Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Apr 25, 2025

By Chris Williamson and Jingyi Pan

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

The coming week sees some key data releases out of the US, including GDP, the Fed's favored core PCE price gauge, ISM and PMI data, plus non-farm payrolls. Global PMI data will also reveal how worldwide manufacturing fared in the aftermath of US tariff announcements on April 2, while central bank policy decisions are due in Japan and Thailand.

Having started the year on a wave of optimism, the US economy has since sent worrying signals. First quarter GDP numbers will provide the first major official indication of the state of play. Business surveys from ISM and S&P Global, both of which are updated for April during the week, have underscored growing concerns from business about the introduction of tariffs, with the S&P Global survey indicating annualized GDP growth of only about 1% in the first quarter. While the consensus currently stands at 0.5%, some nowcast models suggest there's a risk of contraction.

Markets will be looking in particular to see how the US administration might respond to any heightened recession risks, especially in relation to its tariffs and trade deals.

Likewise, the monthly US employment report will be eagerly anticipated on Friday (notably preceded by the JOLTS report on Wednesday, which tracks job openings) to gauge the impact of DOGE-related job cuts and the broader hiring trend. Surveys have so far hinted at sustained private sector hiring, but confidence has slumped to warrant some caution in relation to the future jobs trend. Prior data showed a consensus-beating 228k payroll rise in March, but the unemployment rate ticked up to 4.2%.

How the FOMC might react to any signs of weakening labor markets can only be gauged alongside the PCE price data to be updated during the week. Core PCE inflation, widely seen as a key gauge watched by policymakers, jumped by 0.4% in February but consensus points to a 0.1% rise in March. Any upside surprise could dampen hopes of FOMC rate cuts.

The European Central Bank will also be hoping for some benign inflation numbers for April on Friday, to keep the door open to some widely-anticipated further rate cuts in 2025, while policymakers in Canada, Mexico, mainland China and many other export-focused Asian economies will be eager to assess the April manufacturing PMI numbers for the first signs of output and export trends following the April 2nd US 'reciprocal' tariff announcements.

Monday 28 Apr

South Africa Market Holiday

India Industrial Production (Mar)

Tuesday 29 Apr

Japan Market Holiday

Germany GfK Consumer Confidence (May)

Sweden GDP (Q1, flash)

Spain GDP (Q1, flash)

Spain Inflation (Apr, prelim)

Eurozone Economic Sentiment (Apr)

United States Goods Trade Balance (Mar, advance)

United States Wholesale Inventories (Mar, advance)

United States S&P/Case-Shiller Home Price (Feb)

United States JOLTs Job Openings (Mar)

Wednesday 30 Apr

Sweden, Vietnam Market Holiday

South Korea Industrial Production (Mar)

Japan Industrial Production and Retail Sales (Mar, prelim)

Australia Inflation (Q1)

China (Mainland) NBS PMI (Apr)

China (Mainland) Caixin Manufacturing PMI* (Apr)

France Inflation (Apr, prelim)

Thailand BoT Interest Rate Decision

Germany Unemployment Rate (Apr)

Taiwan GDP (Q1, adv)

Eurozone GDP (Q1, flash)

Italy Inflation (Apr, flash)

Germany Inflation (Apr, flash)

Mexico GDP (Q1)

United States ADP Employment Change

Canada GDP (Feb)

United States GDP (Q1, adv)

United States Personal Income and Spending (Mar)

United States Core PCE Price Index (Mar)

United States Pending Home Sales (Mar)

Thursday 1 May

Austria, Belgium, Brazil, China (Mainland), Colombia, Egypt, France, Germany, Hong Kong SAR, Hungary, India, Indonesia, Ireland, Italy, Malaysia, Netherlands, Norway, Pakistan, Philippines, Poland, Portugal, Singapore, South Africa, Spain, Sweden, Switzerland, Taiwan, Thailand, Türkiye, Vietnam Market Holiday

Australia Trade (Mar)

Japan BoJ Interest Rate Decision

Japan Consumer Confidence (Apr)

United Kingdom Nationwide Housing Price (Apr)

United Kingdom Mortgage Lending and Approvals (Mar)

United States ISM Manufacturing PMI (Apr)

Friday 2 May

China (Mainland) Market Holiday

Worldwide Manufacturing PMIs, incl. global PMI* (Apr)

South Korea Inflation (Apr)

Japan Unemployment Rate (Mar)

Hong Kong SAR GDP (Q1, adv)

Eurozone Inflation (Apr, flash)

Eurozone Unemployment Rate (Mar)

United States Non-Farm Payrolls, Unemployment Rate, Average Hourly Earnings (Apr)

United States Factory Orders (Mar)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

Worldwide manufacturing PMI data

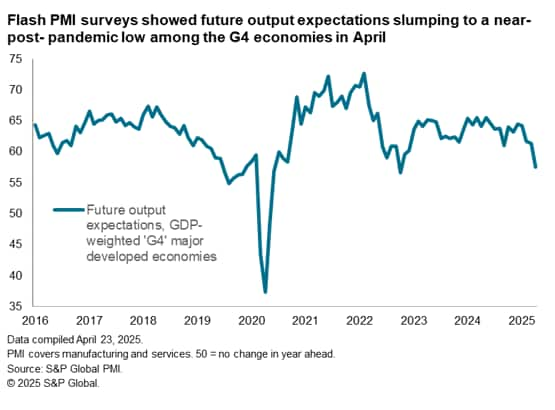

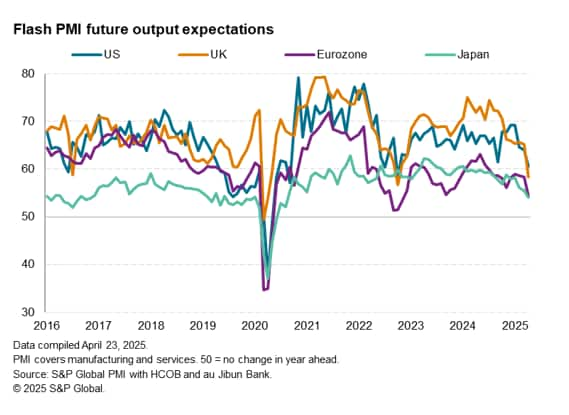

Global Manufacturing PMI will be published at the end of the fresh week for insights into conditions in the goods producing sector amid the introduction of additional US tariffs following the April 2 announcement. This comes after flash PMI revealed that major developed economies' output growth hit the lowest since 2023. Key sub-indices to track include export orders for trade conditions, while the surveys' price and sentiment data will also be under scrutiny.

Americas: US GDP, labour market, core PCE, ISM PMI, goods trade, factory orders, personal income and spending data; Mexico and Canada GDP

The advance reading of US first quarter GDP will be published midweek, with PMI data having indicated a slow first quarter expansion. Some nowcast models also signal only very modest growth, or even contraction. Additionally, April payroll numbers will be released at the end of the week. Early S&P Global Flash US PMI data revealed that employment growth slowed but remained relatively resilient.

Other key US data releases besides the PMI and ISM surveys include core PCE data, plus goods trade and factory orders, the latter to be eyed for the impact of US tariffs

Over in Canada and Mexico, first quarter GDP figures will also be due in the new week after PMI data earlier showed signs of stress in both economies during March.

EMEA: Eurozone inflation, GDP; Germany GfK consumer confidence; UK mortgage and lending, nationwide housing prices data

In Europe, first quarter GDP will be published for the eurozone. A modest expansion is expected, based on PMI data. The eurozone also publishes April flash inflation data after the latest HCOB Flash Eurozone PMI revealed that price pressures had further eased alongside the worrying growth trends.

In the UK, mortgage lending data will be under the spotlight alongside the final manufacturing PMI.

APAC: BoJ meeting; mainland China PMI; Australia inflation and trade data

Besides the PMI data, notably including NBS and Caixin surveys alongside those of various other APAC economies which were shocked by US 'reciprocal' tariff announcements, key data updates include industrial production, retail sales and consumer confidence from Japan, Hong Kong SAR GDP, plus Australia's inflation and trade numbers.

The Bank of Thailand and Bank of Japan also convene for their April meetings. While no changes to Japanese interest rates are expected till the latter half of the year, the BoJ's stance amid rising inflation will be watched.

© 2025, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location

Products & Offerings