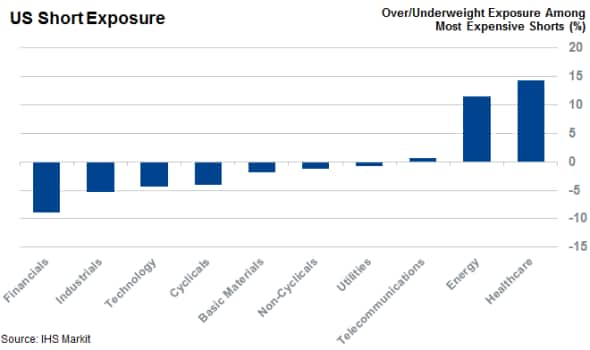

While transportation stocks have been disproportionally targeted in recent weeks, the ultimate transportation sector, industrials, is still relatively underrepresented among the latest analysis of the 10% most expensive to borrow stocks.

The same can't be said for healthcare names which make up a quarter of high conviction shorts, despite only making up 13% of all listed US stocks.

Energy names are disproportionally represented among top short targets, as bearish investors have a 11% overweight towards the sector. With oil volatility now back on the market, we've seen short sellers add to their energy shorts. This increased shorting activity has pushed the average demand to borrow shares across Russell 3000 energy stocks up by 40% since the February lows of 7.5% of shares outstanding. The 12 month high in energy shorting activity has been led by helicopter operator Bristow Group, which has seen the demand to borrow its shares double to 26% of shares outstanding. This spike in short interest exemplifies the current situation for many players in the energy sector, as it came after the firm announced a sharp fall in revenue, which the company does not expect to rectify until at least fiscal 2019.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062017-equities-fine-weather-for-shorts.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062017-equities-fine-weather-for-shorts.html&text=Fine+weather+for+shorts","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062017-equities-fine-weather-for-shorts.html","enabled":true},{"name":"email","url":"?subject=Fine weather for shorts&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062017-equities-fine-weather-for-shorts.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Fine+weather+for+shorts http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062017-equities-fine-weather-for-shorts.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}