Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 16, 2018

Using PMI survey data to nowcast Malaysia's GDP

- Nikkei PMI data exhibit an 81% correlation with Malaysian GDP

- Survey output index is a better guide to GDP than headline PMI

- PMI data are available faster than official GDP and at higher frequency, providing an accurate advance guide to economic growth

- Simple rules allow easy interpretation of PMI data for economic growth

PMI data can be used to provide a simple but effective tool for predicting Malaysia’s GDP growth rates well ahead of official statistics.

The Nikkei Malaysia Manufacturing PMI™, compiled by IHS Markit since mid-2012, offers an early indication of the health of the economy. The survey results are published on the first working day of the month, with data relating to business conditions in the prior month, making it the timeliest economic indicator available.

The manufacturing sector accounts for around one-quarter of all economic activity in Malaysia, and almost one-in-five jobs. Many other industries, such as transport and energy, are also highly correlated with manufacturing, meaning the manufacturing PMI acts as a useful barometer of the state of the wider economy.

PMI data therefore have an advantage of being available every month compared to GDP data that are published with a considerable delay and issued only on a quarterly basis.

GDP nowcasting using the PMI

One of the common questions that we receive is how to use the PMI to predict economic growth, or GDP. Nowcasting¹ models are typically complex, with many variables, of which the PMI can certainly be included as a variable. But in many countries, not many models offer significantly greater accuracy than a simple but effective model that uses just the PMI.

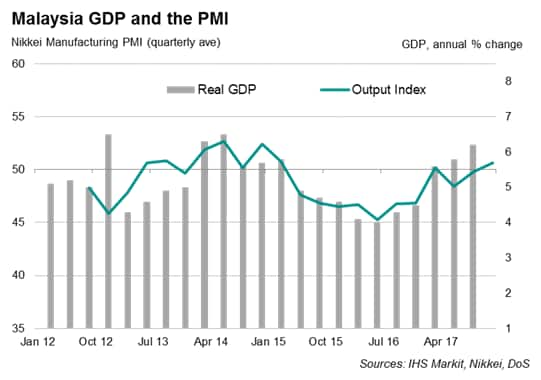

In the case of Malaysia, comparing the headline PMI² against GDP shows that a reasonably high correlation (70%) is achieved with the PMI acting as a coincident indicator of economic growth. However, the correlation improves to 81% if we use an average of the PMI Output Index (instead of headline PMI, which is a composite indicator including measures of employment, orders, stocks and supplier performance) for each calendar quarter.

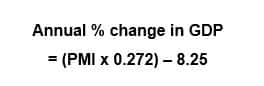

With this correlation as the basis of PMI-implied GDP growth rates, we can build a simple OLS regression model where the annual rate of change in GDP is explained by a single variable: the quarterly averages of the PMI Output Index.

The model therefore allows us to estimate GDP using the following formula:

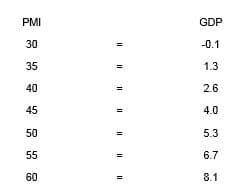

The regression analysis can be used to produce a ‘ready reckoner’ with PMI-implied GDP estimates as follows:

Using this formula, a PMI Output index reading of 30.3 is comparable to a zero annual growth rate of GDP. Each PMI index point above (below) is roughly the same as 0.3 percentage points of GDP growth (decline).

At 51.2, the average reading for the fourth quarter of 2017 is indicative of a 5.7% annual GDP growth rate.

- The ECB defines nowcasting as the prediction of the present, the very near future and the very recent past. Essential to this process is to use timely monthly information to nowcast key economic variables such as GDP that are usually collected at low frequency and published with long delays

- Headline PMI is a composite indicator derived from questions on new orders, output, employment, supplier capacity constraints and inventories

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16012018-Using-PMI-survey-data-to-nowcast-Malaysias-GDP.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16012018-Using-PMI-survey-data-to-nowcast-Malaysias-GDP.html&text=Using+PMI+survey+data+to+nowcast+Malaysia%e2%80%99s+GDP","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16012018-Using-PMI-survey-data-to-nowcast-Malaysias-GDP.html","enabled":true},{"name":"email","url":"?subject=Using PMI survey data to nowcast Malaysia’s GDP&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16012018-Using-PMI-survey-data-to-nowcast-Malaysias-GDP.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Using+PMI+survey+data+to+nowcast+Malaysia%e2%80%99s+GDP http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16012018-Using-PMI-survey-data-to-nowcast-Malaysias-GDP.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}