Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 15, 2017

Bank of England moves closer to rate hike despite retail sales fall

Disappointing retail sales data failed to deter the Bank of England from moving closer to hiking interest rates at its June meeting.

Retail sales fall for fifth time in seven months

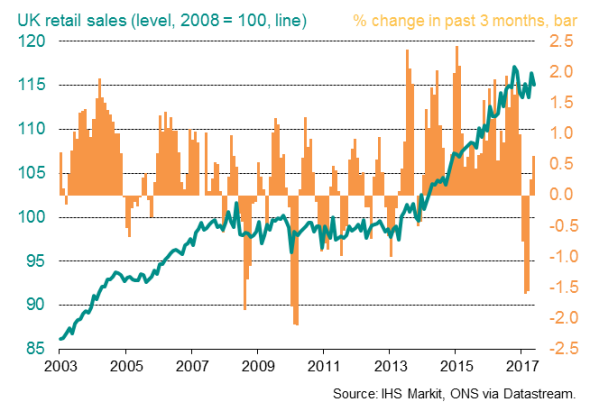

When prices rise faster than wages, it should be no surprise to see household spending come under pressure, and that's exactly what the UK is seeing right now. Retail sales fell 1.2% in May, according to the Office for National Statistics, matching similar declines seen in other non-official data such as the Visa consumer spending index.

UK retail sales

The latest decline needs to be looked at in the context of the marked 2.5% sales increase seen in April, which was linked to the timing of Easter. The strong April still means second quarter sales are so far running 1.4% higher than the first quarter on average, and are up 0.6% in the latest three months compared to the prior three months. However, the latest decline means sales have now fallen in five of the past seven months, which is a clear warning sign that households are feeling the pinch.

The drop in spending follows news that consumer prices are rising at an annual pace of 2.9% and regular pay is growing at a rate of just 1.7%. Real (inflation adjusted) pay is now falling at an annual rate of 0.6%, which is the steepest decline seen since 2014.

The squeeze on household budgets is likely to get worse before it gets better. Inflation could well breach 3% in coming months but there's little prospect of pay growth picking up. Inflation should start to cool later in the year, taking some of the pressure off, but this looks like it's going to be a tough year as a whole for households. The economy will inevitably suffer as a consequence.

Hawkish policymakers

The drop in spending and squeeze on consumers failed to stop an increasing number of policymakers from voting to hike interest rates at the June Monetary Policy Committee meeting at the Bank of England. The MPC voted 5-3 to keep rates on hold, compared to 7-1 at the May meeting.

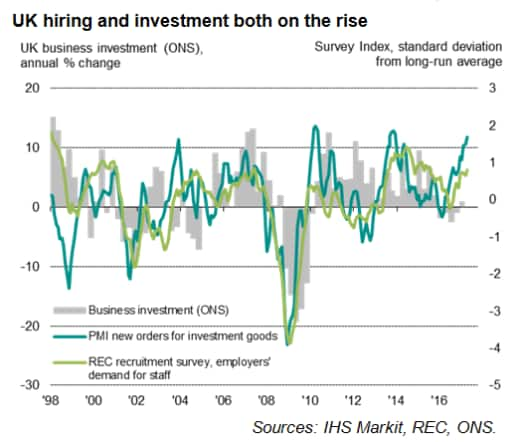

The increasingly hawkish mood largely reflected worries about inflation rising faster than previously anticipated alongside signs that companies remained upbeat about the future, as indicated by rising employment and business investment.

The big question is the extent to which business spending - which appears to have been the main driver of growth so far this year - will hold up in the face of the increased uncertainty caused by the election and forthcoming Brexit talks. The worry is that companies could pull back on investment and hiring amid the heightened uncertainty, acting as an additional drag on the economy at the same time that households are cutting back on their purchases. We will know more about how business has initially responded to the surprise election result with the June PMI data.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062017-economics-bank-of-england-moves-closer-to-rate-hike-despite-retail-sales-fall.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062017-economics-bank-of-england-moves-closer-to-rate-hike-despite-retail-sales-fall.html&text=Bank+of+England+moves+closer+to+rate+hike+despite+retail+sales+fall","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062017-economics-bank-of-england-moves-closer-to-rate-hike-despite-retail-sales-fall.html","enabled":true},{"name":"email","url":"?subject=Bank of England moves closer to rate hike despite retail sales fall&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062017-economics-bank-of-england-moves-closer-to-rate-hike-despite-retail-sales-fall.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bank+of+England+moves+closer+to+rate+hike+despite+retail+sales+fall http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062017-economics-bank-of-england-moves-closer-to-rate-hike-despite-retail-sales-fall.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}