Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 16, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in companies due to announce results in the coming week.

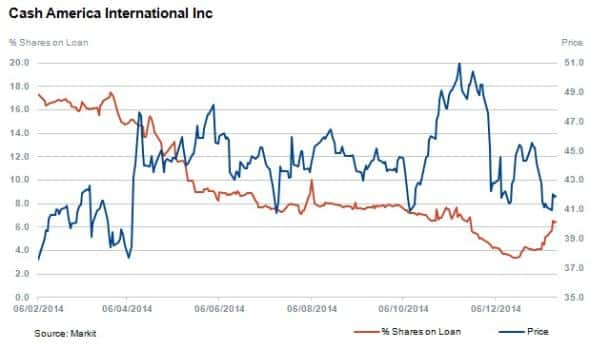

- 90% jump in short interest for payday loan and pawn broker Cash America International

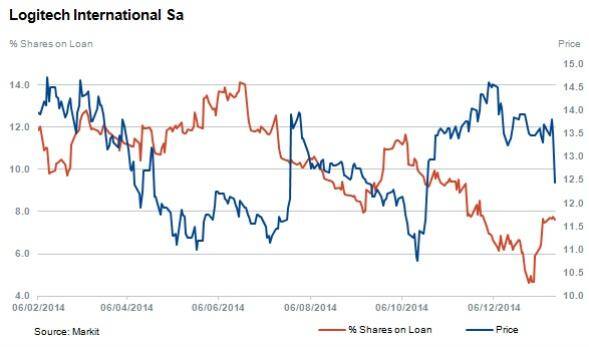

- Logitech and Bang & Olufsen targeted by short sellers after lower European demand

- Taiwanese technology makers HTC and Acer attracting short sellers despite better results

North America

Top of the table this week is Janus Capital, rising up the ranks compared to its previous position in the fourth quarter of 2014. However shares out on loan have actually slightly decreased from 20% to 19% over this timeframe.

Attracting the largest increase among short sellers is Cash America International; a pawn, payday and unsecured financial services provider. The company's shares outstanding on loan increased by 92% in one month to 6.4%. This is after decreasing almost consistently throughout 2014 from 19% in January to 3.4%. Consensus forecasts point to a drop in revenue and earnings in the last fiscal quarter and for 2015.

Other notable moves in short interest ahead of earnings include Coach and First Horizon National. Coach, a leather goods designer and manufacturer, has seen a 20% increase in shares outstanding out on loan to hit 6.9%. First Horizon, a traditional regional bank offering commercial banking services and mortgages, has had an 18% monthly increase to 7.8% of shares outstanding on loan.

Western Europe

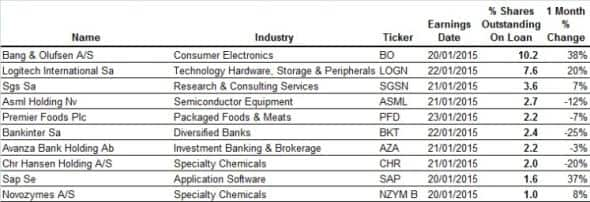

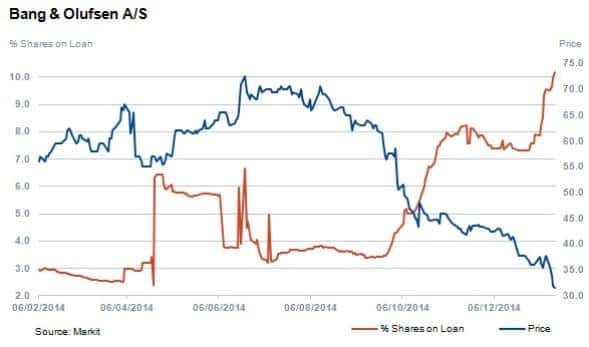

Bang & Olufsen leads the week's most shorted companies in Europe. The Danish high end audio systems designer and manufacturer has had a 38% increase in shares outstanding on loan over last month's results, rising to 10.2%.

The company released a pre-Christmas profit warning citing poor sales in Europe and other production related issues, with management guiding for an operating loss for the period and a tough 2015. The share is down 44% over 12 months.

Swiss firm Logitech manufactures consumer technology peripherals. Short interest in the stock has halved from a high of 14.1% in June 2014 to 7.6% currently. The firm earns the majority of its revenue, around ~65%, outside of EMEA, meaning its exposure to the runaway appreciation by the Swiss franc has been limited.

Asia Pacific

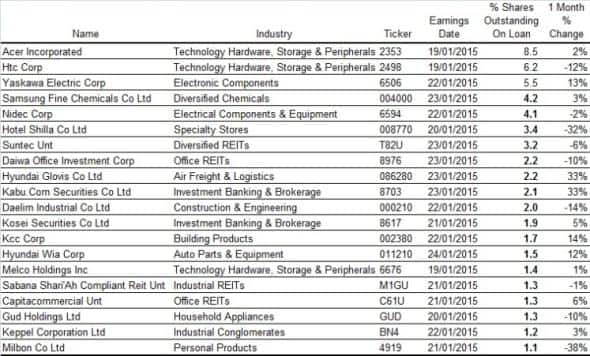

Taiwanese consumer electronics firms Acer and HTC top this week's most shorted firms in APAC with 8.5% and 6.2% of shares outstanding on loan respectively.

Strong reported growth in US PC sales for the fourth quarter is positive for Acer as it represents approximately 20% of the revenue mix. The share has seen a marginal increase in shares outstanding on loan over the past month, reaching 8.5%, but this figure is down by 13% over the last three months while the share price has increased by 5%.

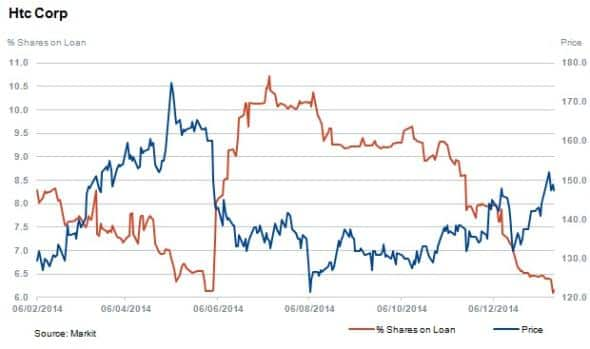

HTC significantly beat analyst expectations in early January 2015 as the company reported improved earnings of $180m for the fourth quarter, compared to estimates closer to $30.4m. However consensus estimates still call for the company to underperform this year. The share price is up by 13% and shares outstanding of loan have decreased to 6.2% from highs of 11% in June 2014. The next earnings announcement is expected on the 19th January 2015.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16012015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16012015-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16012015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16012015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16012015-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}