Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 16, 2015

Week Ahead Economic Overview

Markit releases flash PMI data for China, Japan, the eurozone and the US, all of which will provide fresh evidence on the health of the world's largest economies at the beginning of the second quarter. Meanwhile, the Bank of England releases minutes from its latest policy meeting, while retail sales numbers are also issued in the UK. The publication of durable goods orders data is one of the data highlights in the US.

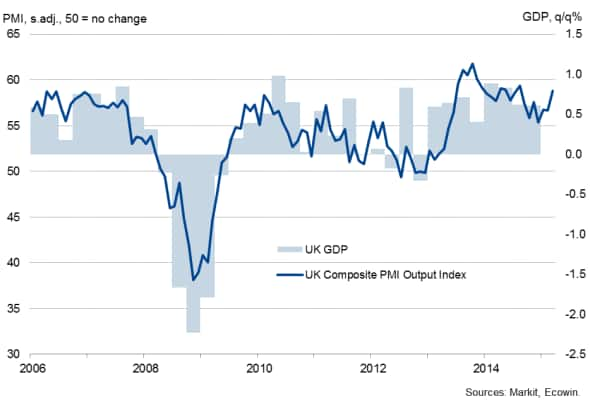

The Bank of England releases minutes from its April monetary policy meeting, in which the Bank held interest rates steady at 0.5%. The minutes are likely to show that all nine Monetary Policy Committee members again voted to keep policy on hold. The lack of action at the Bank does not come as a surprise. While the UK economy grew strongly in 2014 and PMI data are pointing to robust growth being sustained so far in 2015, a lack of inflationary pressures, weak pay growth expectations and uncertainty resulting from May's general election suggest policymakers are in no rush to start hiking interest rates.

UK GDP and the PMI

Retail sales numbers are also out in the UK. In February, sales increased 0.7%, with an initial 0.3% drop in January revised up to a 0.1% rise. So far this year, sales are running 1.0% above the fourth quarter, adding to evidence that the economy is enjoying another quarter of reasonably robust growth as consumer spending is boosted by the drop in inflation to zero.

The timing of the first US rate rise is "data dependent", so flash manufacturing PMI results and durable goods orders will be eyed closely. With industrial production and retail sales both pointing to the weakest economic growth since 2009 in the opening months of the year, policymakers are seeking clues as to the extent to which the slowdown might be only temporary. Encouragingly, the business survey data for March signalled accelerated growth of production and new orders, albeit with a strong dollar hampering growth of new export orders. Durable goods orders declined 1.4% in February and the March update will provide clues about the second-quarter order book pipeline for goods producers.

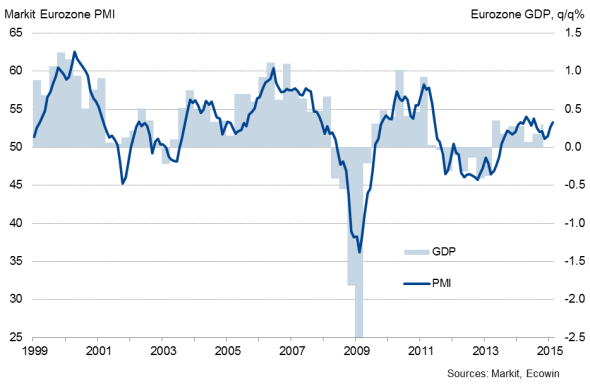

Amid the ongoing debt crisis in Greece, eurozone market watchers will be eagerly awaiting flash PMI data for the currency union. March data showed signs of improvement, with the rate of activity growth picking up further speed. Encouragingly, all of the four largest member states are now back in expansion, thereby indicating a broad-based upturn. The survey data will be eyed to see if the ECB's policy of quantitative easing is continuing to boost the economy, or whether growth is being hit by risk aversion arising from 'Grexit' worries. Other important releases in the currency bloc include Ifo and GfK data for Germany and unemployment numbers for Spain.

Eurozone GDP and the PMI

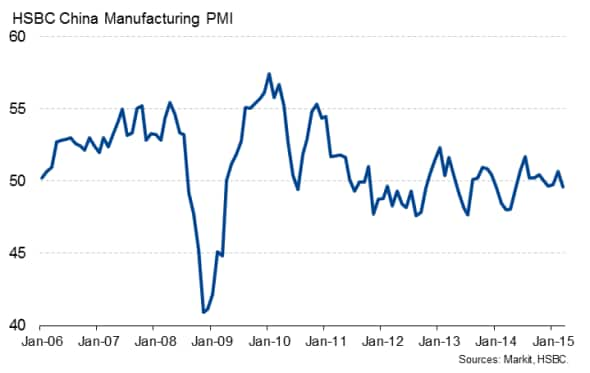

Having cut banks' reserve ratio requirements again in early February, policymakers will be hoping to see renewed signs of life in China's manufacturing sector. April's flash survey results will give first insights into the performance of China's economy at the start of the second quarter, after economic growth slowed to the weakest in six years in the opening three months of the year.

China manufacturing PMI

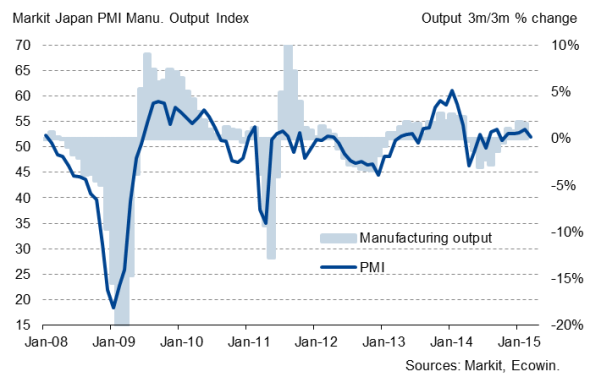

Flash manufacturing PMI data for April will also be updated in Japan. Survey data for March indicated that the Japanese economy is faltering again, calling into question the Bank of Japan's recent upbeat analysis of the economy and upping the likelihood of the authorities seeking new ways to revive consumer and business spending.

Japan manufacturing output and the PMI

Monday 20 April

The latest Bank of Scotland Report on Jobs is out.

Producer price numbers are meanwhile issued in Germany.

Greece sees the release of current account figures.

Monthly GDP data are updated in Russia.

The Chicago Fed National Activity Index is published in the US.

Tuesday 21 April

ZEW release their latest economic sentiment data for Germany and the eurozone.

In Canada, wholesale trade numbers are out.

Wednesday 22 April

Australia sees the release of inflation numbers.

In Japan, trade data for March are issued.

The latest UK Household Finance Index is released by Markit.

Industrial orders numbers and retail sales data are out in Italy, while the eurozone sees the release of consumer confidence figures.

The Bank of England publishes minutes from its April meeting.

Inflation figures are out in South Africa.

Payroll growth numbers and current account data are out in Brazil.

Home price figures and existing home sales numbers are updated in the US.

Thursday 23 April

Flash PMI results are out in Japan, China, the eurozone and the US.

In Italy, wage inflation numbers and trade balance data are issued.

Spain sees the release of unemployment data, while GfK consumer confidence numbers are out in Germany.

Meanwhile, business confidence figures are updated in France.

Retail sales numbers and public sector net borrowing data are published in the UK.

Initial jobless claims figures are out in the US.

Friday 24 April

In Germany, import price numbers are released alongside latest Ifo data.

The US sees the release of building permit and durable goods orders data.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16042015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16042015-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16042015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16042015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16042015-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}