Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 16, 2018

Week Ahead Economic Preview

- Flash PMI surveys for the US, eurozone and Japan

- UK unemployment and earnings

- Japan inflation figures

Flash February PMI releases will provide all-important insights into first quarter economic growth and price trends of major economies. UK labour market data will be keenly watched for clues of reviving wage growth. Other key data highlights include Japan’s inflation figures, UK business investment and US existing home sales.

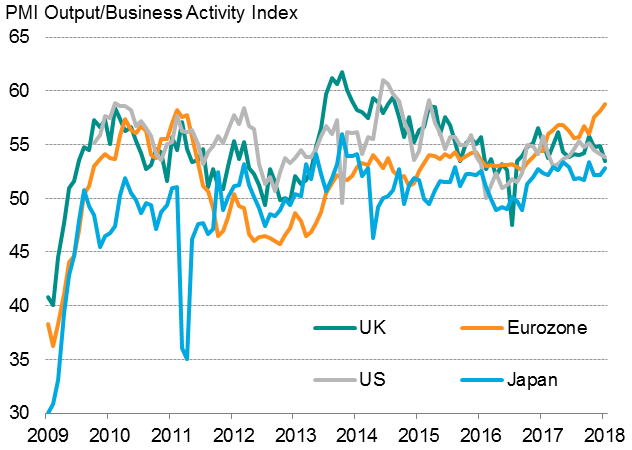

The global economy started 2018 with accelerating momentum. All major advanced economies remained firmly in expansion mode, with the eurozone extending its lead as growth rates eased in both the US and the UK. Analysts will keenly watch the flash February PMI data for further clues of first quarter economic performance.

PMI performance of major developed markets

Sources: IHS Markit, CIPS, Nikkei

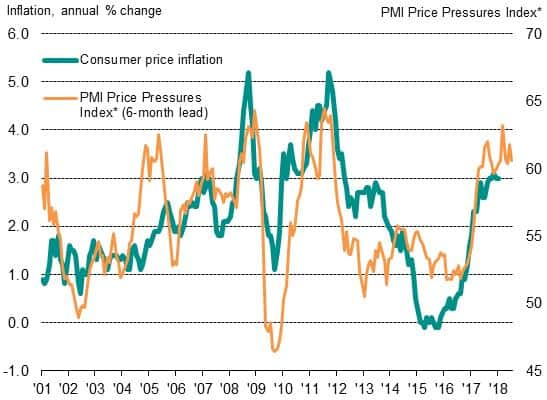

UK labour market update

In the UK, wage data will be a big influence on future monetary policy as policymakers remain concerned about the extent to which higher prices and falling real pay will continue to erode consumer spending power. At the same time, the IHS Markit UK Household Finance Index will provide an indication of consumer spending patterns and finances. January HFI figures revealed that pressures on UK household finances intensified at the fastest pace in four months. Other key data releases include business investment for the fourth quarter of 2017, which could signal the degree to which Brexit uncertainty has held back capital spending.

UK inflation (CPI) and survey price pressures*

*A PMI index of price pressures constructed from indicators of input costs in manufacturing, services and construction, blended with the manufacturing PMI suppliers’ delivery times index (which acts as a proxy for the amount of spare capacity in the economy).

Sources: ONS, IHS Markit

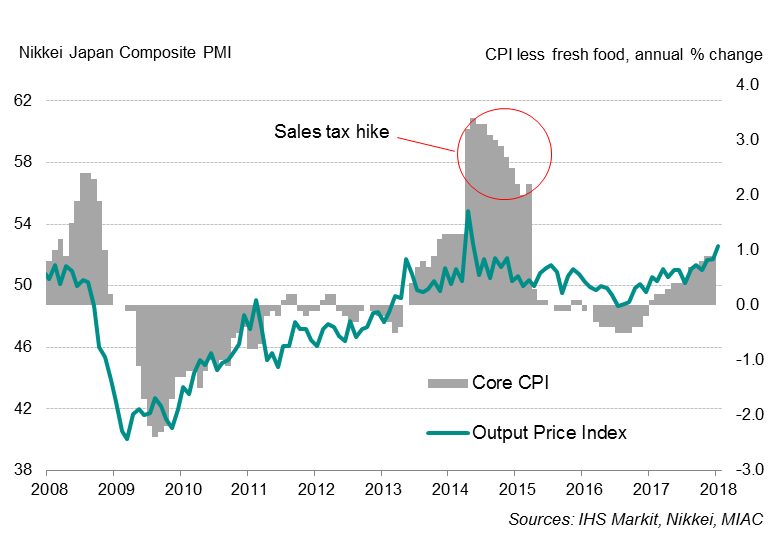

Japan inflation

In Japan, the Nikkei Flash Manufacturing PMI for February will provide an important lead as to first quarter GDP. In the same week, inflation figures will also be released. January PMI data showed firms’ cost pressures running at their highest for over nine years, which pushed them to raise selling prices to the greatest extent since the sales tax hike in 2014, suggesting that headline inflation will likely move higher in 2018. Rising inflationary pressures will add to expectations that the Bank of Japan could soon start to adopt a more hawkish tone.

Japan PMI and inflation

Download the report for a full diary of key economic releases

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16022018-week-ahead-economic-preview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16022018-week-ahead-economic-preview.html&text=Week+Ahead+Economic+Preview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16022018-week-ahead-economic-preview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16022018-week-ahead-economic-preview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16022018-week-ahead-economic-preview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}