Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 16, 2016

CDS market readies for wave of retail downgrades

After US retailer Gap's downgrade to 'junk' status the credit default swap (CDS) market is implying more downgrades to come across the battered US retail sector.

- CDS spreads imply six US retailers are on the brink of being downgraded to 'junk' status

- Macy's 5-yr CDS spread has widened back to the levels seen at the start of the year

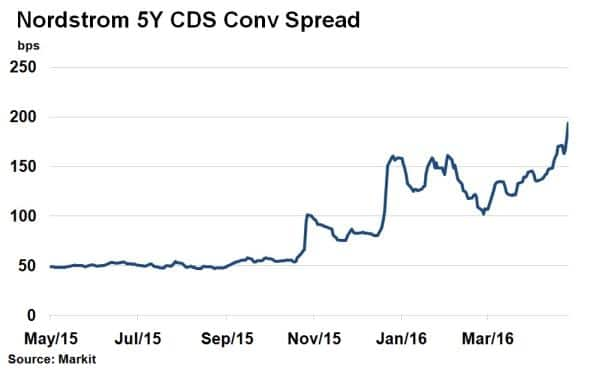

- Upscale fashion retailer Nordstrom has seen its CDS spread triple since last November

US clothes retailer Gap became a 'fallen angel' last week as Fitch downgraded its credit rating to junk status (BB+), from investment grade (BBB-). The rating agency cited continued weak sales, volatile margins and waning customer loyalty for the ratings action.

For credit market participants, the action came as no surprise. Gap's 5-yr CDS spread widened 68bps last week to 426bps, having been as low as 190bps in mid-March. According to Markit's CDS pricing service, current spread levels imply a 'B' rating and have been implying 'junk' status for some time.

Gap's troubles are not isolated among the US retail sector. Big names like Macy's and Nordstrom also reported disappointing earnings last week, which begs the question, which retailer is next to be downgraded?

Taking the constituents of the Markit iBoxx $ Domestic Retail index, five names stand out.

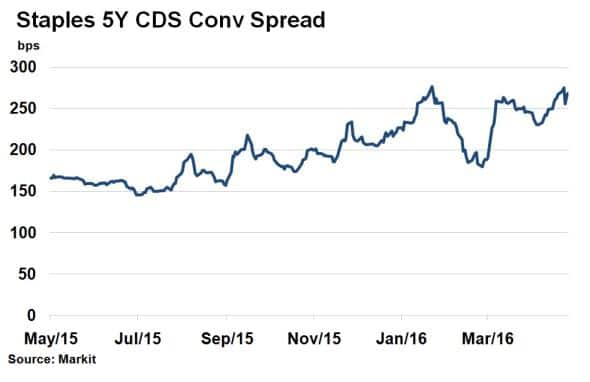

Staples Inc.

5-yr CDS spread 269bps; Av Rating BBB; Implied Rating BB

Staples saw its merger with Office Depot halted by regulators earlier this month, in what would have joined two of the largest office suppliers in the US. The company has been struggling to deal with the immense competition in the sector especially from online retailer Amazon Inc. 5-yr CDS spreads have hovered above 150bps for the past year, with the latest setback pushing spreads above 250bps.

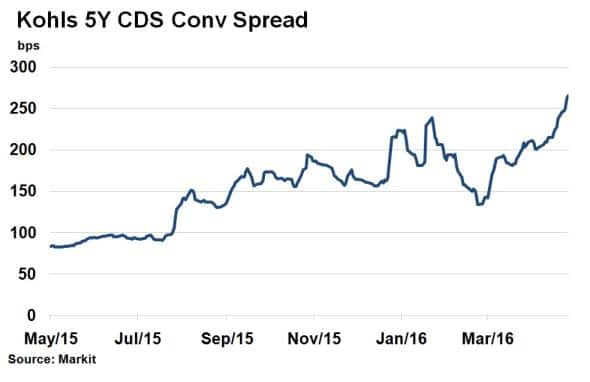

Kohl's Corp

5-yr CDS spread 266bps; Av Rating BBB; Implied Rating BB

Retail department store Kohl's has seen its 5-yr CDS spread double over the last two months, with credit spreads now implying a real threat to its investment grade status. Last week saw earnings disappoint, with shares slumping to a seven year low. A shift in consumer preferences away from traditional department stores, and the growth of fast fashion chains such as Zara and Forever 21 have heaped pressure on apparel market.

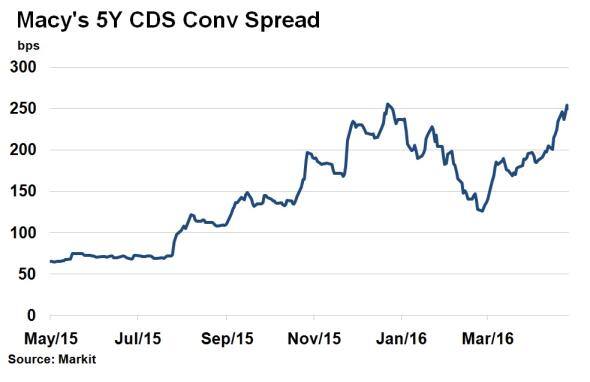

Macy's Inc.

5-yr CDS spread 250bps; Av Rating BBB; Implied Rating BB

Macy's announced sales fell 5.6% during the first quarter and forecasted a gloomy year ahead during earnings last week. Headwind's, particularly from a strong dollar, which has affected international consumer traffic, has dampened top line revenue. 5-yr CDS spreads have widened back to the levels seen at the start of the year.

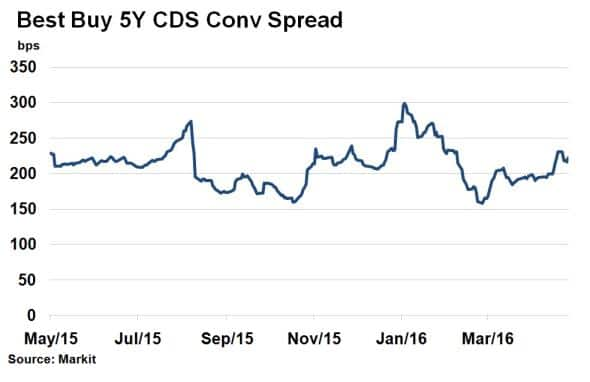

Best Buy Co Inc.

5-yr CDS spread 237bps; Av Rating BBB; Implied Rating BB

Electronics retailer Best Buy has seen its 5-yr CDS spread trade above 150bps for the past year as it faces stiff competition from Walmart and Amazon. Current levels imply a BB rating.

Nordstrom Inc.

5-yr CDS spread 194bps; Av Rating BBB; Implied Rating BB

A prime example of the jitters in the US retail market, upscale fashion retailer Nordstrom has seen its CDS spread triple since last November. The negativity was compounded last week when earnings showed a plunge in sales as high end consumers pulled back on purchases. CDS spreads were somewhat benign this time last year at around 50bps but are now approaching 200bps fast.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052016-credit-cds-market-readies-for-wave-of-retail-downgrades.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052016-credit-cds-market-readies-for-wave-of-retail-downgrades.html&text=CDS+market+readies+for+wave+of+retail+downgrades","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052016-credit-cds-market-readies-for-wave-of-retail-downgrades.html","enabled":true},{"name":"email","url":"?subject=CDS market readies for wave of retail downgrades&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052016-credit-cds-market-readies-for-wave-of-retail-downgrades.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=CDS+market+readies+for+wave+of+retail+downgrades http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052016-credit-cds-market-readies-for-wave-of-retail-downgrades.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}