Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 14, 2018

Earnings outlook improves as Asia tech shows upturn, joining strong Europe

- Asia Tech sector output PMI at four-year high

- Tech Equipment leading the way despite the drop in European new orders

- Two years’ of rising stock prices for semiconductors

The technology sector has been in the spotlight as various technologic evolutions boost tech companies’ revenues. More detailed sector PMI data provide a global view of the industry, and also help anticipate regions and sub-sectors that are particularly over- or under-performing.

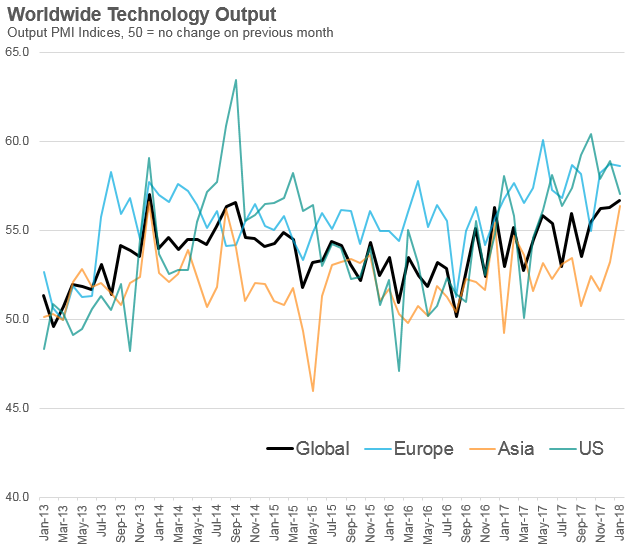

Global Technology enjoys solid start to 2018

With a PMI Output Index reading of 56.7 in January, the global technology sector is displaying its fastest growth for the past four years. After experiencing a global upward trend since January 2016, it appears that regional trends are currently displaying a shifting picture. At the start of 2018, US tech sector growth slowed, while Asian companies saw growth kick higher. However, Europe remains the leader of the sector expansion, with the PMI Output Index regsitering 58.6, only slightly down from 58.7 in December 2017.

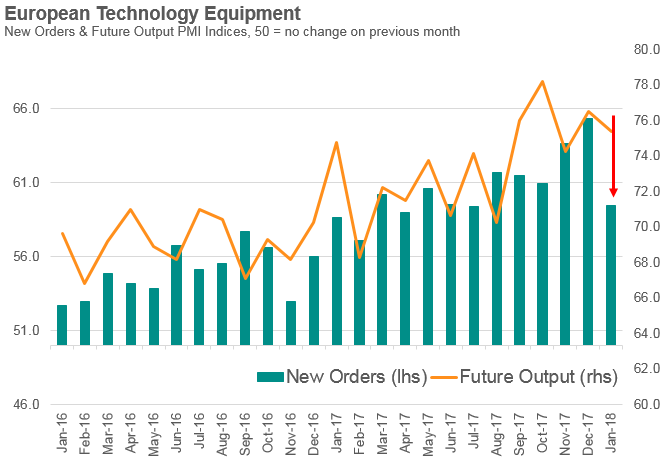

European Technology Equipment weaker

Despite leading the pack, there are challenges for technology firms in Europe. Looking at the technology equipment sub-sector, we note that companies again reported robust order book growth, but also indicated a salient drop of the rate of growth of new orders. The PMI New Orders Index dropped from 65.3 to 59.5, making it the biggest slowdown since the summer of 2014. The Future Output Index, a forward-looking indicator, also showed that companies became slightly less optimistic about the next 12 months.

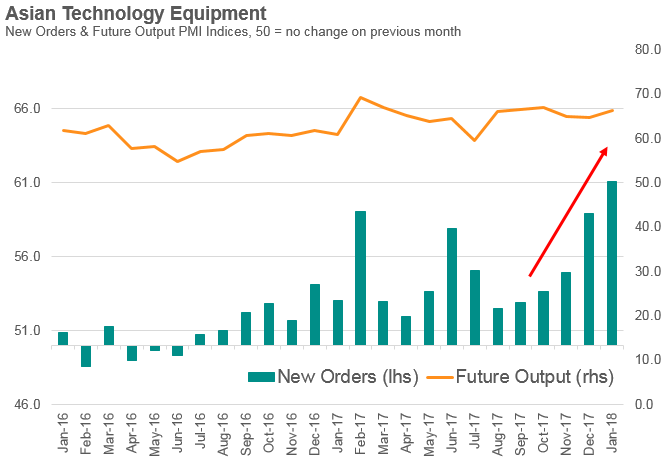

Asian Technology Equipment booming

January meanwhile saw a positive surprise from Asia. Asian-based technology equipment makers reported a twelfth successive month of expansion, culminating in a PMI New Orders Index of 61.1, the highest in eight years. The region also has a stable and promising outlook, with the forward-looking Future Output Index rising to 66.2 and therefore reflecting an optimistic view towards the 12-month business outlook.

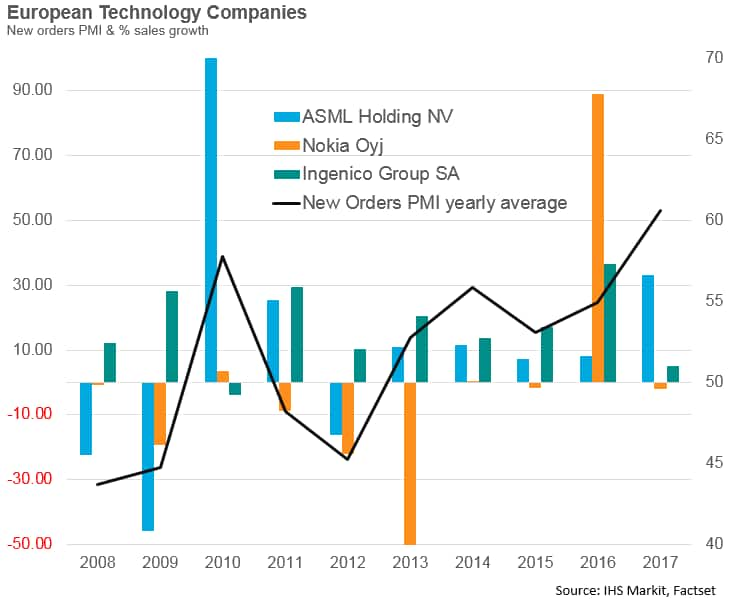

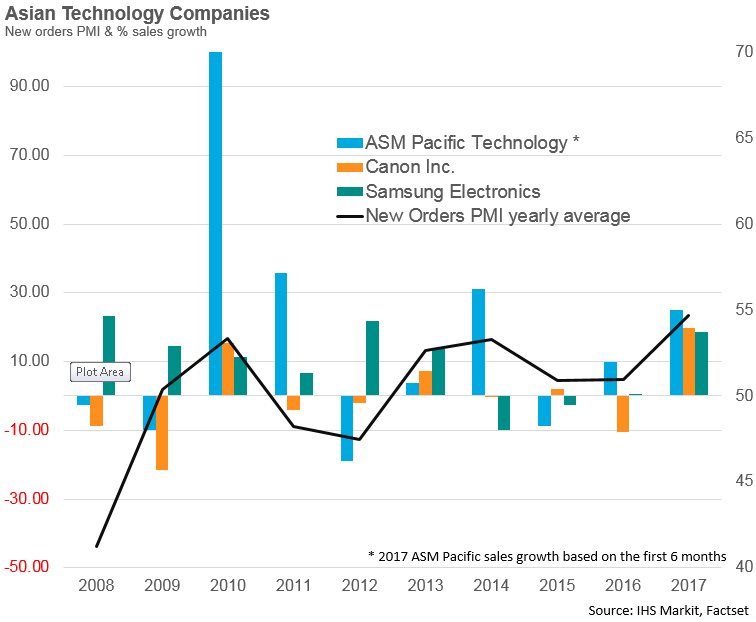

Predictive power on sales growth

When comparing the yearly averages of the PMI New Orders Index to the sales growth of some of the biggest European and Asian tech companies, we can see that PMI data provide a useful indicator of the earnings environment (see charts), although non-systemic analysis remains essential in order to anticipate any particular event specific to each company.

Within this context, and looking back to our earlier analysis on the Asian technology equipment sector, we can assume that tech companies are likely to publish increased mid-year financial results if the PMI New Orders Index can sustain the current robust pace of expansion.

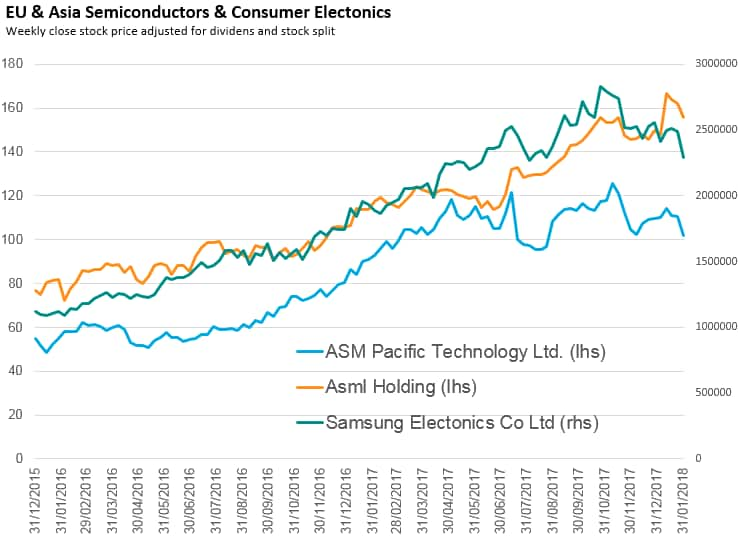

Rising stock prices for semiconductors and consumer electronics

While looking at company valuations on the financial market, the stock prices of a similar sub-sector have already been rising significantly. ASM Pacific Tech, ASML Holding (semiconductors) and Samsung Electronics (consumer electronics) were the strongest performers across our selection of equities. While the PMI outlook for the technology sector remains positive, only an extensive analysis of the fundamentals of each company would allow an investor to accurately predict the potential of these stocks.

Mathieu Ras, Client Services, Economic Indices at IHS Markit

Tel: +44 20 7260 2145

mathieu.ras@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fEarnings-outlook-improves-as-Asia-tech.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fEarnings-outlook-improves-as-Asia-tech.html&text=Earnings+outlook+improves+as+Asia+tech+shows+upturn%2c+joining+strong+Europe","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fEarnings-outlook-improves-as-Asia-tech.html","enabled":true},{"name":"email","url":"?subject=Earnings outlook improves as Asia tech shows upturn, joining strong Europe&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fEarnings-outlook-improves-as-Asia-tech.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Earnings+outlook+improves+as+Asia+tech+shows+upturn%2c+joining+strong+Europe http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fEarnings-outlook-improves-as-Asia-tech.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}