Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 16, 2016

US Fed keeps policy on hold

As expected, the US Fed kept policy on hold at its June meeting, worried about signs of a weakening labour market in particular.

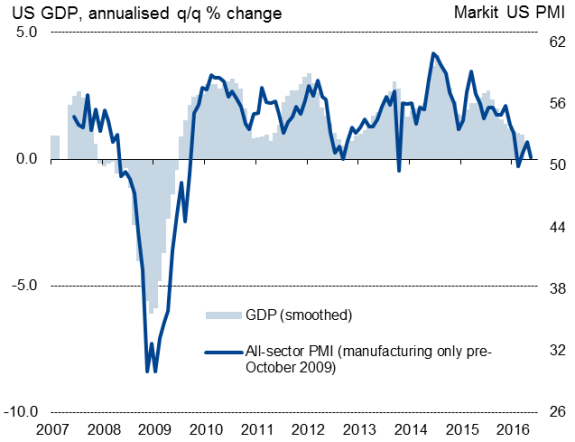

Two further rate hikes in 2016 are still being envisaged by policymakers, based on suggestions that the pace of economic growth may be reviving, but Markit's PMI data cast doubts on the extent on any second quarter rebound.

Markit US PMI v GDP trend

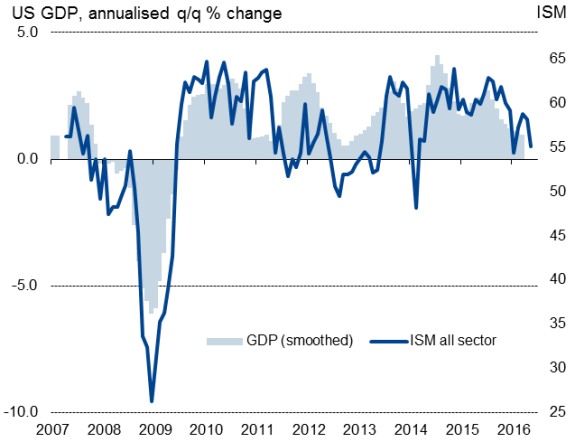

ISM v GDP trend

Bleaker assessment

The US Federal Open Market Committee decided unanimously to keep interest rates on hold at its June meeting. This represents a more downbeat assessment of the economy, after one member had voted for a 25 basis point hike in May.

The Fed target rate stands at 0.25-0.50% following the first rate hike since the financial crisis made back in December.

The accompanying statement noted that "the pace of improvement in the labour market had slowed", reflecting two weaker than expected non-farm payroll reports in April and May, and that business investment "had been soft". Market based inflation expectations indicators were also reported to have declined.

The Fed also downwardly revised its expected long-run, or 'neutral' federal funds rate, now down to 3.0% from 3.3% in March and 3.5% back in December. This implies that policymakers believe that the economy is fundamentally weaker than previously thought, requiring a lower interest rate to allow the economy to generate trend rate economic growth without the risk of igniting inflation.

Rate hikes still on the table

However, the statement also noted that "growth of economic activity appears to have picked up,....the unemployment rate has declined,...growth in household spending has strengthened...the housing sector has continued to improve and the drag from exports appears to have lessened".

These bullish observations kept alive the prospect of further rate hikes this year, if the economy shows more concrete signs of improving after the disappointing pace of GDP growth seen in the first quarter and the recent payroll disappointments.

The median view of the Fed's policymakers is for another two rate hikes in 2016. However, investors remain sceptical. Calculations based on futures markets prices point to just an 8% chance of the Fed hiking in July and only a 40% likelihood of a rise before next February.

Second quarter uncertainty

Official data on retail sales suggest that the economy is set to rebound in the second quarter after the weakness suffered in the opening three months of the year. Many 'nowcast' models based on official data point to annualised GDP growth reviving from 0.8% in the first quarter to 2.5% or even more.

However, many of these nowcast models are based to a large extent on nothing more recent than April data. Markit's PMI surveys also sent a message of the economy rebounding in April, but have more recently shown the pace of expansion fading again in May, corresponding with the deterioration in hiring shown by the non-farm payroll numbers.

A weighted average of the two ISM business surveys also fell back sharply in May, having likewise previously indicated faster growth in April.

Consumer reliance

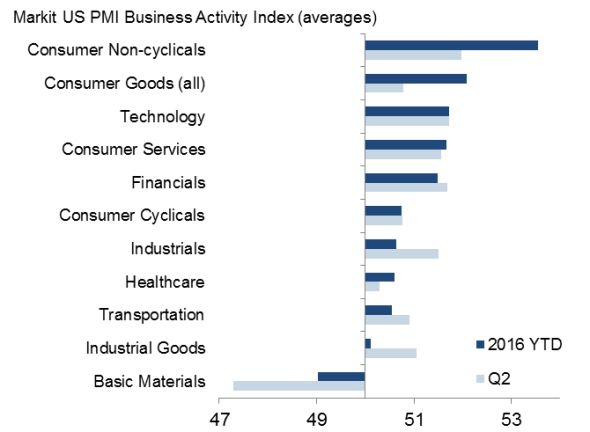

Like the official data, Markit's PMI data highlight how consumers are driving economic growth this year, but also reveal the extent to which other parts of the economy have continued to struggle in the second quarter.

Detailed sector PMI data show growth this year being led by sectors such as consumer goods production, for example household goods and food & drink, as well as certain consumer service providers. However, other large parts of the economy, notably industrial goods production, travel, transport, tourism and healthcare have either been in decline or growing only modestly, acting as a drag on the economy.

Markit's flash PMI data for June, published on 23rd (manufacturing) and 27th (services) of June, will provide more insight into second quarter growth trends.

US business activity by sector

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062016-Economics-US-Fed-keeps-policy-on-hold.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062016-Economics-US-Fed-keeps-policy-on-hold.html&text=US+Fed+keeps+policy+on+hold","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062016-Economics-US-Fed-keeps-policy-on-hold.html","enabled":true},{"name":"email","url":"?subject=US Fed keeps policy on hold&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062016-Economics-US-Fed-keeps-policy-on-hold.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+Fed+keeps+policy+on+hold http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062016-Economics-US-Fed-keeps-policy-on-hold.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}