Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 16, 2015

Specials grow in Europe

Despite its recent strong run, the European equity market still sees plenty of investors willing to pay for exposure to the most in demand short positions.

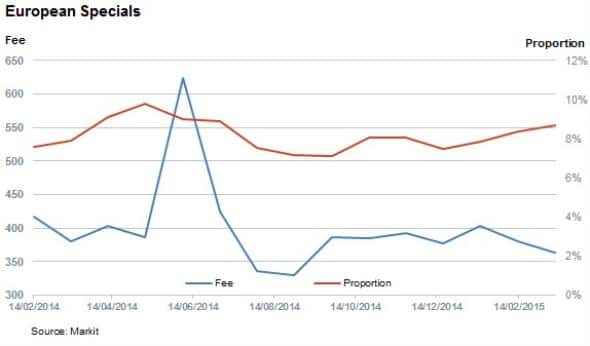

- The proportion of "specials" within Europe has grown by a fifth in the last four months and now account 8.5% of European equities on loan

- Industrials see the greatest demand to borrow

- Fees have held steady: Quindell is the most expensive European special by far

Markit's European securities financing forum is taking place on March 25th in London. To attend, please click here.

European markets have surged in the last few weeks, with investors having rushed to gain long exposure at the fastest pace on record, if ETF flows are anything to go by. Investor have not been willing to take the other side of this momentum driven market with the average proportion of shares out on loan across the Stoxx 600 index having remained flat since the start of the rally.

One area that has seen activity in the European securities lending market has been the shares which are in most demand from short sellers.

The proportion of shares trading special (a stock loan fee greater than 100bps and which have more than $5m on loan) among the 2,500 European listed shares which see the most stock lending activity accounts for 8.7%, the highest level since the summer of last year.

Most of the recent jump in specials was seen over the last four months when European shares started their recent strong run.

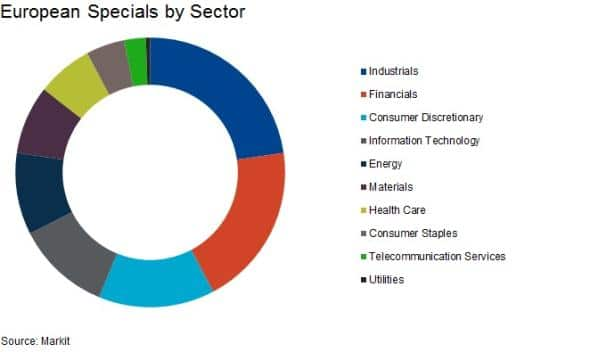

Industrials lead the jump

Industrials have traditionally featured prominently among the shares seeing the most demand to borrow from short sellers. The recent bull market has seen this trend strengthen with 39 industrial shares having traded special in the closing weeks of last year - a number which has since grown by over 10%.

Shares currently seeing the highest stock loan fee in the sector include Turkish defence contractor, Aselsan Elektronik and German listed Meyer Burger which both see a stock loan fee north of 900bps.

This rise in Industrial specials goes against the perceived knowledge that the recent steps taken by the European Central Bank will boost the region's export driven shares.

The number of energy specials, a sector which has been buffeted by the recent fall in oil prices, has actually fallen in recent months.

Fees steady

The fee required to borrow these specials has also held up well in the bull market. The weighted average fee needed to borrow specials in Europe was 370bps in the closing weeks of last year, which is roughly in line with the current 360bps charged to borrow the current crop.

Quindell Plc is the European stock which currently sees the highest cost to borrow, with a fee of over 25% - by quite some distance.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16032015-equities-specials-grow-in-europe.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16032015-equities-specials-grow-in-europe.html&text=Specials+grow+in+Europe","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16032015-equities-specials-grow-in-europe.html","enabled":true},{"name":"email","url":"?subject=Specials grow in Europe&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16032015-equities-specials-grow-in-europe.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Specials+grow+in+Europe http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16032015-equities-specials-grow-in-europe.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}