Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 15, 2017

Eurozone employment rises to record high as economic recovery gains strength

The good news keeps flowing out of the eurozone, with fresh official data showing record employment and industrial production growth picking up.

The stronger employment and production data will add to views that the criteria of eurozone economic growth becoming self-sustaining are increasingly being met, and that downside risks to the outlook appear to be fading.

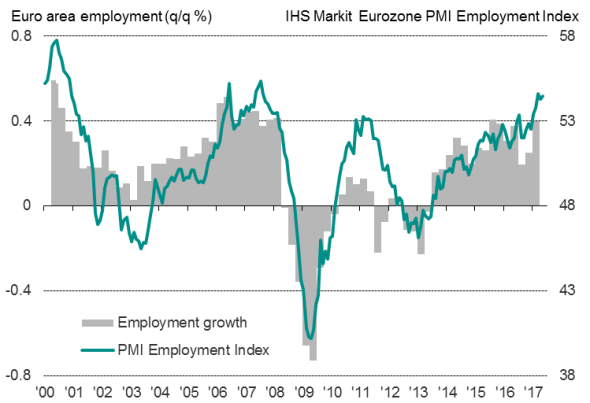

Employment rose 0.4% in the first quarter, according to Eurostat, in line with survey evidence which also suggests the rate of job creation has accelerated further in the second quarter. PMI data showed private sector employment growing at one of the fastest rates for a decade in May, with manufacturing jobs being created at a pace not previously seen in the 20-year survey history.

Eurozone employment

The surveys show jobs are being created across all major euro member states, albeit led by Germany.

The rise in eurozone employment means 154.8 million people were in jobs in the first quarter, surpassing the previous peak seen in the first quarter of 2008.

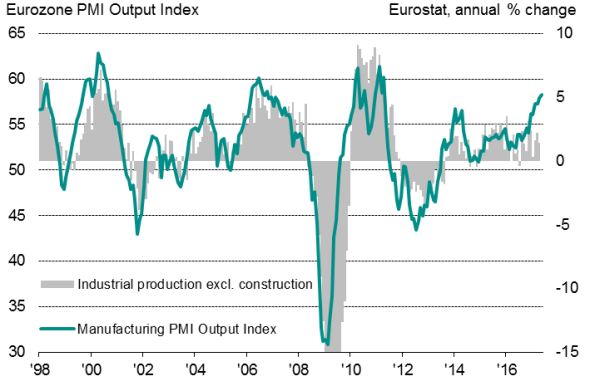

Industrial production meanwhile rose 0.5% in April, indicating a strong start to the second quarter. The upturn in official production data also tallies with PMI data, which have indicated a strengthening recovery of eurozone manufacturing in recent months. The IHS Markit Eurozone Manufacturing PMI rose to a 73-month high of 57.0 in May, up from 56.7 in April.

Eurozone industrial production

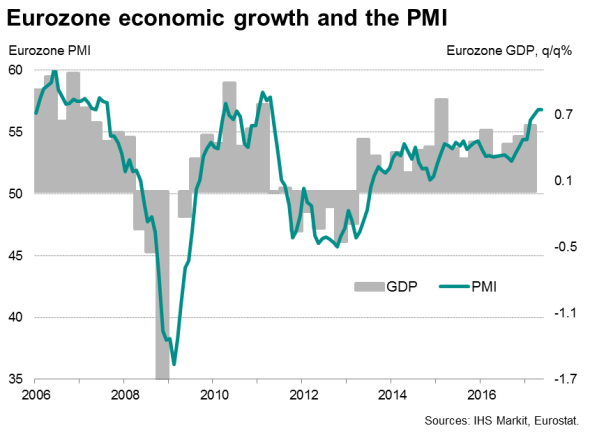

The eurozone is clearly enjoying a strong year so far. Official data now show the single currency area growing 0.6% in the first quarter, up from a prior estimate of 0.5%. The faster growth is in line with the signals from the PMI surveys, which had been indicating a 0.6% expansion as far back as February.

The first quarter expansion is no aberration. In fact, running at six-year highs, the PMI readings for April and May suggest that the rate of GDP growth will have picked up further in the second quarter, rising to 0.7%.

The weak euro appears to be providing a major stimulus to the manufacturing sector.

The Eurozone Manufacturing PMI survey's new export orders index has been hitting six-year highs in recent months. A ranking of PMI export orders growth in May showed euro member nations dominating the global leader board, holding seven of the top eight places.

European PMI sector data meanwhile add to signs that business investment is rising strongly in the second quarter. Output growth in capex bellwethers such as machinery & equipment, technology equipment and construction & engineering have all seen marked upturns in recent months, with growth accelerating especially sharply in the tech sector to a near-record pace in May. The latter was also the fastest growing sector covered by the PMI, with machinery & equipment manufacturing in third place.

Employment, exports, investment and economic output all therefore appear to be growing at increased rates in the second quarter, representing an encouragingly sustainable-looking upturn.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062017-Economics-Eurozone-employment-rises-to-record-high-as-economic-recovery-gains-strength.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062017-Economics-Eurozone-employment-rises-to-record-high-as-economic-recovery-gains-strength.html&text=Eurozone+employment+rises+to+record+high+as+economic+recovery+gains+strength","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062017-Economics-Eurozone-employment-rises-to-record-high-as-economic-recovery-gains-strength.html","enabled":true},{"name":"email","url":"?subject=Eurozone employment rises to record high as economic recovery gains strength&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062017-Economics-Eurozone-employment-rises-to-record-high-as-economic-recovery-gains-strength.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+employment+rises+to+record+high+as+economic+recovery+gains+strength http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062017-Economics-Eurozone-employment-rises-to-record-high-as-economic-recovery-gains-strength.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}