Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 16, 2017

Watch out for bond bears

Monitoring bearish bond investor sentiment can help better inform stock pickers.

- Demand to borrow USD high yield bonds doubled during last year's volatility

- Incorporating bond borrow activity in long-short equity investment strategies across US Large Caps would have increased annual returns by 250bps

- European bond and equity investors are least likely to agree on investor sentiment

This note summarizes the key points of the recently released note "Equity Short Signals from the Corporate Bond & CDS Market". Please contact us for a copy.

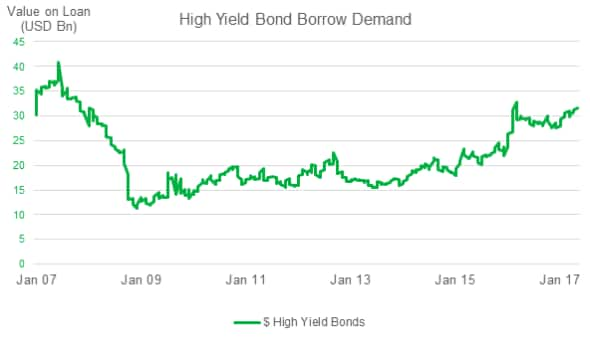

Last year's credit market volatility saw investors rush to borrow the most dollar denominated high yield bonds since the financial crisis. While it's hard to pin down exactly what motivated each one of the $34 billion worth of loans taken out during the heights of last year's volatility, it's safe to assume that a large part of that went to express bearish views on assets that were hardest hit by the market slump.

While demand to borrow high yield bonds has moderated somewhat from last year's highs, as they regained most of the ground lost during the recent slump, the current value of outstanding loans against the asset class is still elevated from recent averages.

Investors stand to benefit

Equity investors should take notice of this bearish bond activity as valuable insights can be gained by monitoring bond shorting behavior and combining these sentiments with conventional equity sentiment strategies. In fact, adding a bond borrow signal to the equity signal to create conventional long-short strategies that short highly shorted US Large Cap companies while going long those on the other end of the sentiment spectrum with the least amount of shorting activity would have increased annual returns by over 250bps over the returns earned by simply monitoring the equity side of the balance sheet.

The above conclusion was drawn on analysis that aggregated the borrow demand and lending program inventory of bonds issued by US large cap companies featured in any of the investment grade and high yield iBoxx USD, EUR or GBP indices over the last 10 years. Our research team then combined this issuer level bond utilization, which also accounts for mergers and subsidiaries, and linked it to the parent equity.

This combined equity-bond investor sentiment strategy lifted the long-short returns of the equity only strategy and decreased the annual volatility.

Monitoring investor bond sentiment through CDS spreads also delivered improvements on the equity only strategy when combined with bond shorting activity. This approach captured short sentiment across the entire capital structure.

Europe shows the same trend

European investors should also take heed as the same trend was observed in developed Europe over the same period of time. Much like in the US, further information uplift can be gained by adding CDS spreads to the equity-bond sentiment analysis.

Current examples

Perennial shorts such as Herbalife and K&S earn the most negative combined equity-bond sentiment score which indicates that both sets of investors are broadly in agreement. There are plenty of instances where bond and equity bears haven't reached an agreement however, which is why the two strategies have complemented each other over the last decade.

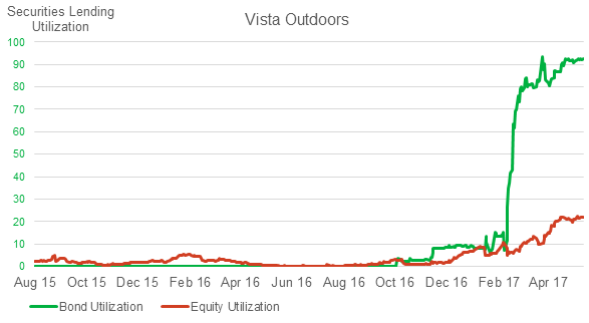

One such name is outdoor sports conglomerate Vista Outdoors. Its equity utilisation, at 20%, wasn't enough to warrant inclusion into the last sort of the equity-only portfolio. Bond investors are much more bearish about the company however as over 90% of the October 2023-5.875% bonds that sit in lending programs are currently out on loan. This extreme bearish bond sentiment is enough to warrant its inclusion into the combined equity-bond negative sentiment portfolio.

Vista isn't the only such example in the US as seven other firms earn inclusion into the negative sentiment short portfolio by virtue of their bond borrow activity.

European investors are even less likely to reach a consensus as 26 firms earn entry into the group of shares to avoid on bearish bond sentiment. These include satellite communication firm Inmarsat, German grocer Metro and French distiller Remy Cointreau.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052017-Equities-Watch-out-for-bond-bears.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052017-Equities-Watch-out-for-bond-bears.html&text=Watch+out+for+bond+bears","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052017-Equities-Watch-out-for-bond-bears.html","enabled":true},{"name":"email","url":"?subject=Watch out for bond bears&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052017-Equities-Watch-out-for-bond-bears.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Watch+out+for+bond+bears http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052017-Equities-Watch-out-for-bond-bears.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}