Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 15, 2016

Fixed income sectors in double digit returns for 2016

Bonds have produced substantial returns for investors so far this year - we look at the top performing sectors.

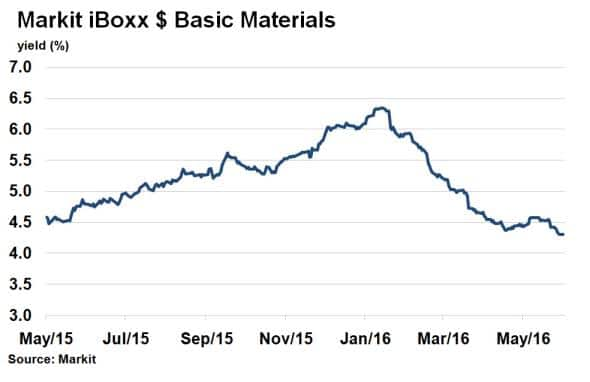

- Markit iBoxx $ Basic Materials index has seen its yield fall 2% since January

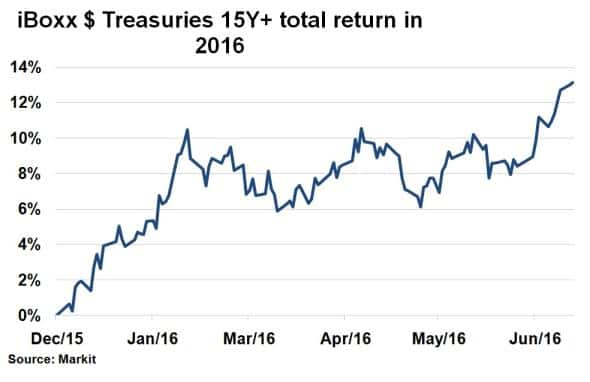

- Markit iBoxx $ Treasuries 15Y+ index has returned 13.1% so far this year

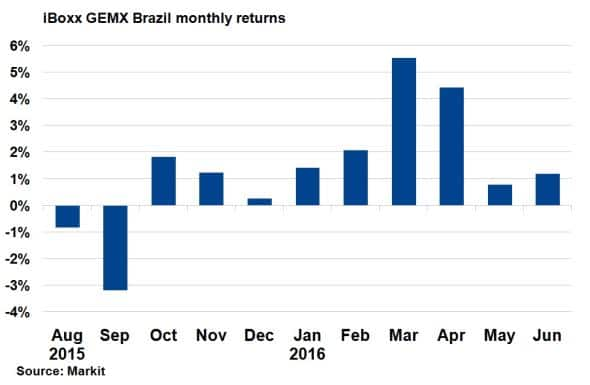

- Markit GEMX Brazil index has seen a positive return for the past nine consecutive months

This week saw 10-yr German bund yields fall below 0% as Brexit fears and European growth concerns resurfaced. The safety of fixed income has been a dominant theme in markets in 2016 and the asset class has enjoyed broad based returns so far this year, with certain sectors having already produced double digit returns.

Commodities rebound

The rebound in commodity prices has been a boon for the Basic Materials sector globally. The Bloomberg Commodity Index has risen to 88.7, from as low of 73.6 on January 19th. The alleviation of downside risk has meant confidence in the sector has returned and bond yields have steadily fallen.

The Markit iBoxx $ Basic Materials index, which tracks dollar denominated bonds in the sector, has seen its yield fall 2% since January. It has meant returns have topped 10% so far this year on a total return basis.

Long bonds

Falling government bond yields spurred on by unprecedented monetary policy in developed nations has forced investors to search for yield by taking on more risk. Long maturity safe haven US treasuries have been a beneficiary, flattening the US yield curve in the process.

The Markit iBoxx $ Treasuries 15Y+ index has returned 13.1% so far this year, outperforming shorter tenure treasuries. Low yields, sluggish economic growth and low inflation continue to be a boon for longer term bonds.

Brazil leads emerging markets

Market confidence in emerging market bonds has returned, buoyed by rising commodity prices and a weaker US dollar. Brazil has led the charge, spurred on by a change in presidency, reducing political risk in the country.

The Markit GEMX Brazil index, which tracks the performance of Brazilian government bonds, has seen a positive return for the past nine consecutive months. March and April returned 10% together, contributing to 15.4% return so far this year.

Healthcare

One of the best performing sectors among sterling denominated corporate bonds this year has been Healthcare. The defensive sector, which has a long duration, has seen its returns relatively insulated from the Brexit induced volatility.

The Markit iboxx " Health Care index has returned 11% so far this year. The rally has been fairly consistent since March, with June (up till the 13th) having already returned 2.7%.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062016-credit-fixed-income-sectors-in-double-digit-returns-for-2016.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062016-credit-fixed-income-sectors-in-double-digit-returns-for-2016.html&text=Fixed+income+sectors+in+double+digit+returns+for+2016","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062016-credit-fixed-income-sectors-in-double-digit-returns-for-2016.html","enabled":true},{"name":"email","url":"?subject=Fixed income sectors in double digit returns for 2016&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062016-credit-fixed-income-sectors-in-double-digit-returns-for-2016.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Fixed+income+sectors+in+double+digit+returns+for+2016 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062016-credit-fixed-income-sectors-in-double-digit-returns-for-2016.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}