Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 15, 2015

UK policy debate roused as wage growth picks up but unemployment rises

A mixed bag of news on the UK labour market adds plenty to the policy debate at the Bank of England.

The latest data show private sector pay growth is approaching rates that would normally start to worry policymakers into tightening policy to avoid wage-price spirals developing. However, a fall in employment in the three months to May is a concern which could lead to further hesitation in starting the policy normalisation process. Survey data suggest that this drop in hiring is temporary, and that the economy has picked up speed again since the election. If the data continue to strengthen in coming months in line with the surveys, a November rate hike remains very much in the picture.

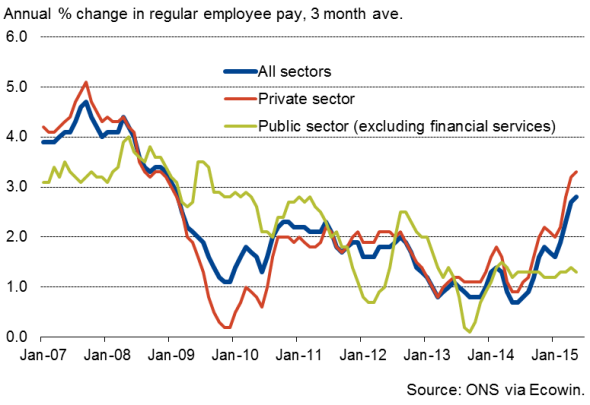

Pay growth continues to accelerate

Regular pay was 2.8% higher than a year ago in the three months to May, up from 2.7% in the three months to April, according to the Office for National Statistics, its fastest rate of increase since early-2009. Private sector pay rose even faster, growing at an annual rate of 3.3%, the highest seen since late-2008.

Pay growth

Including bonuses, the rate of increase also accelerated, up from 2.7% to 3.2%, with a 3.8% rise seen in the private sector. These are the fastest rates for just over five years.

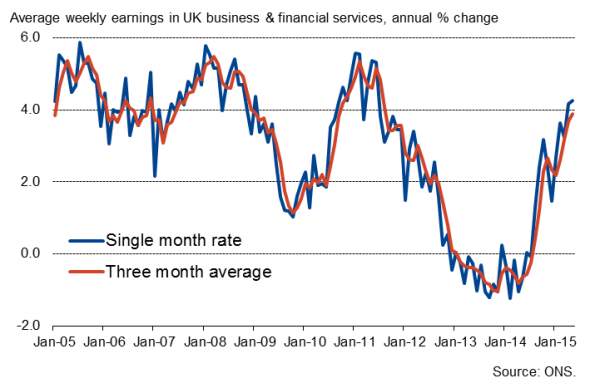

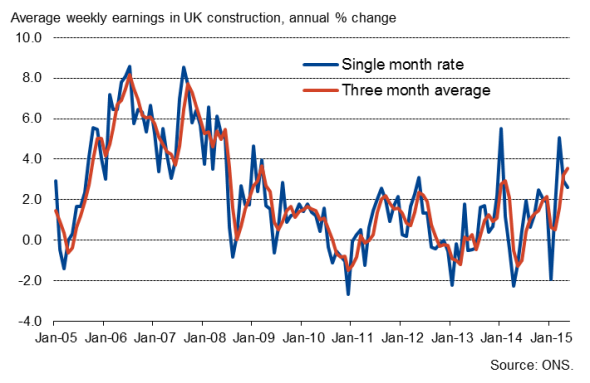

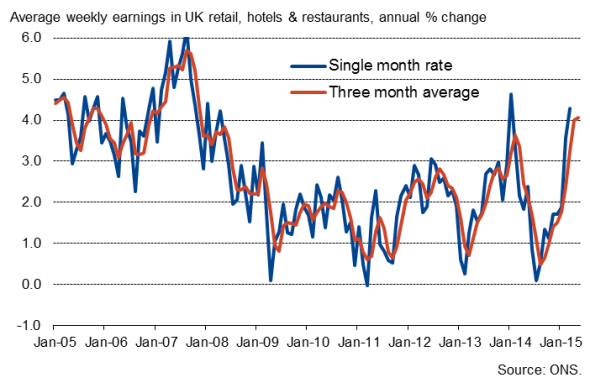

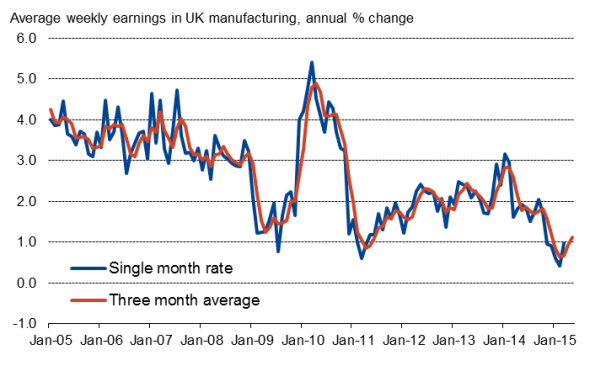

Regular retail sector pay growth accelerated to 4.1%, its highest since 2007. At 3.9%, financial and business services pay growth rose to the fastest since 2011, while construction workers saw an annual rate of 3.5%, one of the highest seen since the financial crisis. Manufacturing pay growth again lagged behind at 1.1%, but even here the pace has picked up markedly since the start of the year.

UK pay growth (excluding bonuses)

Business and financial services

Construction

Retail, hotels & restaurants

Manufacturing

Hiring intentions at one-year high

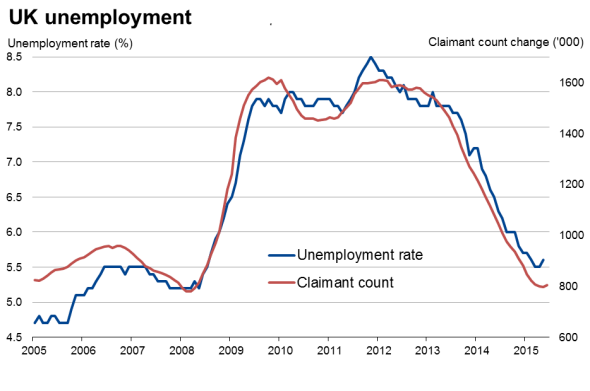

There was some worrying news, however, on the employment front. The unemployment rate rose to 5.6% in the three months to May, its first rise since 2013 (up from 5.5%, which had been its lowest since 2008), as employment fell by 67,000.

Source: ONS via Ecowin.

It's too early to become too worried about the employment slowdown. Survey data from the recruitment industry suggest that some of the slowdown in hiring is due to increasingly widespread skill shortages. It's also likely that the General Election caused a hiccup in the hiring trend.

The Markit/CIPS PMI surveys indicate that the pace of economic growth has picked up again after slowing ahead of the General Election, with impressive job creation continuing to be recorded in June (albeit less so in manufacturing, where the strong pound is hurting exporters and leading to a reluctance to hire). Markit's Global Business Outlook survey also showed UK corporate optimism to be the highest of all major economies in June, with hiring intentions hitting a one-year peak.

Rate hike later this year?

It therefore seems likely that employment will pick up again, and pay growth also looks set to continue to build. Increasing numbers of employers have to offer higher salaries to attract workers as skill shortages intensify. Although people staying in the same jobs are tending to see disappointing annual salary reviews as their pay is linked to inflation, which is currently zero, this is likely to change next year. By the end of 2015, the fall in oil prices will have worked out of the annual inflation comparisons, lifting inflation higher and pushing pay reviews higher.

A big unknown is the extent to which policymakers will want to act ahead of these inflationary pressures picking up. It's likely that at least two MPC members, Martin Weale and Ian McCafferty, will renew their calls for a rate hike at the next meeting due to the upturn in pay and the renewed upturn in the pace of economic growth signalled by the survey data.

Bank Governor Mark Carney is also warning that rate hikes are getting closer, and even 'arch-dove' David Miles (albeit soon to leave the MPC) is now warning that rate hike delays should not be delayed too long, so it's easy to see more policymakers joining the hawks. This leaves plenty of scope for rates to start rising later this year, perhaps November, alongside the Bank's updated forecasts in its Inflation Report.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15072015-economics-uk-policy-debate-roused-as-wage-growth-picks-up-but-unemployment-rises.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15072015-economics-uk-policy-debate-roused-as-wage-growth-picks-up-but-unemployment-rises.html&text=UK+policy+debate+roused+as+wage+growth+picks+up+but+unemployment+rises","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15072015-economics-uk-policy-debate-roused-as-wage-growth-picks-up-but-unemployment-rises.html","enabled":true},{"name":"email","url":"?subject=UK policy debate roused as wage growth picks up but unemployment rises&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15072015-economics-uk-policy-debate-roused-as-wage-growth-picks-up-but-unemployment-rises.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+policy+debate+roused+as+wage+growth+picks+up+but+unemployment+rises http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15072015-economics-uk-policy-debate-roused-as-wage-growth-picks-up-but-unemployment-rises.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}